- United States

- /

- Biotech

- /

- NasdaqGS:ALNY

Assessing Alnylam After Stock Surges 100% on RNAi Momentum in 2025

Reviewed by Simply Wall St

If you own Alnylam Pharmaceuticals stock or are thinking about starting a position, you might be feeling a mix of excitement and caution right now. With shares closing recently at $465.89 and riding a year-to-date gain of nearly 100%, Alnylam has easily outpaced the broader biotech sector. That surge is even more impressive over the long term, with a five-year return topping 250%. It is clear the market has taken notice.

What has fueled this momentum? Beyond general enthusiasm for biotech’s potential, Alnylam has benefited from high-profile partnerships and ongoing optimism around its RNA interference (RNAi) technology platform. These trends, along with growing attention from large pharmaceutical players, have helped re-shape investor sentiment and might explain the sharp upward moves over the past several years. In the most recent week, the stock rose another 3.1%, building on a strong 5.2% gain over the last month alone.

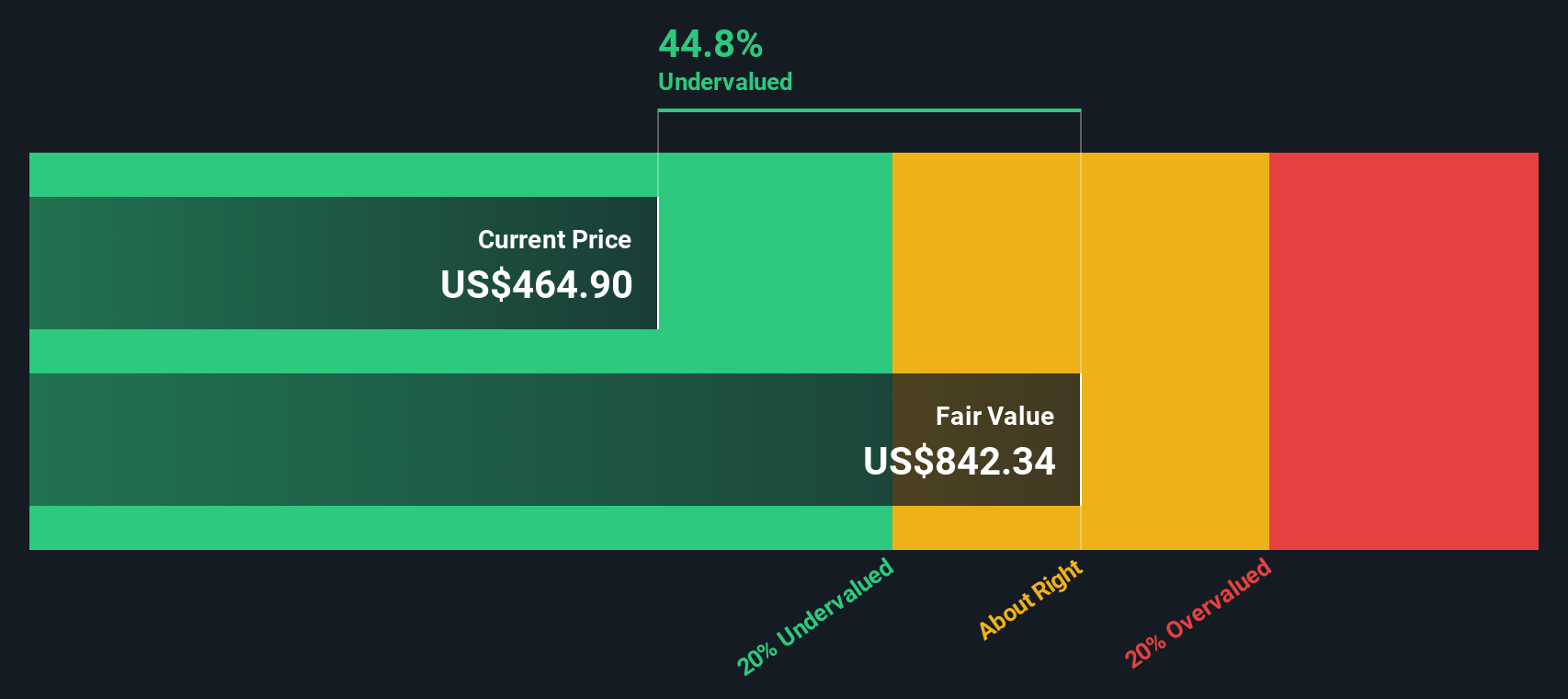

Of course, the key question now is whether all this excitement is justified by Alnylam’s current valuation. Is the stock still a buy at these levels? When we look across six commonly used valuation checks, Alnylam is considered undervalued in zero out of six. That means its value score is just 0 out of 6, which is hardly a convincing case for cheapness by traditional measurements.

Let’s dig deeper into what those valuation checks actually say about Alnylam, and then consider if there might be a smarter, more nuanced way to think about the company’s true worth.

Alnylam Pharmaceuticals scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Alnylam Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company’s expected future cash flows and discounting them back to their present value. This process gives investors an estimate of what the company is fundamentally worth today.

For Alnylam Pharmaceuticals, analysts estimate the company's latest twelve-month Free Cash Flow at approximately -$79.9 million. Looking ahead, projections show that Free Cash Flow could ramp up significantly. Analyst estimates suggest $1.24 billion in 2026 and $2.70 billion in 2029. Beyond those years, further estimates rely on a gradual extrapolation, which remains speculative but aims to capture longer-term growth as the business matures.

After aggregating these future cash flows and applying the appropriate discount rate, the DCF model calculates an intrinsic value of $377.92 per share. When this is put alongside the recent closing price of $465.89, Alnylam stock is currently about 23.3% higher than its DCF-based intrinsic value. In other words, the DCF suggests the stock is overvalued by traditional cash flow projections, even as growth expectations remain high.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Alnylam Pharmaceuticals.

Approach 2: Alnylam Pharmaceuticals Price vs Sales

The price-to-sales (P/S) ratio is especially useful for valuing biotech companies like Alnylam Pharmaceuticals, which often operate at a loss but show meaningful revenue growth. Since earnings can be negative or volatile during periods of heavy investment and development, the P/S multiple offers a clearer snapshot of how the market values each dollar of sales generated by the company.

In theory, companies with higher growth expectations and lower risk profiles tend to justify higher P/S ratios. Conversely, companies facing more uncertainty or with slower growth will trade at lower multiples. It is important to benchmark Alnylam’s P/S ratio against both its direct peers and the broader biotech industry to see how the market’s optimism stacks up.

Currently, Alnylam trades at a steep P/S multiple of 24.8x. For comparison, the average for biotech peers sits at 8.1x and the broader industry average is 9.0x. However, Simply Wall St’s proprietary Fair Ratio model, which considers the company’s specific growth profile, market risks, margins, and market cap, assigns Alnylam a fair P/S ratio of 17.8x. This approach is more tailored than a simple peer or industry comparison because it accounts for factors unique to Alnylam, rather than just looking at the averages in the sector.

With Alnylam's market P/S at 24.8x and the Fair Ratio at 17.8x, the stock appears to be trading meaningfully above what our model considers fair for its risk and growth profile.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Alnylam Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is an investor’s personal story of how they see a company’s future unfolding. It connects their perspective on things like Alnylam’s clinical progress and global expansion to precise forecasts of revenue, earnings, and margins, which then shape their own estimate of fair value.

Narratives go beyond the numbers, making it easy for you to combine your views about a company’s prospects with dynamic financial modeling. This allows you to compare your Fair Value estimate to the current Price and quickly decide whether to buy, hold, or sell. On Simply Wall St’s Community page, millions of investors are already using Narratives to capture these stories, updating live as news or earnings roll in so your view stays relevant.

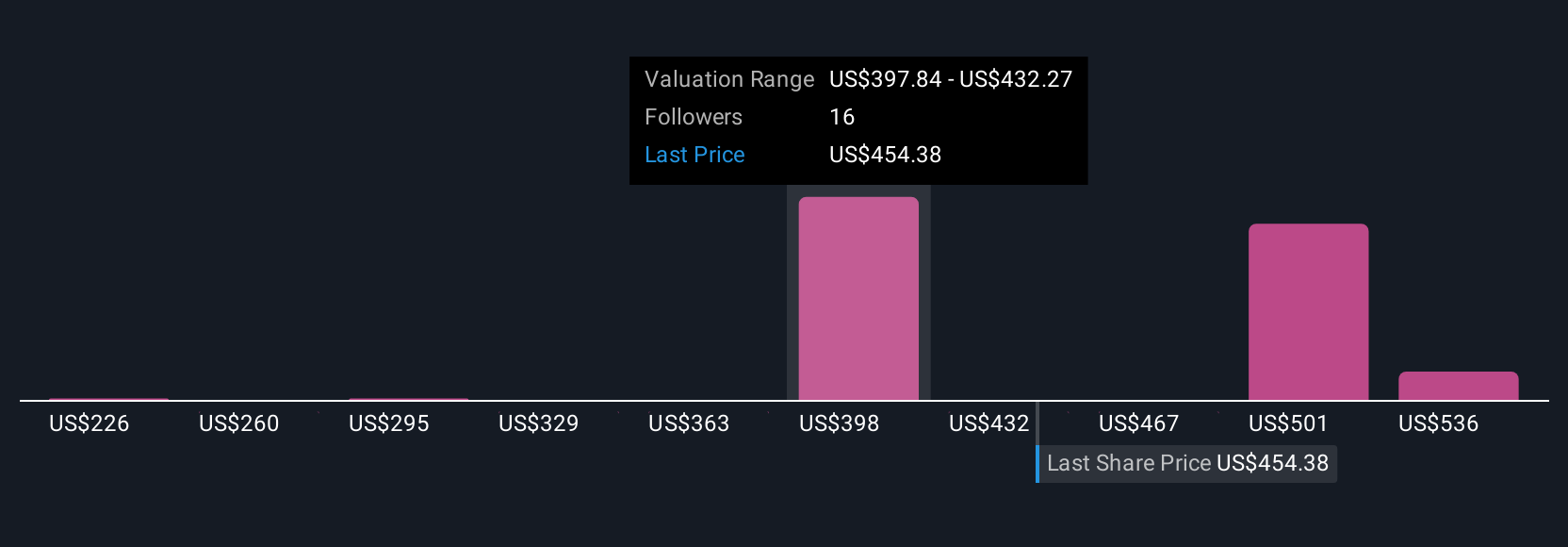

For example, with Alnylam Pharmaceuticals, one Narrative might reflect an optimistic outlook that expects earnings to reach $4.3 billion in 2028, leading to a sky-high price target of $583. A more cautious Narrative might only assume $104.4 million in earnings, suggesting a much lower price target of $236. Your own Narrative helps you draw your line in the sand, making your decisions smarter and more informed with every update.

Do you think there's more to the story for Alnylam Pharmaceuticals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALNY

Alnylam Pharmaceuticals

Alnylam Pharmaceuticals, Inc. discovers, develops, and commercializes therapeutics based on ribonucleic acid interference.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives