- United States

- /

- Biotech

- /

- NasdaqGM:APGE

Apogee Therapeutics (APGE) Is Up 13.8% After Promising APG333 Phase 1 Data Release Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Earlier this month, Apogee Therapeutics announced positive interim Phase 1 results for APG333, showing it was well tolerated in healthy volunteers and supporting potential for 3- and 6-month dosing intervals based on a half-life of approximately 55 days.

- This milestone highlights Apogee's advancement in antibody engineering aimed at treating immunology and inflammation conditions that remain underserved in the market.

- Next, we'll explore how promising early data for APG333 shapes Apogee Therapeutics' investment narrative and pipeline momentum.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Apogee Therapeutics' Investment Narrative?

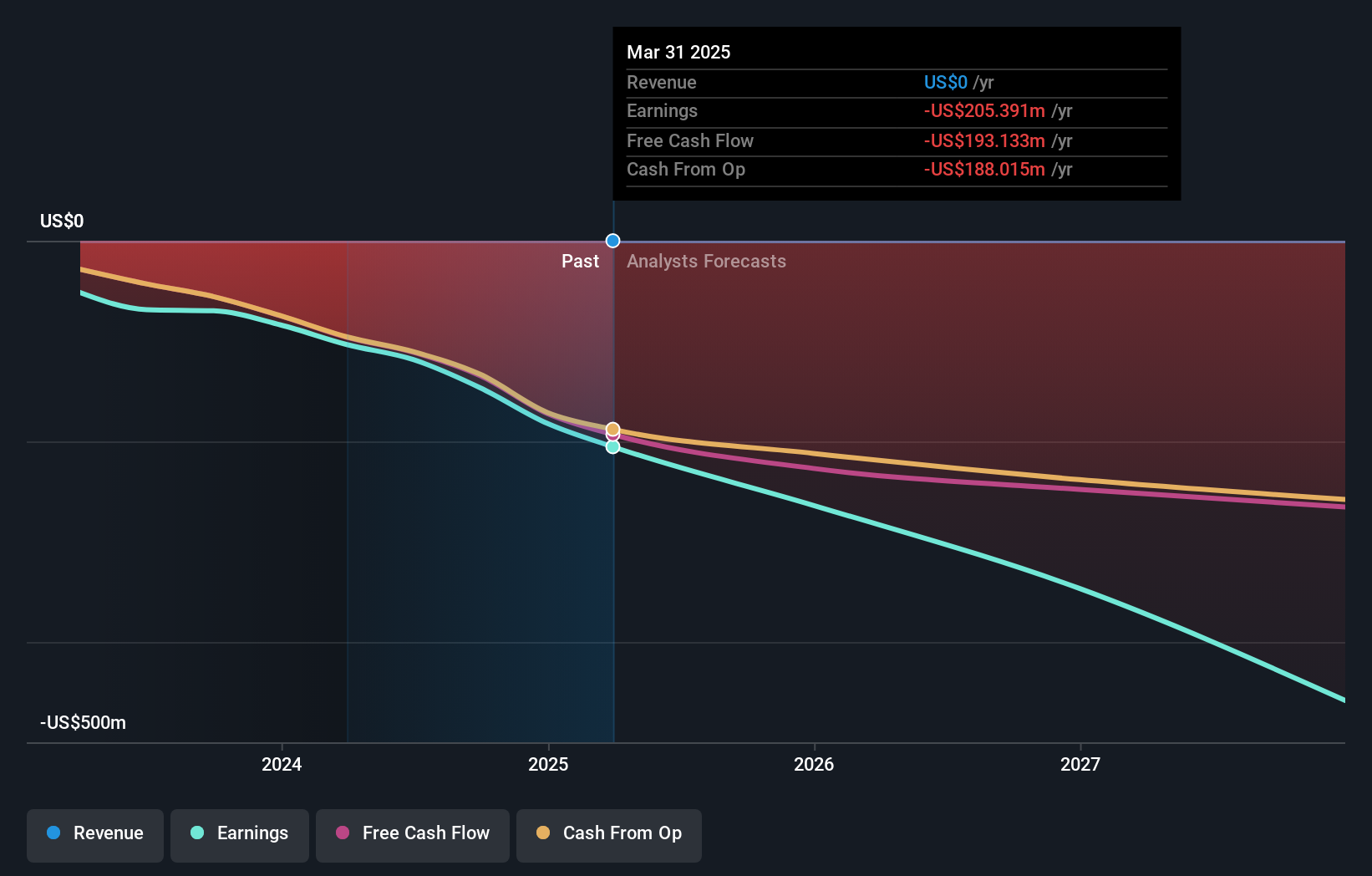

For investors considering Apogee Therapeutics, the central thesis hinges on belief in the company’s ability to convert promising clinical readouts into long-term value, despite a history of widening losses and lack of revenue. The recent positive Phase 1 data for APG333 does highlight fresh potential in Apogee’s pipeline, giving some near-term momentum and suggesting the company is making progress toward differentiated treatments in immunology and inflammation. However, these advances come at a cost: growing net losses and ongoing operational expenses remain front and center, and with no revenue expected for the foreseeable future, the company is entirely reliant on raising capital to sustain development. This shift in pipeline progress could reprioritize APG333 as a key short-term catalyst, but the underlying risk of dilution and continued negative earnings is still significant for shareholders. Ultimately, the latest announcement injects some optimism but doesn’t fundamentally alter the main risks facing the business. Yet, even as new trial results spark short-term excitement, funding risk is impossible to ignore for investors.

Our comprehensive valuation report raises the possibility that Apogee Therapeutics is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 3 other fair value estimates on Apogee Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Apogee Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Apogee Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Apogee Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Apogee Therapeutics' overall financial health at a glance.

No Opportunity In Apogee Therapeutics?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APGE

Apogee Therapeutics

A clinical stage biotechnology company, develops novel biologics for the treatment of atopic dermatitis (AD), asthma, eosinophilic esophagitis (EoE), chronic obstructive pulmonary disease (COPD), and other inflammatory and immunology indications.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives