- United States

- /

- Biotech

- /

- NasdaqCM:APVO

Did You Manage To Avoid Aptevo Therapeutics's (NASDAQ:APVO) Devastating 79% Share Price Drop?

Even the best investor on earth makes unsuccessful investments. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. It must have been painful to be a Aptevo Therapeutics Inc. (NASDAQ:APVO) shareholder over the last year, since the stock price plummeted 79% in that time. That'd be a striking reminder about the importance of diversification. Aptevo Therapeutics hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The falls have accelerated recently, with the share price down 50% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Check out our latest analysis for Aptevo Therapeutics

Because Aptevo Therapeutics is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Aptevo Therapeutics grew its revenue by 57% over the last year. That's a strong result which is better than most other loss making companies. So on the face of it we're really surprised to see the share price down 79% over twelve months. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. We'd recommend taking a very close look at the stock (and any available forecasts), before considering a purchase, because the share price is not correlated with the revenue growth, that's for sure. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

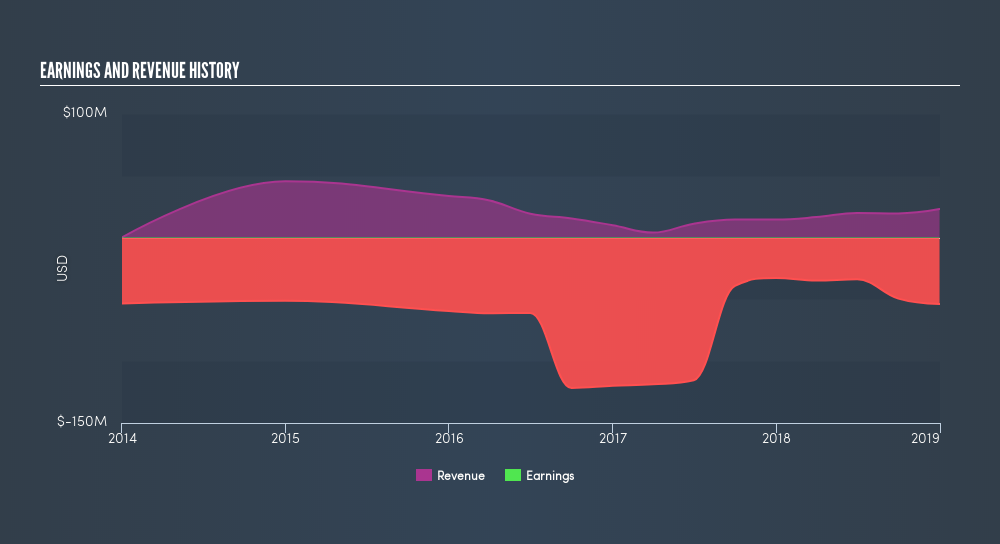

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

A Different Perspective

While Aptevo Therapeutics shareholders are down 79% for the year, the market itself is up 9.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 50%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:APVO

Aptevo Therapeutics

A clinical-stage research and development biotechnology company, focuses on developing immunotherapeutic candidates for the treatment of various forms of cancer in the United States.

Medium-low with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives