- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

How Amgen’s (AMGN) Dividend and Tezspire Approval Could Shape Investor Expectations for 2025

Reviewed by Sasha Jovanovic

- Amgen recently announced that its Board of Directors declared a US$2.38 per share dividend for the fourth quarter of 2025, payable on December 12, 2025, to shareholders of record as of November 21, 2025, while also highlighting upcoming major clinical trial data presentations for its cardiovascular drug Repatha and new regulatory approvals for Tezspire in chronic rhinosinusitis.

- The combination of sustained dividend payments and recent approvals underscore Amgen's focus on broadening its late-stage portfolio and expanding its reach across major therapeutic areas.

- We will review how the new EU approval for Tezspire, supported by strong clinical trial results, impacts Amgen's long-term growth narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Amgen Investment Narrative Recap

To own Amgen, you have to believe that its diversified pipeline, strong late-stage assets, and dependable dividend can overcome headwinds from industry pricing pressures and biosimilar competition. The recent dividend declaration and regulatory advancements for Repatha and Tezspire reinforce Amgen’s dedication to late-stage pipeline growth, but do not appear to materially affect the most important near-term catalyst: execution on major product launches like MariTide for obesity. Meanwhile, the most significant risk, erosion in legacy brands from biosimilar entry, remains largely unchanged for now.

Amgen’s EU approval for Tezspire in chronic rhinosinusitis with nasal polyps is especially relevant, as it highlights the company’s push to expand in specialty immunology. This approval, built on strong Phase 3 WAYPOINT results, supports the argument for broader late-stage innovation, yet the primary short-term market mover continues to be the pace and success of larger pipeline launches aimed at high unmet needs.

By contrast, investors should also be aware that while new launches show promise, risks tied to accelerating biosimilar competition in core franchises may...

Read the full narrative on Amgen (it's free!)

Amgen’s narrative projects $37.4 billion revenue and $8.2 billion earnings by 2028. This requires 2.3% yearly revenue growth and a $1.6 billion earnings increase from $6.6 billion currently.

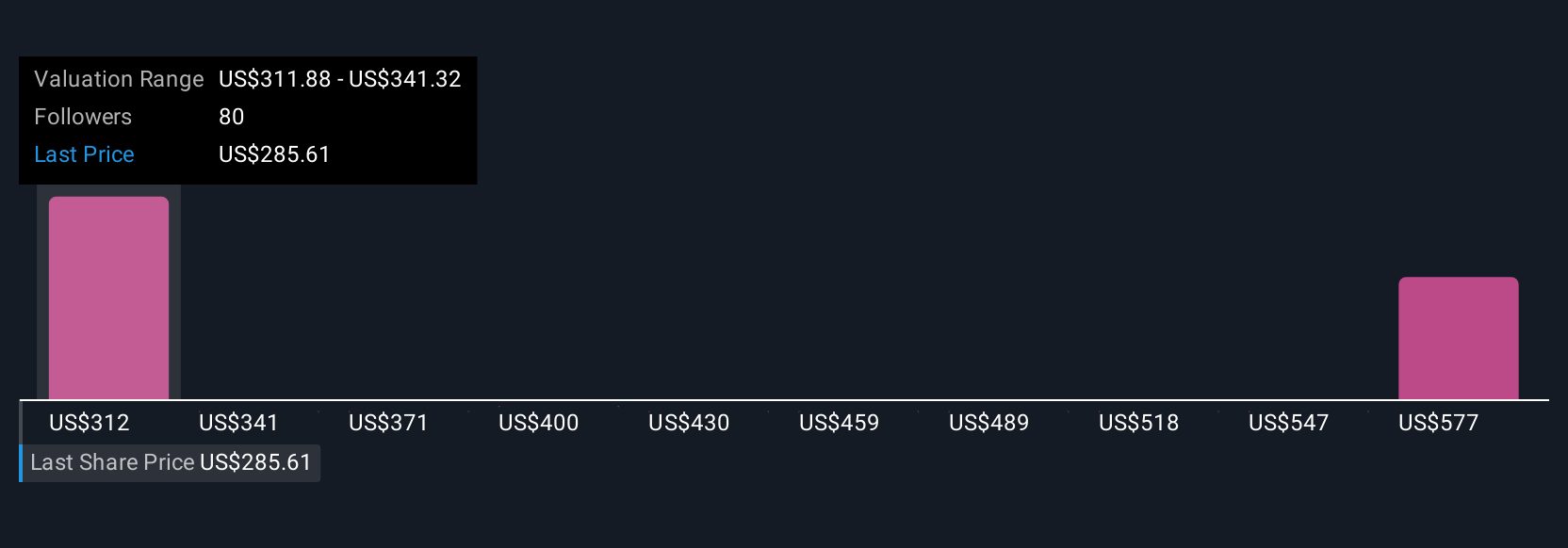

Uncover how Amgen's forecasts yield a $311.88 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts see Amgen’s expanding chronic care volumes and AI-driven R&D as setting up frequent high-impact launches. These bulls expected US$42.8 billion in revenue and US$13.3 billion in earnings by 2028, suggesting recent news could lead them to revise projections even higher. Investor opinions vary widely, so it’s worthwhile to explore these different viewpoints and consider how recent announcements may shift the consensus.

Explore 6 other fair value estimates on Amgen - why the stock might be worth just $311.88!

Build Your Own Amgen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amgen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amgen's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 23 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives