- United States

- /

- Pharma

- /

- NasdaqGM:ANIP

A Fresh Look at ANI Pharmaceuticals (ANIP) Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

ANI Pharmaceuticals (ANIP) has recently caught the attention of investors, with shares declining nearly 11% over the past month. This shift has prompted a closer look at how the company’s fundamentals might influence its current valuation.

See our latest analysis for ANI Pharmaceuticals.

While ANI Pharmaceuticals’ share price has pulled back recently, momentum over the past year tells a different story. The company delivered a 52.07% total shareholder return and an impressive 197.73% gain over five years. The recent dip may reflect shifting risk sentiment rather than a fundamental change in the business, with long-term investors still well in the green and growth potential keeping the stock on many watchlists.

If moves like this have you thinking about the broader market, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With a recent pullback and shares still well above their multi-year starting point, is ANI Pharmaceuticals now trading at a discount, or are investors already factoring in the company’s continued growth prospects, leaving little room for upside?

Most Popular Narrative: 23.5% Undervalued

According to the market’s most widely followed narrative, ANI Pharmaceuticals appears to be trading well below its estimated fair value. The narrative fair value signals meaningful upside compared to the last close price. This perception is fueling debate over whether current market skepticism underestimates the company’s growth trajectory and profit potential.

There is significant, untapped growth potential for Cortrophin Gel across core and emerging indications (neurology, nephrology, rheumatology, pulmonology, ophthalmology, and gout), with patient populations far below prior peaks and epidemiological data suggesting the addressable market could be several times larger due to an aging population and the rising prevalence of chronic diseases, supporting multiyear revenue expansion.

This valuation call is built on bold revenue and profit margin projections driven by a blockbuster product and ambitious market expansion plans. But are the underlying assumptions as rock-solid as they seem? The narrative hinges on aggressive future earnings estimates and a premium profit multiple typically reserved for sector leaders. Ready to uncover which growth levers and financial bets set this fair value apart? Dive in to see the hidden catalysts that could justify this bullish outlook.

Result: Fair Value of $109.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition in generics and increased operating expenses could pressure margins and slow ANI Pharmaceuticals’ growth, even with its recent momentum.

Find out about the key risks to this ANI Pharmaceuticals narrative.

Another View: What Do Market Multiples Say?

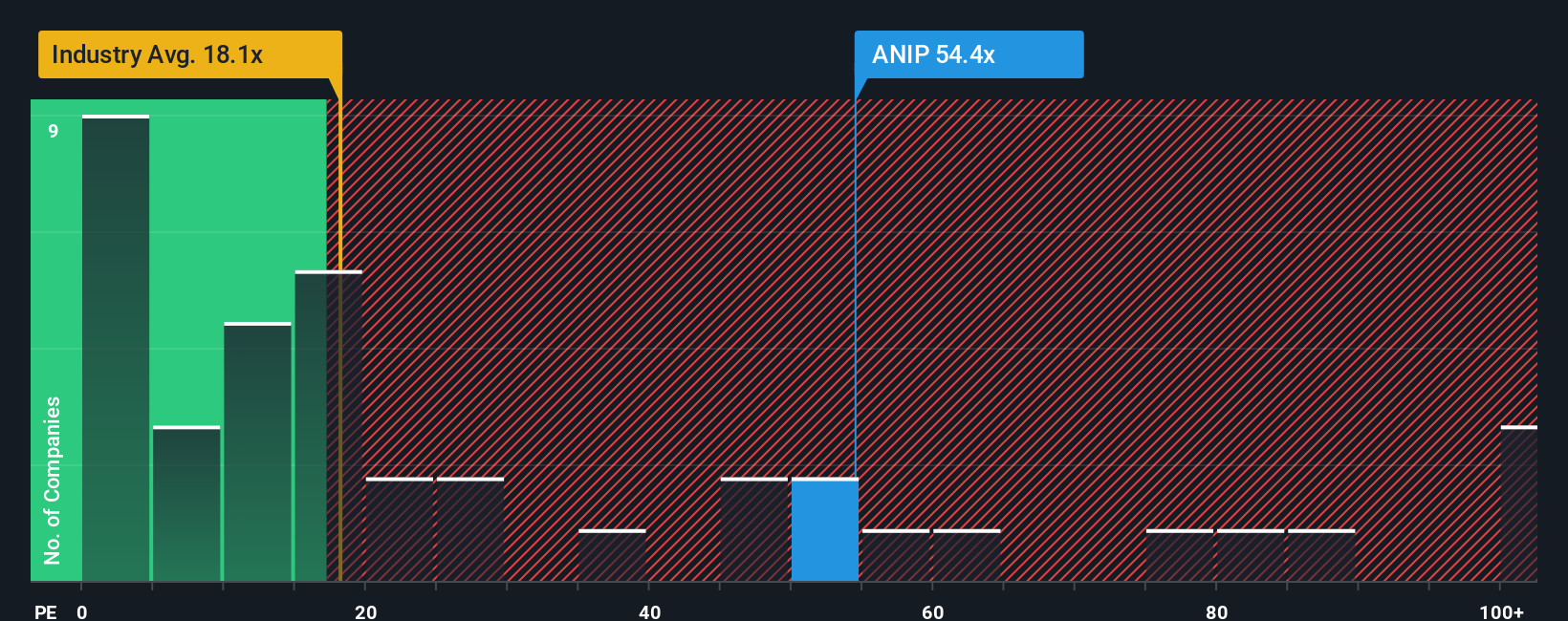

While fair value estimates suggest upside, the market's go-to valuation tool tells a more cautious story. ANI Pharmaceuticals’ price-to-earnings ratio sits at 51.4x, much higher than both the industry average of 18.8x and its fair ratio of 20.3x. Such a large gap could signal a risk that expectations are running too high, or it could simply reflect future growth potential the market is not willing to ignore.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ANI Pharmaceuticals Narrative

Feel free to dig into the numbers yourself and shape your own take on ANI Pharmaceuticals. Building a personalized perspective is quick and insightful. Do it your way

A great starting point for your ANI Pharmaceuticals research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your portfolio to just one opportunity. Uncover new stocks that could supercharge your returns using the powerful Simply Wall Street Screener.

- Capitalize on companies with strong cash flows and potential by reviewing these 905 undervalued stocks based on cash flows, which might be trading at bargain prices right now.

- Catch the next wave of disruption and consider these 26 AI penny stocks that may benefit as artificial intelligence reshapes industries.

- Boost your income with stability by scanning these 16 dividend stocks with yields > 3%, which delivers attractive yields above 3% for potentially smart and reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ANIP

ANI Pharmaceuticals

A biopharmaceutical company, develops, manufactures, and markets branded and generic pharmaceutical products in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives