- United States

- /

- Biotech

- /

- NasdaqGS:APLS

Would Apellis Pharmaceuticals (NASDAQ:APLS) Be Better Off With Less Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Apellis Pharmaceuticals, Inc. (NASDAQ:APLS) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Apellis Pharmaceuticals

How Much Debt Does Apellis Pharmaceuticals Carry?

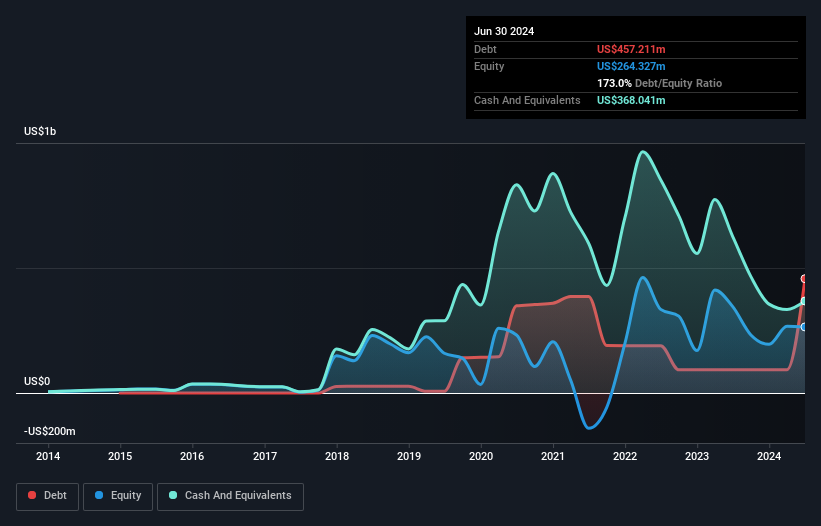

The image below, which you can click on for greater detail, shows that at June 2024 Apellis Pharmaceuticals had debt of US$457.2m, up from US$92.9m in one year. However, it does have US$368.0m in cash offsetting this, leading to net debt of about US$89.2m.

How Healthy Is Apellis Pharmaceuticals' Balance Sheet?

We can see from the most recent balance sheet that Apellis Pharmaceuticals had liabilities of US$169.2m falling due within a year, and liabilities of US$471.0m due beyond that. Offsetting this, it had US$368.0m in cash and US$308.9m in receivables that were due within 12 months. So it actually has US$36.7m more liquid assets than total liabilities.

Having regard to Apellis Pharmaceuticals' size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the US$3.40b company is struggling for cash, we still think it's worth monitoring its balance sheet. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Apellis Pharmaceuticals can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Apellis Pharmaceuticals reported revenue of US$629m, which is a gain of 241%, although it did not report any earnings before interest and tax. That's virtually the hole-in-one of revenue growth!

Caveat Emptor

Despite the top line growth, Apellis Pharmaceuticals still had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost US$313m at the EBIT level. Looking on the brighter side, the business has adequate liquid assets, which give it time to grow and develop before its debt becomes a near-term issue. Still, we'd be more encouraged to study the business in depth if it already had some free cash flow. Nonetheless, the revenue growth is clearly impressive and that would make it easier to raise capital if need be. Despite that strong positive, this one could still be considered a bit too risky, by some. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Apellis Pharmaceuticals that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:APLS

Apellis Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutic compounds to treat diseases with high unmet needs.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives