- United States

- /

- Pharma

- /

- NasdaqGS:AMPH

Amphastar Pharmaceuticals (AMPH) Is Up 6.5% After Earnings Beat and Pipeline Expansion—What's Changed?

Reviewed by Sasha Jovanovic

- Amphastar Pharmaceuticals recently reported third-quarter earnings that exceeded analyst forecasts, with net revenues of US$191.8 million and adjusted net income of US$44.6 million, and announced executive participation in the 37th Annual Piper Sandler Healthcare Conference where updates on regulatory and clinical operations will be highlighted.

- The company continues to grow through a dual approach of organic expansion and acquisitions, strengthened by a diversifying product pipeline and regulations that may quicken the pace of future product approvals.

- We'll explore how Amphastar's stronger-than-expected quarterly earnings and ongoing product pipeline expansion impact its overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Amphastar Pharmaceuticals Investment Narrative Recap

To own shares in Amphastar Pharmaceuticals, investors need to believe in the company's ability to expand its revenue and margins by steadily launching new pipeline products and integrating past acquisitions, while managing risks around pricing pressure and competition in critical product categories. The recent announcement of executive participation at the Piper Sandler Healthcare Conference is not expected to materially impact Amphastar's most important short-term catalysts, timely product approvals and market diversification, but it does provide a forum for regulatory updates that could address pressing investor concerns. The main risk remains earnings sensitivity to competitive pricing and concentration in a few key products, which could pressure profitability if pipeline launches are delayed or underperform.

Of the recent announcements, Amphastar's US$415 million share buyback authorization stands out. Continuing with substantial buybacks signals management's confidence in the business and could support shareholder value during periods when earnings are under pressure from competition or margin compression, tying directly to the ongoing risks and catalysts facing the company.

But on the other hand, investors should not overlook the growing influence of price competition on core product revenues and how this could affect...

Read the full narrative on Amphastar Pharmaceuticals (it's free!)

Amphastar Pharmaceuticals is expected to generate $830.2 million in revenue and $142.5 million in earnings by 2028. This outlook assumes revenue will grow at a rate of 4.7% annually, and forecasts an earnings increase of $7.8 million from current earnings of $134.7 million.

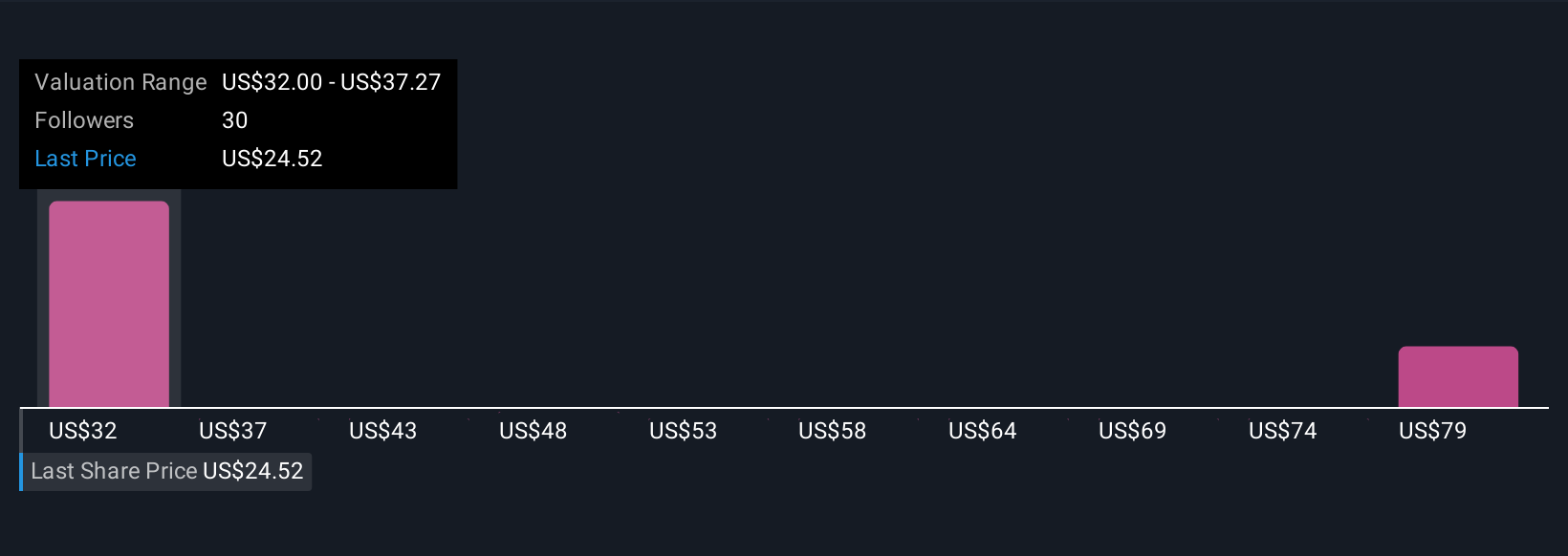

Uncover how Amphastar Pharmaceuticals' forecasts yield a $32.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Three recent fair value estimates from the Simply Wall St Community span from US$32.00 to US$97.29 per share, highlighting wide-ranging expectations for Amphastar stock. With competitive pressures seen as a leading risk, opinions vary strongly, check out more independent views to get the complete picture.

Explore 3 other fair value estimates on Amphastar Pharmaceuticals - why the stock might be worth just $32.00!

Build Your Own Amphastar Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amphastar Pharmaceuticals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amphastar Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amphastar Pharmaceuticals' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMPH

Amphastar Pharmaceuticals

A bio-pharmaceutical company, develops, manufactures, markets, and sells generic and proprietary injectable, inhalation, and intranasal products in the United States, China, and France.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026