- United States

- /

- Pharma

- /

- NasdaqGS:AMPH

Should Amphastar’s (AMPH) Exclusive 10-Year BAQSIMI Deal in Greater China Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Amphastar Pharmaceuticals recently announced an exclusive 10-year distribution agreement with Nanjing Chengong Pharmaceutical to market its BAQSIMI nasal powder product across Mainland China, Taiwan, Hong Kong, and Macau.

- This deal expands Amphastar’s access to the Greater China region while highlighting a related party transaction reviewed and approved by independent company directors.

- We'll examine how this exclusive arrangement for BAQSIMI in Greater China could reshape Amphastar's investment outlook and international expansion strategy.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Amphastar Pharmaceuticals Investment Narrative Recap

For those looking at Amphastar Pharmaceuticals, the investment story centers on building a diversified portfolio of essential medicines with expanding global reach, while navigating margin risks from competition and payer pressure. The recent 10-year BAQSIMI agreement in Greater China extends global access and could help offset product concentration risk, but likely does not materially shift near-term catalysts, which hinge on stable US sales and future product approvals.

Of the company’s recent updates, the exclusive license for three proprietary peptides in the US and Canada stands out. This move, like the China BAQSIMI deal, highlights efforts to diversify Amphastar’s pipeline and limit exposure to individual products, reinforcing longer-term growth interests if future launches succeed.

Conversely, investors should be aware of how Amphastar’s dependence on a few key products...

Read the full narrative on Amphastar Pharmaceuticals (it's free!)

Amphastar Pharmaceuticals' narrative projects $830.2 million revenue and $142.5 million earnings by 2028. This requires 4.7% yearly revenue growth and a $7.8 million earnings increase from current earnings of $134.7 million.

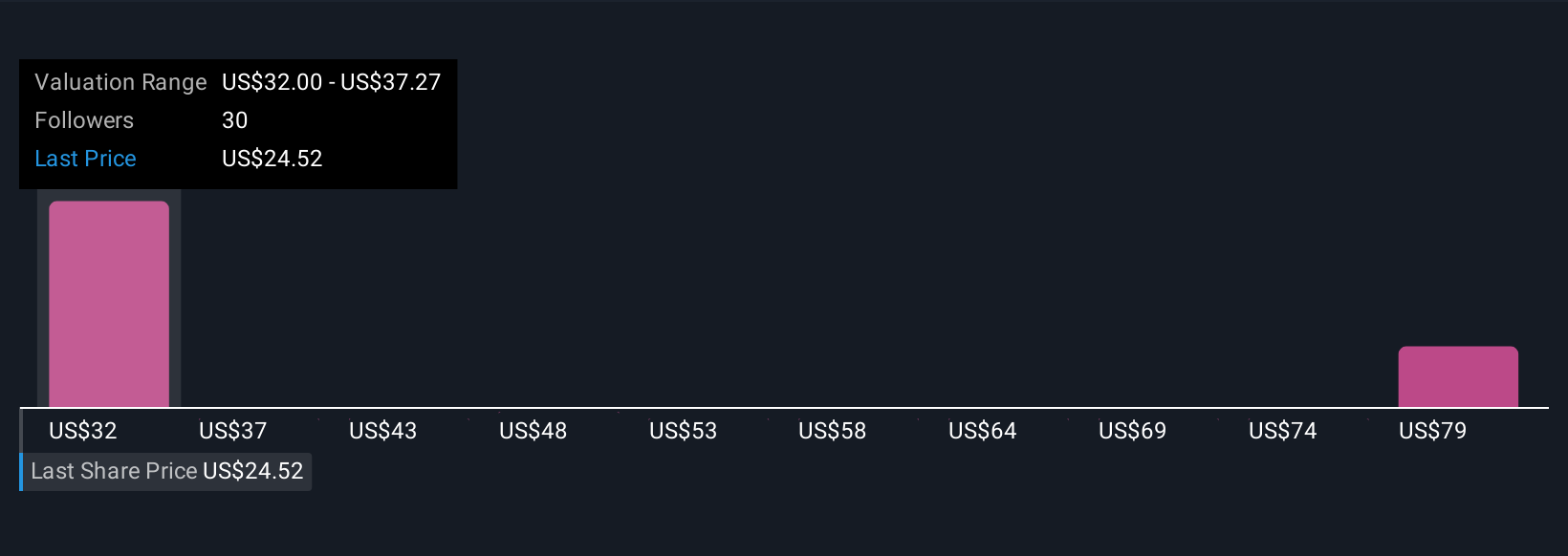

Uncover how Amphastar Pharmaceuticals' forecasts yield a $32.00 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from US$32 to US$84.72, underscoring wide divergence in expectations. Concentrated revenue sources remain a central concern as you weigh these differing perspectives on Amphastar’s outlook.

Explore 3 other fair value estimates on Amphastar Pharmaceuticals - why the stock might be worth just $32.00!

Build Your Own Amphastar Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amphastar Pharmaceuticals research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amphastar Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amphastar Pharmaceuticals' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMPH

Amphastar Pharmaceuticals

A bio-pharmaceutical company, develops, manufactures, markets, and sells generic and proprietary injectable, inhalation, and intranasal products in the United States, China, and France.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives