- United States

- /

- Biotech

- /

- NasdaqGM:ARDX

Ardelyx (ARDX): Assessing Valuation Following Break-Even Quarter, Strong Guidance, and Pipeline Progress

Reviewed by Simply Wall St

Ardelyx (ARDX) delivered a quarter that surprised many, with stronger-than-expected results driven by meaningful growth in its IBSRELA and XPHOZAH product lines. The company’s performance outpaced forecasts and resulted in break-even earnings.

See our latest analysis for Ardelyx.

Ardelyx’s momentum has been hard to miss lately, with a 20.96% one-day share price jump following its Q3 beat and raised guidance. Although the 1-year total shareholder return stands at 2.89% after a volatile stretch, the stock’s three-year total shareholder return of 332.86% highlights how much value has been created for long-term holders. Recent product milestones and pipeline progress have reignited investor optimism.

If Ardelyx’s surge has you thinking about new opportunities, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock posting such strong gains and analysts continuing to lift their expectations, investors now face a key question: Is Ardelyx still undervalued given its new outlook, or are markets already pricing in that pipeline-fueled growth?

Most Popular Narrative: 46.7% Undervalued

Compared to Ardelyx’s last close price of $6.06, the most widely followed narrative assigns a fair value of $11.36. This suggests meaningful upside potential if the future plays out as projected. Analysts and investors are taking notice, especially amid the company’s rapid revenue and earnings growth forecasts that support the case for re-rating.

“Expanding markets, better market access, and prescription growth are accelerating adoption of core therapies, supporting sustained revenue and margin improvement. International partnerships and new indications diversify revenue streams, mitigate risks, and enhance long-term earnings stability.”

What hidden forces could drive this kind of revaluation? One crucial projection has Ardelyx transforming its bottom line in ways not often seen outside of the hottest biotech success stories. The most surprising part? Much of this valuation hinges on a future earnings multiple that some would only expect from established sector giants. Find out what bold assumptions fuel these aggressive targets.

Result: Fair Value of $11.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a narrow drug portfolio and ongoing Medicare reimbursement challenges could quickly change Ardelyx’s outlook if conditions worsen.

Find out about the key risks to this Ardelyx narrative.

Another View: Market Ratios Hint at Caution

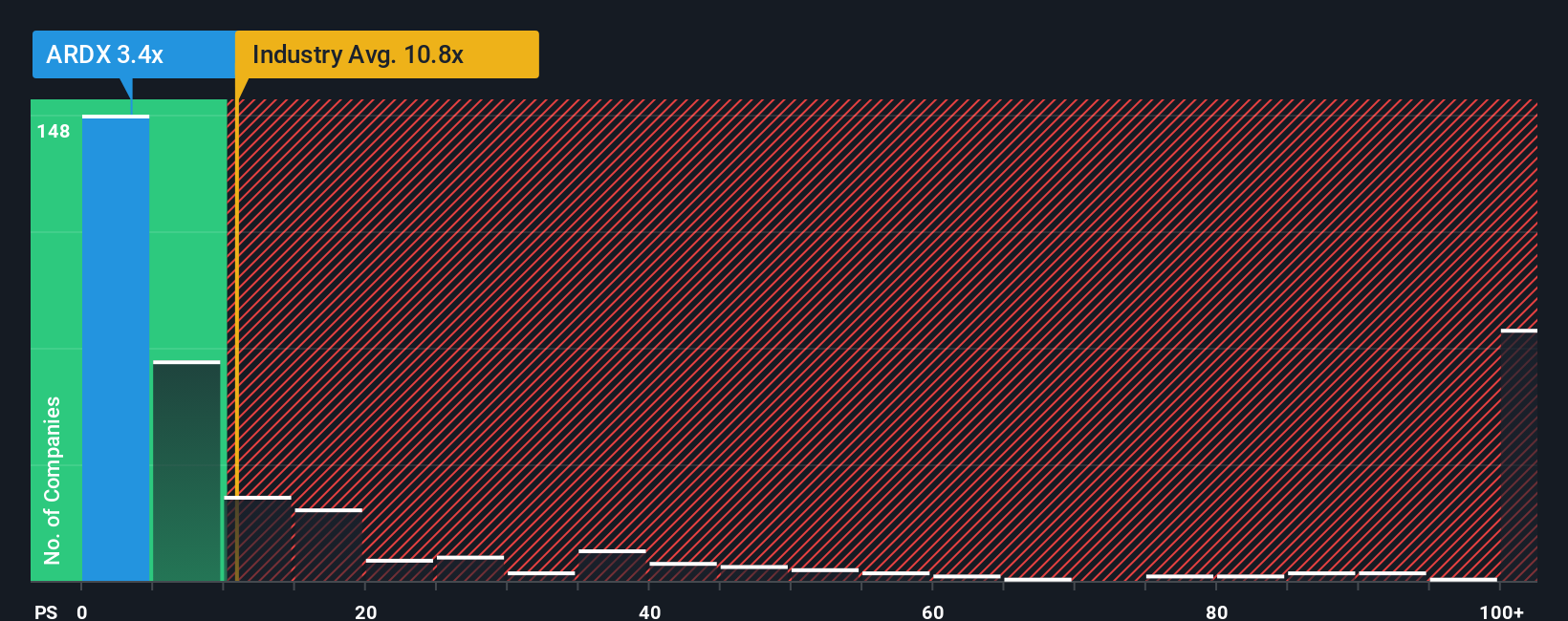

While the fair value estimate points to Ardelyx being significantly undervalued, the current price-to-sales ratio of 3.7x sits right at the peer average. This figure is well below the industry average of 10.8x. Compared to the fair ratio of 6.5x, there is some room for the market to adjust, but also a risk that the price is already reflecting much of the good news. Is the gap a margin of safety, or a signal that expectations are already high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ardelyx Narrative

If you have a different perspective or want to dig deeper into the numbers, you can shape your own Ardelyx story in just a few minutes. Do it your way

A great starting point for your Ardelyx research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always a step ahead. Don’t let great opportunities slip by. Expand your search to stocks that stand out from the crowd with these proven strategies:

- Tap into emerging trends with these 26 AI penny stocks and see which companies are redefining the limits of artificial intelligence.

- Secure stable returns as you browse these 18 dividend stocks with yields > 3% offering consistent yields above 3%. This can help strengthen your portfolio’s foundation.

- Catalyze your growth ambitions by checking out these 843 undervalued stocks based on cash flows primed for potential upside based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARDX

Ardelyx

Ardelyx, Inc. discovers, develops, and commercializes medicines to treat unmet medical needs in the United States and internationally.

High growth potential and good value.

Market Insights

Community Narratives