- United States

- /

- Pharma

- /

- NasdaqGM:ANIP

Is ANI Pharmaceuticals’ Recent Acquisitions Driving Further Gains in 2025?

Reviewed by Bailey Pemberton

- Curious if ANI Pharmaceuticals is still a good buy after its huge run? Let’s break down what’s truly driving value here and whether the current price makes sense.

- While the stock only edged up 0.4% this week, it has surged 67.1% year-to-date and delivered a staggering 240.3% return over five years. This shows the kind of long-term momentum that catches investors’ attention.

- Behind these remarkable returns, recent news highlights growing interest in ANI’s expanded product lineup and strategic acquisitions. These developments have fueled optimism among investors, and the buzz has contributed to the stock’s steady climb as markets reassess the company’s growth potential.

- On our valuation scorecard, ANI Pharmaceuticals clocks in at 5 out of 6 for being undervalued across major checks. This is a strong signal, but not the whole story. Next up, let’s dive into the valuation math and see why there might be an even smarter way to spot value here.

Approach 1: ANI Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true value of a company by projecting its future cash flows and then discounting them back to today's dollars. This approach helps investors see whether the current stock price accurately reflects the business's long-term earnings power.

For ANI Pharmaceuticals, analysts estimate that current Free Cash Flow stands at approximately $105.8 Million as of the latest twelve months. Over the next five years, analysts forecast significant growth, projecting Free Cash Flow to reach $260.4 Million by 2029. While analyst projections go out five years, Simply Wall St extrapolates further with ten-year forecasts suggesting a steady rise in cash generation.

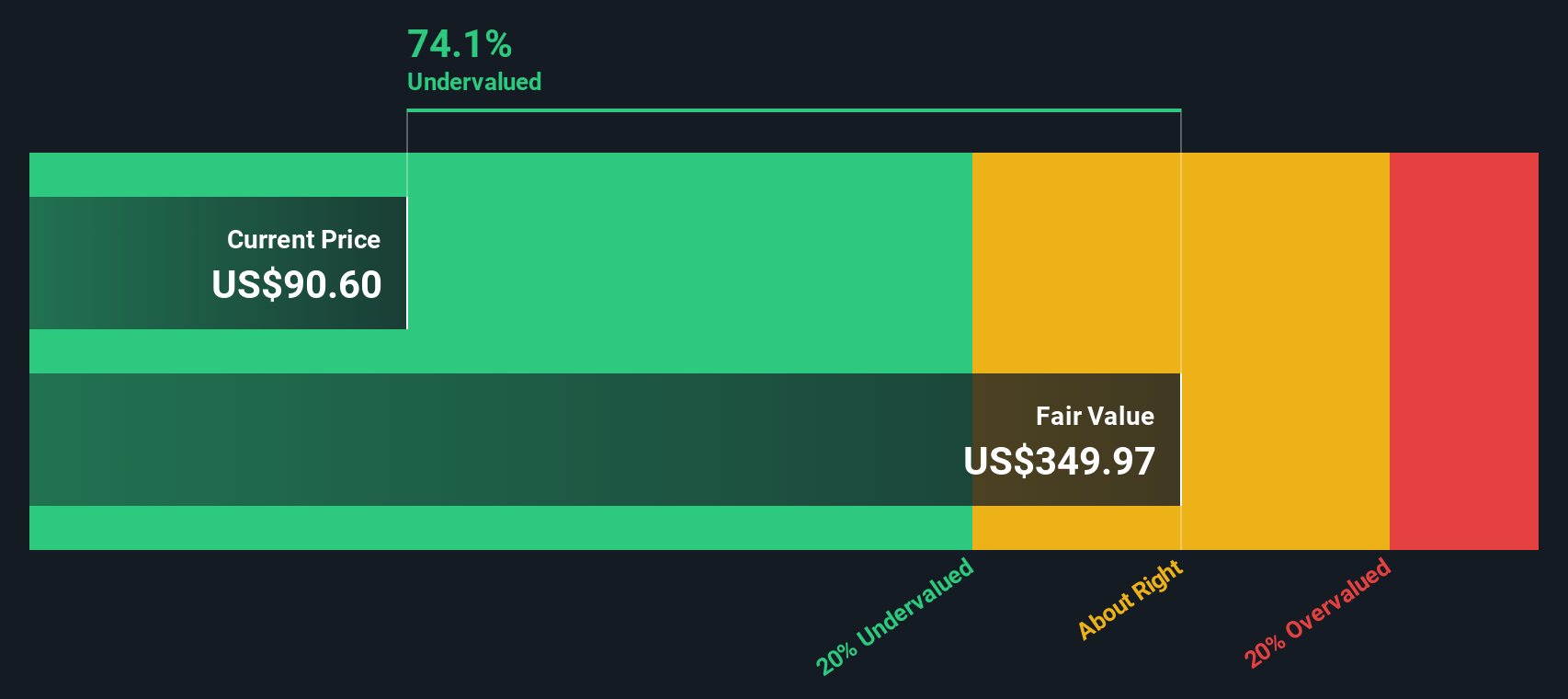

After discounting all these future cash flows to the present, the calculated intrinsic value per share comes to $349.97. This result implies that the stock is trading at a 73.5% discount to its fair value based on today’s share price. Such a large gap means that, according to this DCF analysis, ANI Pharmaceuticals appears to be significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ANI Pharmaceuticals is undervalued by 73.5%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: ANI Pharmaceuticals Price vs Sales

The Price-to-Sales (P/S) ratio is a particularly useful metric for valuing profitable pharmaceutical companies like ANI Pharmaceuticals because it provides a clear view of how the market values every dollar of the company’s sales. Unlike earnings-based multiples, which can be skewed by short-term factors or accounting choices, the P/S ratio tends to better reflect the underlying business performance, especially when growth is steady and profit margins are consistent.

Growth expectations and risk play an important role in determining what a “normal” or “fair” P/S multiple should be. Businesses with higher growth prospects and stronger competitive positions often command higher multiples, while companies facing higher risks or slower growth generally trade at lower ratios.

ANI Pharmaceuticals currently trades at a P/S ratio of 2.56x. For context, the average P/S ratio in the Pharmaceuticals industry is 4.05x, while its peer group averages 3.93x. At first glance, this suggests ANI is trading below the market norm. However, to get a more accurate assessment, Simply Wall St calculates a “Fair Ratio” for each stock. For ANI, this Fair Ratio stands at 3.66x, factoring in growth rates, margins, size, and risk profile. This approach provides a more precise benchmark than generic industry or peer averages.

Because the Fair Ratio adjusts for company-specific attributes, it offers a more meaningful valuation comparison than industry or peer averages alone. Comparing ANI's actual P/S of 2.56x to its Fair Ratio of 3.66x, there is a considerable discount, indicating the stock looks undervalued by this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ANI Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Simply put, a Narrative is your interpretation of a company’s story that connects what you believe about its business future to the numbers in its financial forecast, and ultimately to an estimated fair value. Narratives let investors personalize their outlook: you might factor in new drug launches, market expansion, or operational risks, expressing your viewpoint through projected revenue, margins, and growth assumptions. All of this is available within an easy workflow on Simply Wall St’s Community page, where millions of investors share ideas.

With Narratives, you can make decisions more confidently by directly comparing your fair value estimate to the current share price. Since they update automatically as new information comes in, your outlook remains current. For instance, some community members might build a bullish Narrative for ANI Pharmaceuticals, forecasting high annual revenue growth and a price target exceeding $120. Others may take a more cautious stance with lower growth expectations and a $77 target. Each Narrative reflects a unique perspective on ANI’s future and helps you act based on what you believe, not just what the market says.

Do you think there's more to the story for ANI Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ANIP

ANI Pharmaceuticals

A biopharmaceutical company, develops, manufactures, and markets branded and generic pharmaceutical products in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives