- United States

- /

- Pharma

- /

- NasdaqGS:AMPH

Does Amphastar’s New Product Approvals Signal a Turning Point for the Stock in 2025?

Reviewed by Bailey Pemberton

- Wondering if Amphastar Pharmaceuticals could be a hidden gem or a value trap? You are not alone, as countless investors are keeping a close eye on its price and fundamentals.

- After a rough year with the stock down 39.5%, Amphastar has shown signs of life lately. The stock has jumped 7.8% over the past week and 13.8% in the last month.

- Much of this renewed interest stems from headlines about the company’s ongoing expansion efforts and recent product approvals, both of which signal potential for future growth. These updates have reshaped investor sentiment and contributed to recent price movements.

- When Amphastar is evaluated using six key valuation checks, it scores 5 out of 6 for undervaluation. Next, let’s look at how those valuation methods actually work and which approach could ultimately be even more insightful for long-term investors.

Approach 1: Amphastar Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s value using an appropriate rate. This approach provides investors with a way to assess what a business is truly worth, based on its anticipated cash generation rather than just short-term market sentiment.

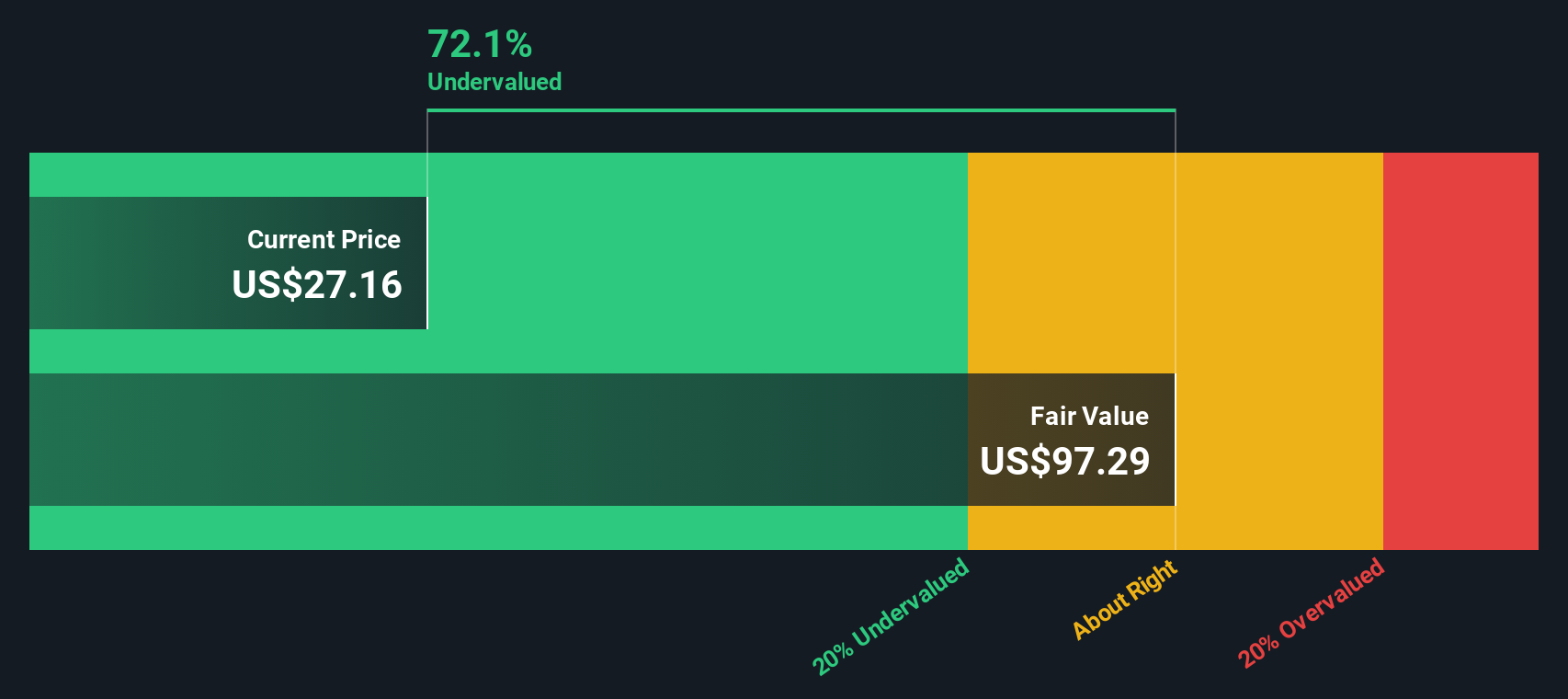

For Amphastar Pharmaceuticals, the DCF evaluation uses the 2 Stage Free Cash Flow to Equity model. Currently, the company’s Free Cash Flow stands at $110.7 million. Analysts provide specific projections for the next five years, forecasting steady growth, and Simply Wall St extrapolates these estimates further out. By 2029, projected Free Cash Flow reaches $187 million, with subsequent years gradually increasing, based on moderate assumed growth rates.

After discounting these future cash flows to their present value, the DCF model estimates Amphastar’s intrinsic value at $97.29 per share. This valuation suggests the stock is trading at a 71.9% discount to its real worth according to this method, signaling notable undervaluation relative to current market pricing.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amphastar Pharmaceuticals is undervalued by 71.9%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Amphastar Pharmaceuticals Price vs Earnings

For consistently profitable companies like Amphastar Pharmaceuticals, the Price-to-Earnings (PE) ratio is often the most relevant valuation metric because it reflects how much investors are paying for each dollar of earnings. A lower PE can signal value if the company is growing steadily and generating solid profits. A higher PE may be justified for businesses with strong growth prospects or lower risk profiles.

The level at which a PE ratio is considered fair depends greatly on market expectations for future earnings growth and the risks associated with the business. Faster-growing, more stable companies tend to command higher PE ratios, while slower growers or riskier stocks usually trade at lower multiples.

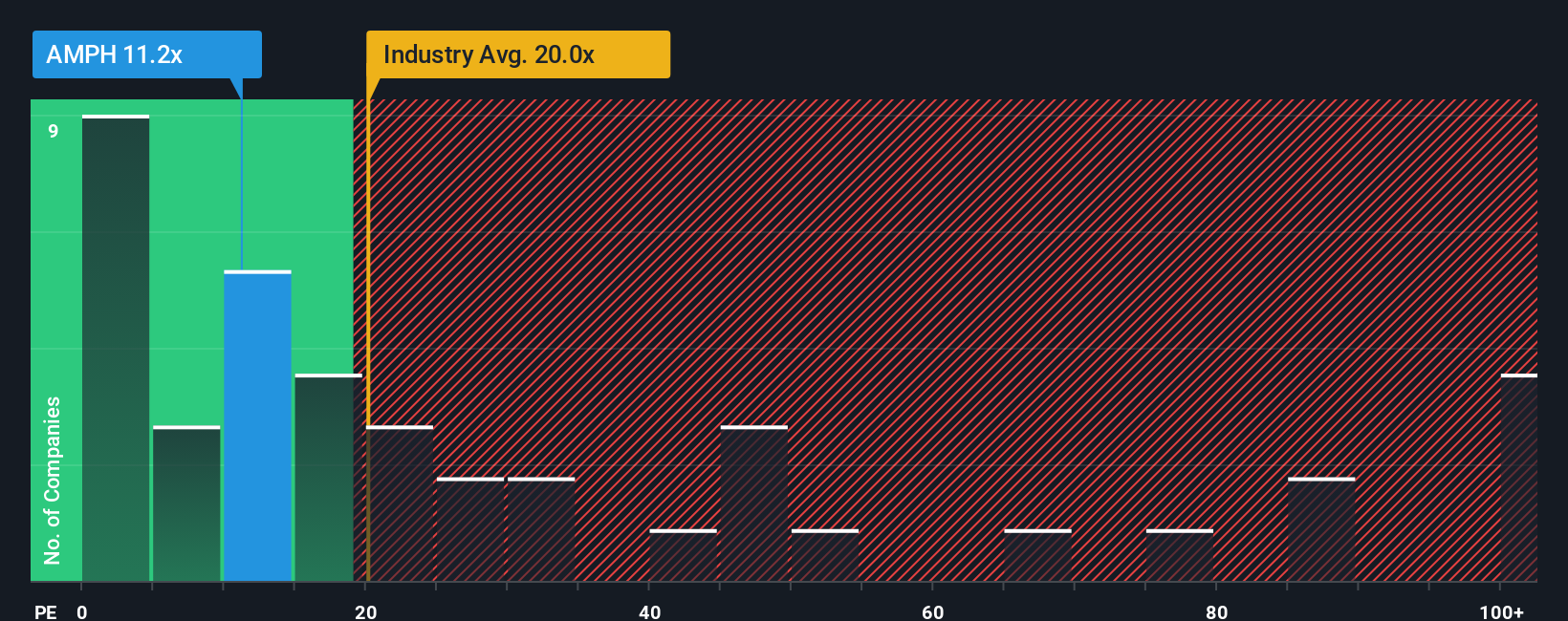

Amphastar currently trades at a PE of 11.3x. That is noticeably lower than the pharmaceuticals industry average of 20.6x and well below the average for its peers, which sits at 33.3x. This initial comparison suggests the stock may be undervalued relative to its sector.

However, simply comparing PE ratios can miss important nuances. That is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio, 15.5x in Amphastar’s case, represents what the company’s PE should be based on its unique blend of earnings growth, industry dynamics, margins, market cap, and business risk. Because the Fair Ratio adjusts for company-specific factors as well as industry trends, it is generally a more insightful measure than the crude peer or market average.

Comparing Amphastar’s current PE of 11.3x to its Fair Ratio of 15.5x shows that the stock is trading meaningfully below its fair value on this basis. This indicates the market is likely underpricing the company’s earnings power at present.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amphastar Pharmaceuticals Narrative

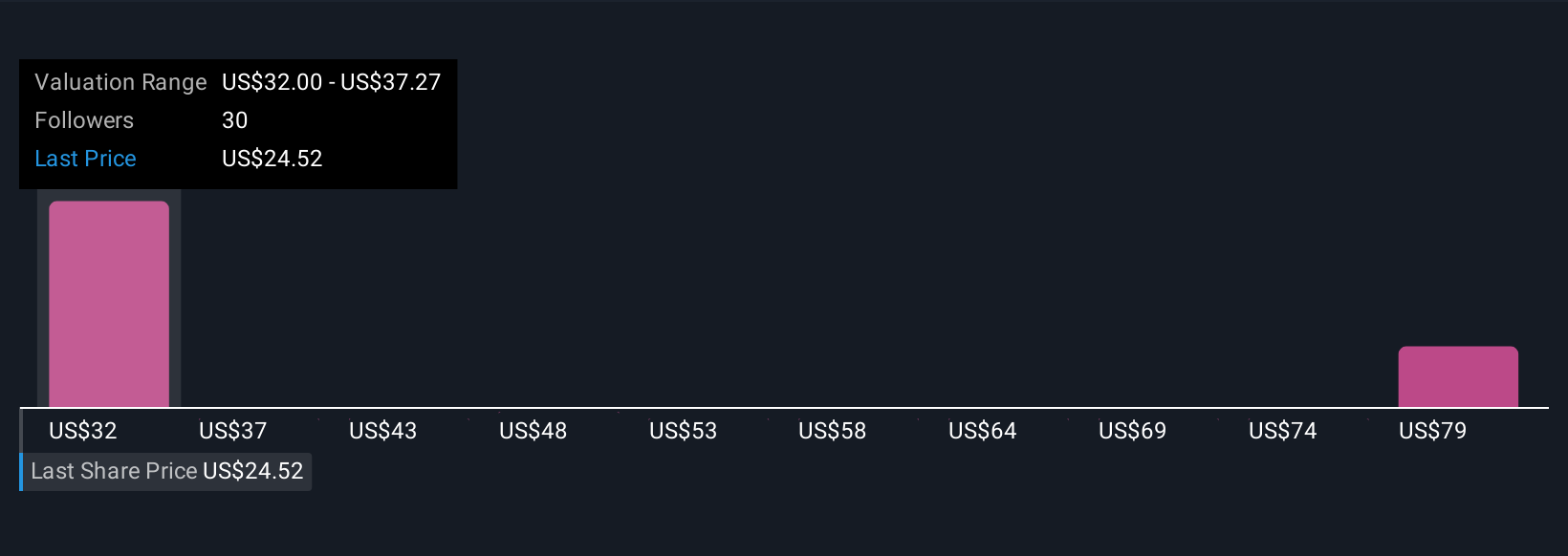

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal investment story. It connects your understanding of Amphastar Pharmaceuticals’ business, your assumptions about its future (such as revenue, earnings, and profit margins), and the fair value you estimate, into one clear financial forecast.

Narratives make investing accessible and dynamic, offering a simple tool you can use on the Simply Wall St platform’s Community page, where millions of investors share their perspectives. By tying together the company’s story, financial estimates, and fair value, Narratives help you quickly see the case for buying or selling by contrasting your calculated fair value with the current price.

These Narratives are automatically updated with the latest developments, so when fresh news or earnings reports emerge, your forecasts stay relevant and actionable. For example, some investors might see Amphastar's focus on injectable generics and cost controls as a reason for a cautious outlook and a lower price target of $25. Others may emphasize pipeline expansion and domestic manufacturing to justify a higher narrative value of $38.

Do you think there's more to the story for Amphastar Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMPH

Amphastar Pharmaceuticals

A bio-pharmaceutical company, develops, manufactures, markets, and sells generic and proprietary injectable, inhalation, and intranasal products in the United States, China, and France.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success