- United States

- /

- Pharma

- /

- NasdaqGS:AMLX

Is Amylyx (AMLX) Reshaping Its Investment Case With Improved Losses and Avexitide’s Path to Market?

Reviewed by Sasha Jovanovic

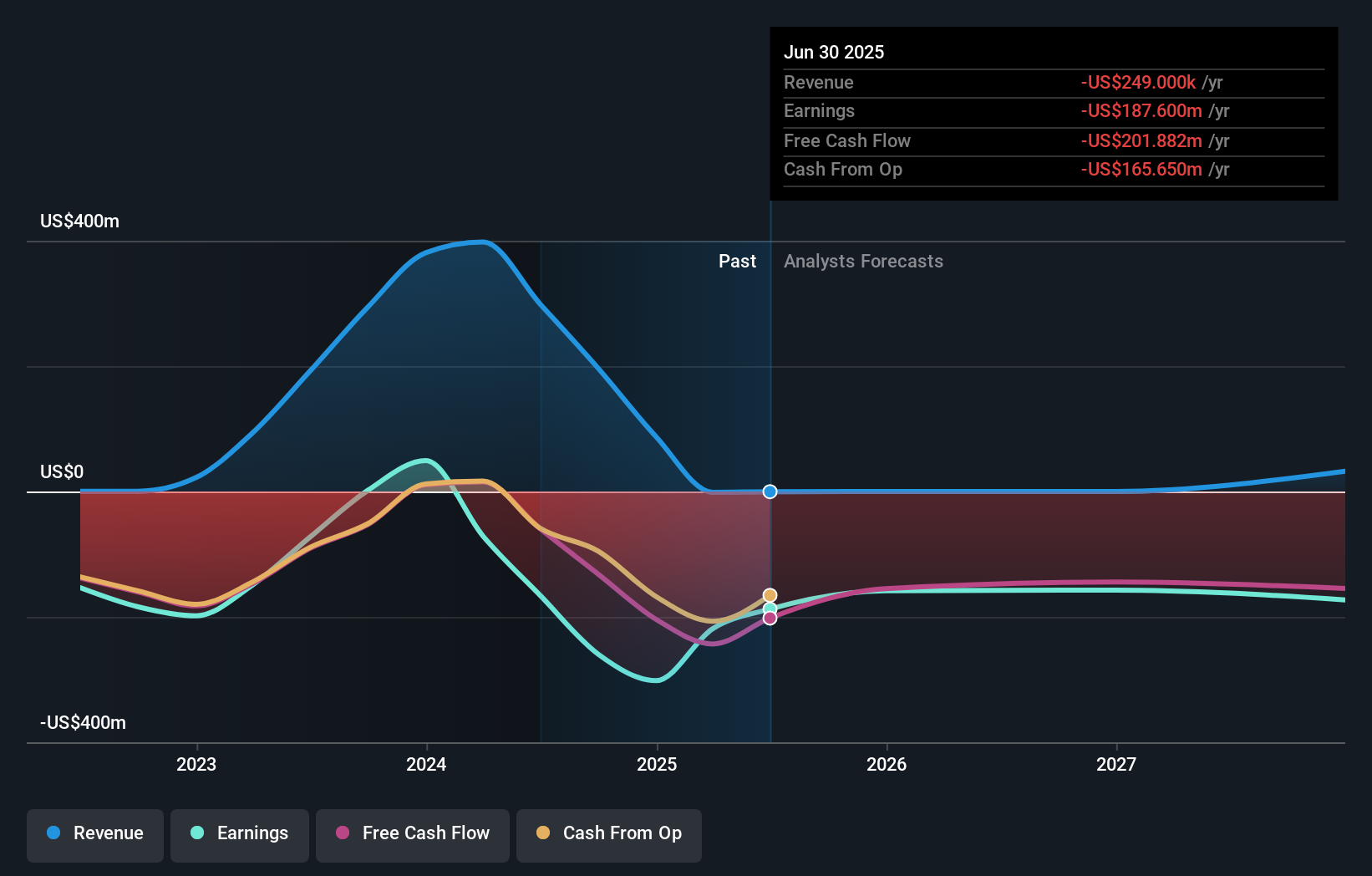

- Amylyx Pharmaceuticals recently reported third quarter 2025 results, revealing a reduction in net loss to US$34.39 million, down from US$72.7 million a year earlier, and provided updates on its clinical pipeline including adjusted timelines for the pivotal Phase III LUCIDITY trial.

- An important development is the progress toward a potential commercial launch for avexitide in 2027, reflecting the company's forward-looking investment in market readiness despite near-term trial delays.

- We'll explore how Amylyx's substantial improvement in financial performance shapes its investment narrative, especially as it advances avexitide's commercialization efforts.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Amylyx Pharmaceuticals' Investment Narrative?

To believe in Amylyx Pharmaceuticals right now, you have to be confident in the company's ability to deliver on its clinical pipeline, particularly as it targets a potential commercial launch of avexitide for post-bariatric hypoglycemia in 2027. The recent third quarter results revealed a marked reduction in net loss, which eases some financial pressure and signals disciplined expense management, even as meaningful revenue remains out of reach. While short-term catalysts hinge on progress in the LUCIDITY Phase III trial, the updated timeline delaying patient recruitment completion to early 2026 pushes pivotal data and, ultimately, regulatory submission further out. This shift introduces some uncertainty, even though the cash position appears strong following a recent capital raise. The biggest risks right now remain tied to regulatory outcomes, execution delays, and the company's reliance on successful clinical trial readouts. While the latest financial update supports continued investment in readiness for commercialization, the trial timeline changes could heighten attention to execution and raise the stakes for future catalysts. Yet, not all investors may realize the impact that a shifting timeline can have on sentiment and risk.

Our expertly prepared valuation report on Amylyx Pharmaceuticals implies its share price may be too high.Exploring Other Perspectives

Build Your Own Amylyx Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amylyx Pharmaceuticals research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Amylyx Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amylyx Pharmaceuticals' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMLX

Amylyx Pharmaceuticals

A clinical-stage pharmaceutical company, engages in the discovery and development of treatment options for neurodegenerative diseases and endocrine conditions in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives