- United States

- /

- Biotech

- /

- NasdaqGS:ALNY

Is Amyloid Regression and Kidney Preservation Data From HELIOS-B Shifting the Investment Case for Alnylam (ALNY)?

Reviewed by Sasha Jovanovic

- Earlier this week, Alnylam Pharmaceuticals announced and presented new post hoc analyses from the HELIOS-B Phase 3 study of AMVUTTRA® (vutrisiran), revealing amyloid regression in 22% of treated patients and preservation of kidney function, with a consistent safety profile demonstrated among those with advanced chronic kidney disease.

- This reinforces AMVUTTRA’s established efficacy as a multi-organ RNAi therapeutic, potentially highlighting its differentiation in treating transthyretin-mediated amyloidosis with cardiovascular and renal benefits.

- We’ll explore how these HELIOS-B results, demonstrating both cardiac amyloid reduction and preserved kidney function, may influence Alnylam’s long-term investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Alnylam Pharmaceuticals Investment Narrative Recap

To be a shareholder of Alnylam Pharmaceuticals, you need to believe in the company’s ability to drive sustained growth through the continued clinical and commercial success of AMVUTTRA and its RNAi pipeline, all while effectively managing margin pressures tied to pricing, reimbursement, and R&D expenses. While the recent positive HELIOS-B data reinforce the clinical value of AMVUTTRA, the most important short-term catalyst remains further uptake and payer acceptance in ATTR-CM, which this news supports but does not fully resolve; key risks like revenue concentration persist despite these updates.

The new post hoc analyses presented at the American Heart Association 2025 meetings, clarifying amyloid regression and kidney function preservation for AMVUTTRA, directly link back to Alnylam’s rapid international rollout and reinforce the recent upward revision in full-year revenue guidance, both of which hinge on expanding global access and physician adoption of the franchise.

However, investors should be aware that competitive pressures in ATTR-CM, if accelerating, could...

Read the full narrative on Alnylam Pharmaceuticals (it's free!)

Alnylam Pharmaceuticals' outlook projects $7.0 billion in revenue and $1.9 billion in earnings by 2028. This scenario assumes a 41.8% annual revenue growth rate and a $2.2 billion increase in earnings from the current level of -$319.1 million.

Uncover how Alnylam Pharmaceuticals' forecasts yield a $480.17 fair value, a 6% upside to its current price.

Exploring Other Perspectives

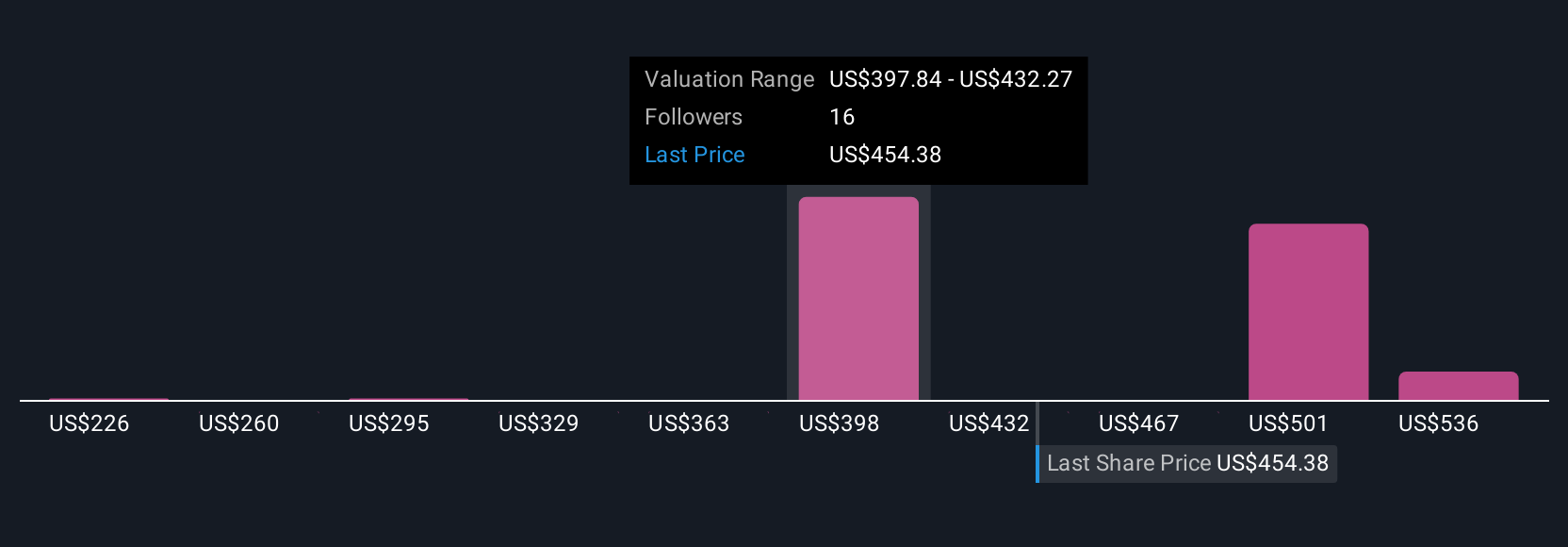

Simply Wall St Community members offered five fair value estimates for Alnylam stock, ranging widely from US$259.89 to US$606.32 per share. While some see strong revenue growth potential driving upside, others balance this view against risks from pricing pressure and earnings volatility, illustrating just how differently investors weigh the outlook for Alnylam’s long-term performance.

Explore 5 other fair value estimates on Alnylam Pharmaceuticals - why the stock might be worth 43% less than the current price!

Build Your Own Alnylam Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alnylam Pharmaceuticals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alnylam Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alnylam Pharmaceuticals' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALNY

Alnylam Pharmaceuticals

Alnylam Pharmaceuticals, Inc. discovers, develops, and commercializes therapeutics based on ribonucleic acid interference.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives