- United States

- /

- Pharma

- /

- NasdaqGS:AMRX

How Amneal Pharmaceuticals’ (AMRX) Return to Profitability and Respiratory Product Wins Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Amneal Pharmaceuticals, Inc. reported strong third-quarter 2025 results, returning to profitability with US$784.51 million in sales and launching new products, including Brekiya® autoinjector for migraines and cluster headaches, while also receiving tentative FDA approval for its first metered-dose inhaler targeting asthma.

- These developments mark significant milestones in Amneal's expansion into complex respiratory and specialty therapies, reflecting a broadened pipeline and strengthening its position in underserved markets.

- We'll examine how Amneal's improved profitability and new respiratory product approval may influence its investment narrative going forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Amneal Pharmaceuticals Investment Narrative Recap

To own Amneal Pharmaceuticals, I think an investor needs to believe that continued expansion into complex generics and specialty products will offset persistent price pressure in U.S. generics and help diversify revenue streams. The company’s strong third-quarter results, return to profitability, and launch of new specialty products may strengthen the short-term investment case, but the primary risk of margin compression from intense generic market competition remains material and unchanged in light of this news.

The recent tentative FDA approval for Amneal’s first metered-dose inhaler, a generic QVAR alternative for asthma, is highly relevant. This important milestone moves Amneal into the respiratory space and directly addresses the need for diversified growth catalysts beyond its established core portfolio, potentially aiding future margin resilience if successfully commercialized.

However, despite financial improvements, investors should also know that heavy reliance on U.S.-based revenues means...

Read the full narrative on Amneal Pharmaceuticals (it's free!)

Amneal Pharmaceuticals' narrative projects $3.5 billion in revenue and $207.9 million in earnings by 2028. This requires 7.2% yearly revenue growth and a $204.5 million increase in earnings from the current $3.4 million.

Uncover how Amneal Pharmaceuticals' forecasts yield a $12.67 fair value, a 21% upside to its current price.

Exploring Other Perspectives

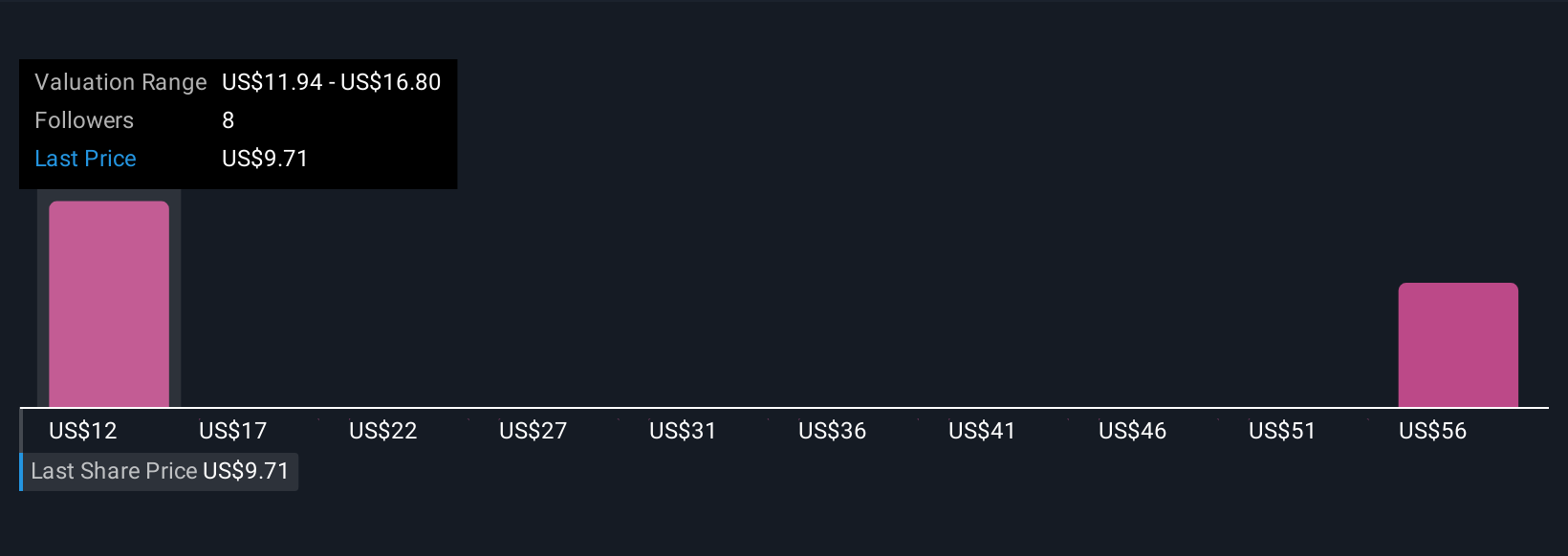

Simply Wall St Community members estimate fair value for Amneal stock from US$11.94 to US$64.09, based on three distinct forecasts. You see the widest optimism alongside real concerns about margin pressure as competition intensifies in the generics space, inviting you to compare a spectrum of viewpoints.

Explore 3 other fair value estimates on Amneal Pharmaceuticals - why the stock might be worth just $11.94!

Build Your Own Amneal Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amneal Pharmaceuticals research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Amneal Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amneal Pharmaceuticals' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMRX

Amneal Pharmaceuticals

A global biopharmaceutical company, develops, manufactures, markets, and distributes generics, injectables, biosimilars, and specialty branded pharmaceutical products worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives