- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

Amgen’s 29.9% Rally in 2025 Sparks Debate After New Drug Approvals

Reviewed by Bailey Pemberton

- Wondering if Amgen is a bargain right now? You are not alone. Investors are constantly on the lookout for stocks whose price might not reflect their true worth.

- The stock has been on quite a run, climbing 5.2% over the past week, 13.3% for the past month, and up an impressive 29.9% year-to-date.

- Amgen's recent gains have coincided with industry optimism around its new drug approvals and ongoing research partnerships, which have been widely discussed in news coverage. In addition, analyst upgrades and sector momentum have fueled renewed interest among institutional investors.

- When it comes to valuation, Amgen scores 4 out of 6 on our valuation checks. This suggests there is real substance behind the surge. Next, we will break down how different valuation methods measure Amgen’s worth and, by the end, share a smarter way to think about value that goes beyond the numbers.

Approach 1: Amgen Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today. This approach gives investors a sense of what Amgen could be worth based on its potential to generate cash.

Currently, Amgen generates approximately $11.7 billion in Free Cash Flow (FCF), as measured over the last twelve months. According to analyst forecasts, FCF is expected to grow steadily over the coming years, with projections reaching $15.9 billion by 2029. Analysts directly forecast up to five years out and beyond that, Simply Wall St extrapolates figures based on historical and expected growth rates.

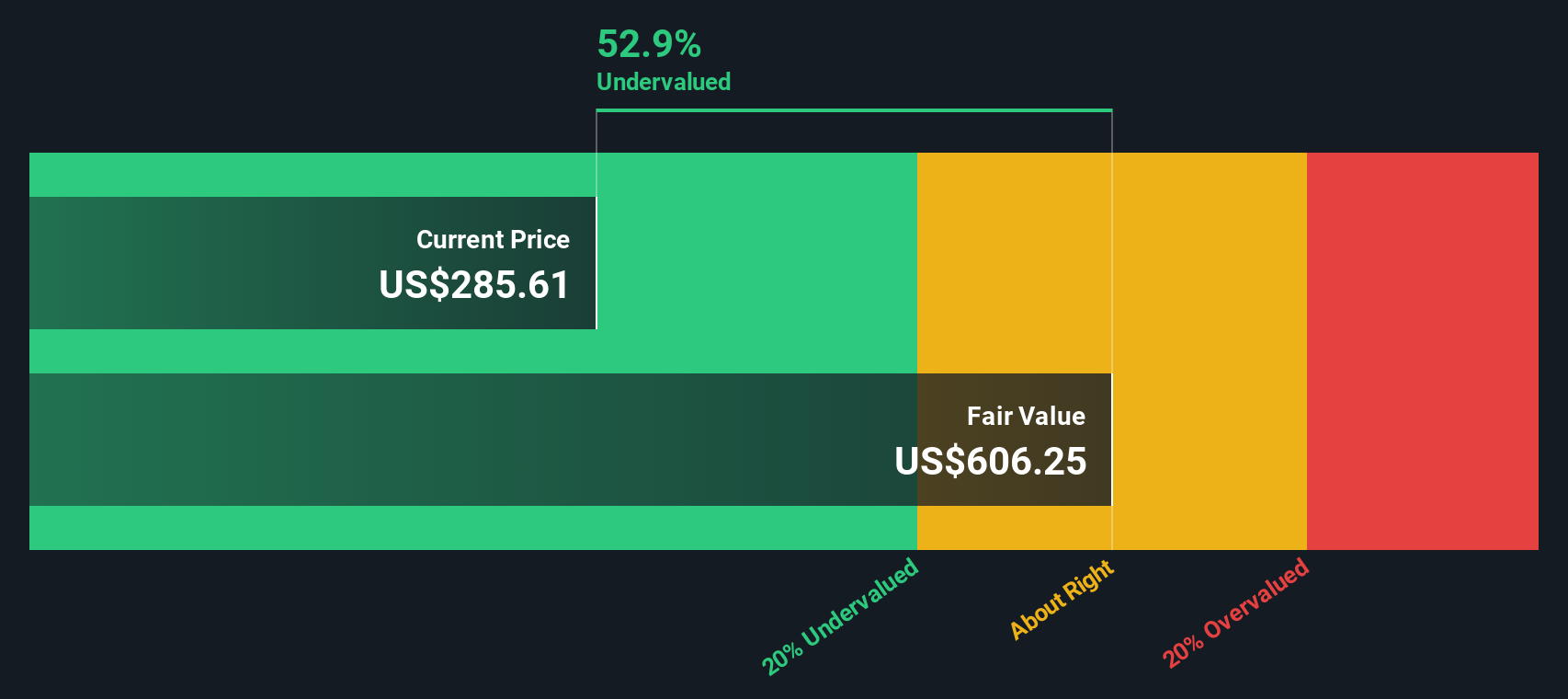

Using these projections, the DCF valuation model calculates Amgen's intrinsic value at $632 per share. With the current share price significantly below this level, the DCF model suggests that Amgen is trading at a 46.7% discount to its intrinsic value. This indicates substantial potential upside if the company's cash flow growth plays out as expected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amgen is undervalued by 46.7%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Amgen Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is a widely used valuation metric for profitable companies like Amgen, as it relates the current share price to the company's earnings. This allows investors to quickly gauge how much they are paying for each dollar of profits.

Growth expectations and risk both play an important role in determining what constitutes a "normal" or "fair" P/E ratio. Companies with brighter growth prospects or lower perceived risks can support higher P/E ratios, while slower growers or riskier businesses typically trade at lower multiples.

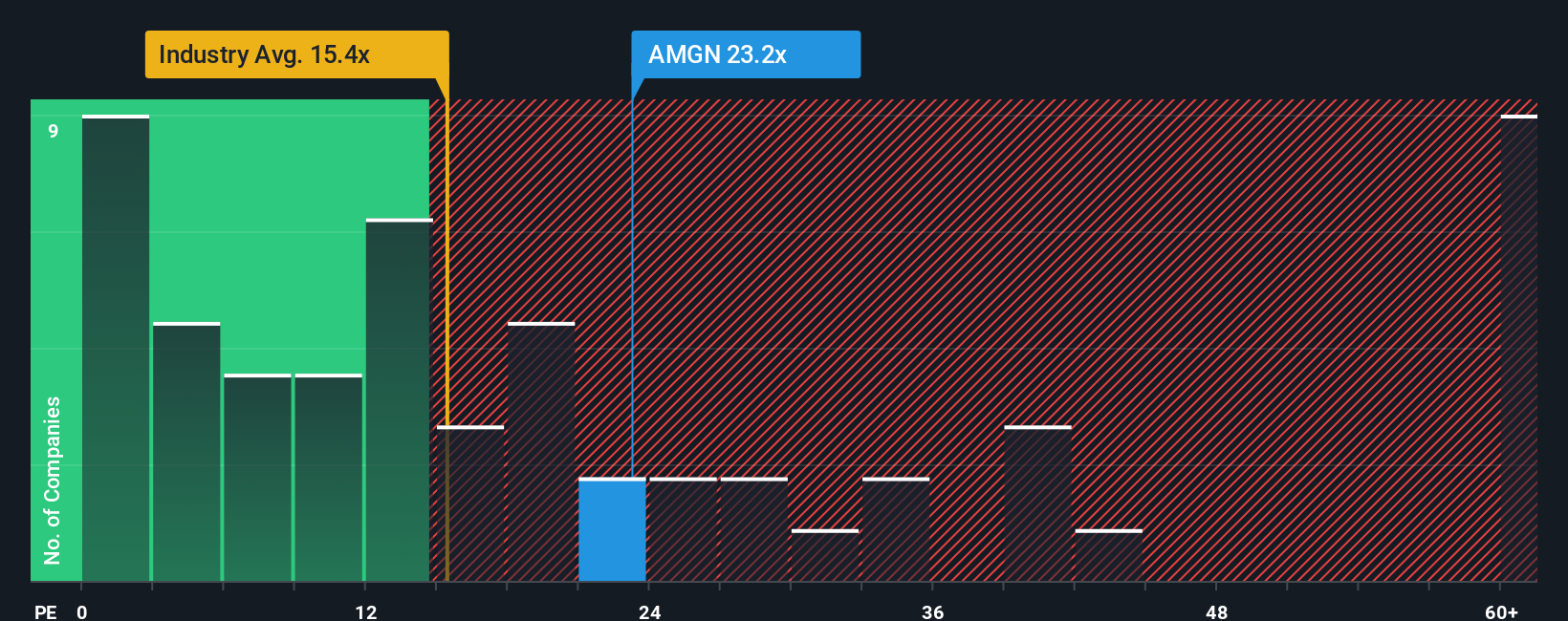

Amgen currently trades at a P/E ratio of 25.9x. This is notably higher than the broader Biotechs industry average of 17.4x, but considerably lower than the peer group average of 59.9x. These benchmarks offer useful context, but do not account for Amgen's unique mix of growth, profitability and risk profile.

That is where Simply Wall St's "Fair Ratio" comes in. The Fair Ratio, in this case 27.1x, reflects an in-depth assessment of what Amgen’s P/E should be by considering factors like its earnings outlook, industry characteristics, profit margins, market cap and risk profile. This approach is more robust than simple comparisons with industry or peer averages and offers a nuanced perspective tailored to the company’s specifics.

Comparing Amgen's actual P/E (25.9x) to its Fair Ratio (27.1x), the stock appears to be priced in line with expectations, suggesting its valuation is fair given current circumstances.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amgen Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a more dynamic and powerful approach to making investment decisions.

A Narrative is a simple, story-driven perspective on a company that connects your view of Amgen’s future with a specific financial forecast and fair value. Instead of only focusing on ratios or number crunching, Narratives invite you to clarify your assumptions about what Amgen’s future holds, such as its growth in key therapy areas, evolving margins, or the risks from competition and regulation, and see how those beliefs translate into numbers and a valuation.

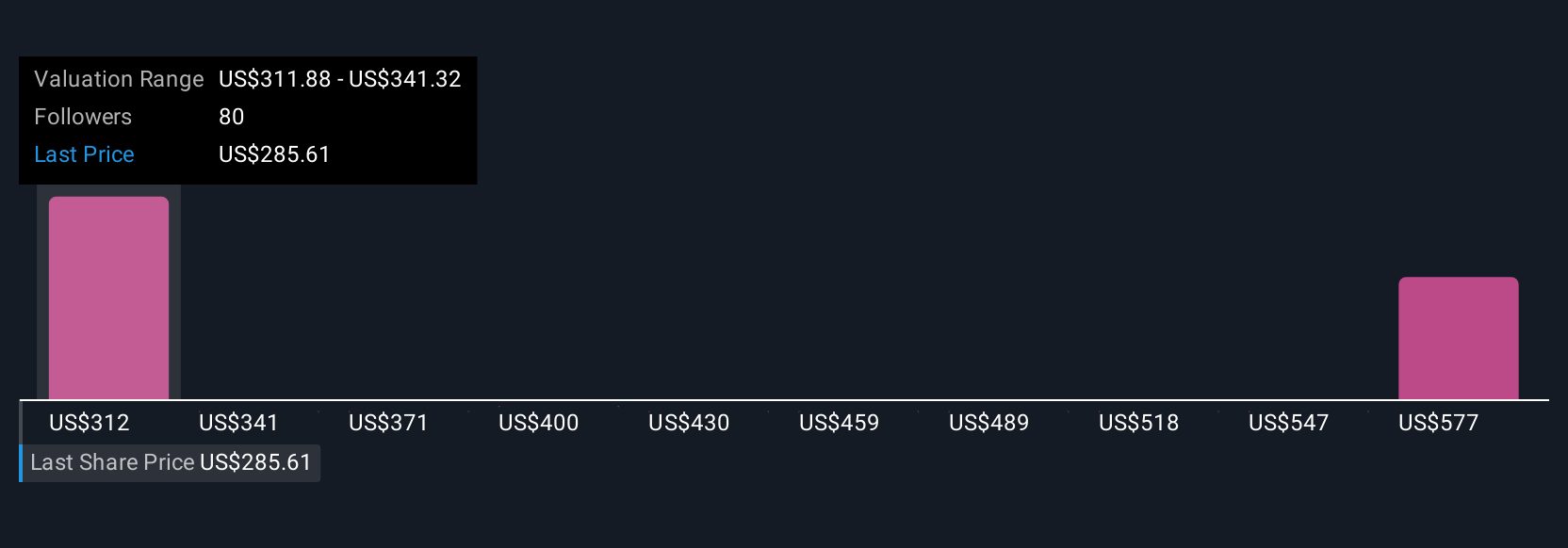

On Simply Wall St’s Community page, millions of investors can access and create Narratives about Amgen, making it easier to understand the range of possible outcomes and discover which Narrative aligns with your beliefs.

By comparing your Narrative’s Fair Value with Amgen’s current price, Narratives provide a smart, accessible way to decide when to buy, hold, or sell, and they update automatically when new news or earnings arrive.

For example, some investors see Amgen’s potential as worth up to $405 per share if obesity and rare disease pipelines outperform, while others warn of downside to $180 if pricing pressure and patent cliffs weigh on profits. You can instantly see how your own perspective fits between these extremes.

For Amgen, however, we’ll make it really easy for you with previews of two leading Amgen Narratives:

Fair Value: $404.87

Current price vs. narrative fair value: 16.8% undervalued

Assumed revenue growth: 7.1%

- Predicts Amgen will outperform revenue expectations, driven by rapid growth across more than 15 products, AI-powered R&D, and accelerated high-margin new launches in obesity, rare diseases, and biosimilars.

- Expects Amgen’s resilience to pricing pressure, global expansion, and strong M&A capacity to deliver multi-year earnings compounding and market share gains.

- Highlights risks from drug price reform, patent expirations, rising R&D costs, and acquisition integration, but sees significant upside if growth materializes as expected.

Fair Value: $218.89

Current price vs. narrative fair value: 53.8% overvalued

Assumed revenue growth: -0.5%

- Projects growing pressure from patent expirations, biosimilar competition, and regulatory changes will reduce Amgen’s revenues and margins over time.

- Warns that pricing reforms, operational and acquisition integration challenges, and escalating costs will cap profitability and threaten sustainable earnings growth.

- Notes some positive trends like a growing product pipeline and efficiency improvements, but believes these will not fully offset legacy declines and industry headwinds.

Do you think there's more to the story for Amgen? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives