- United States

- /

- Biotech

- /

- NasdaqGS:ALKS

How Do Recent Clinical Trial Updates Impact Alkermes Valuation in 2025?

Reviewed by Bailey Pemberton

If you find yourself wondering whether now’s the time to buy, hold, or walk away from Alkermes stock, you’re definitely not alone. With so much noise in the biotech space and share prices that never sit still for long, Alkermes has some investors feeling optimistic, while others are searching for clearer answers. Over the past month, the stock notched a 6.8% gain, bouncing back from a minor dip last week and adding to a solid 14.2% run over the last year. If you’ve been following for longer, you’ve seen the stock climb nearly 86.4% in five years, which is impressive even by industry standards.

Recently, attention has swung back toward Alkermes after some encouraging clinical trial updates and ongoing talks about potential pipeline partnerships. These developments have injected new excitement into the stock and shifted the conversation from risk toward potential upside, with the market starting to reward the company’s strategic plays. It’s no surprise that questions about value have started buzzing again.

When we run Alkermes through six of the most common valuation screens, the company scores a perfect six out of six for being undervalued. That’s a rare outcome, and it instantly makes Alkermes stand out from its peers. This is a big reason many investors are taking a closer look right now.

Of course, not all valuation checks are created equal. There are key differences in how each method views Alkermes’ long-term prospects. Let’s break down the main valuation approaches and stick around, because I’ll share an even sharper perspective by the end of the article.

Approach 1: Alkermes Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting the cash it is expected to generate over future years and then discounting those amounts back to today. This approach helps investors determine what Alkermes might truly be worth based on expected performance rather than just current market trends.

For Alkermes, analysts estimate the latest twelve months' Free Cash Flow (FCF) at $478.9 million. Over the next five years, forecasts see annual FCF figures fluctuating but generally rising, with projections showing $379.9 million in 2029. Beyond this, cash flows are extrapolated, with ten-year outlooks reaching as high as $473.4 million. All projections are in US dollars.

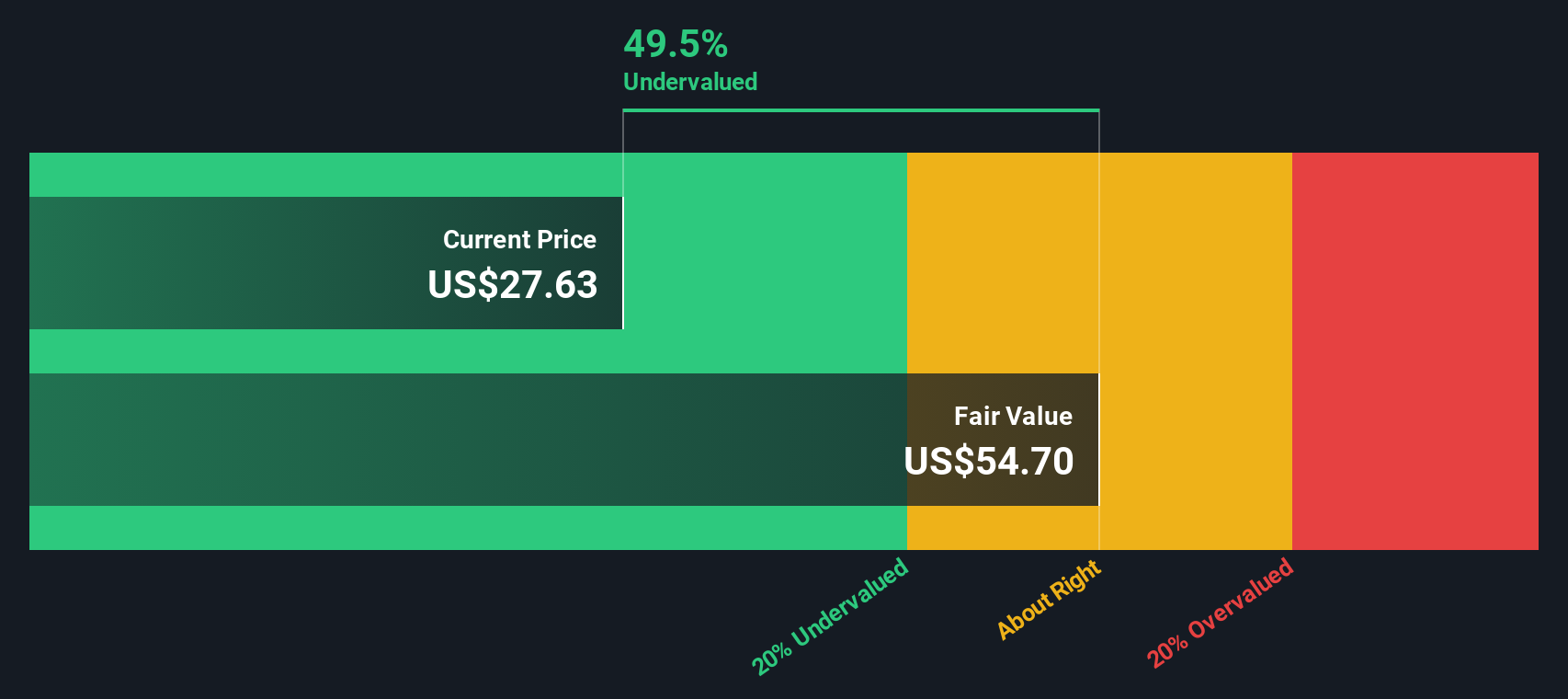

Using these cash flow estimates, the DCF model calculates the intrinsic value of Alkermes at $51.07 per share. Compared to the current market price, this implies the stock is trading at a 41.6% discount, signaling it may be significantly undervalued relative to its future cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alkermes is undervalued by 41.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Alkermes Price vs Earnings

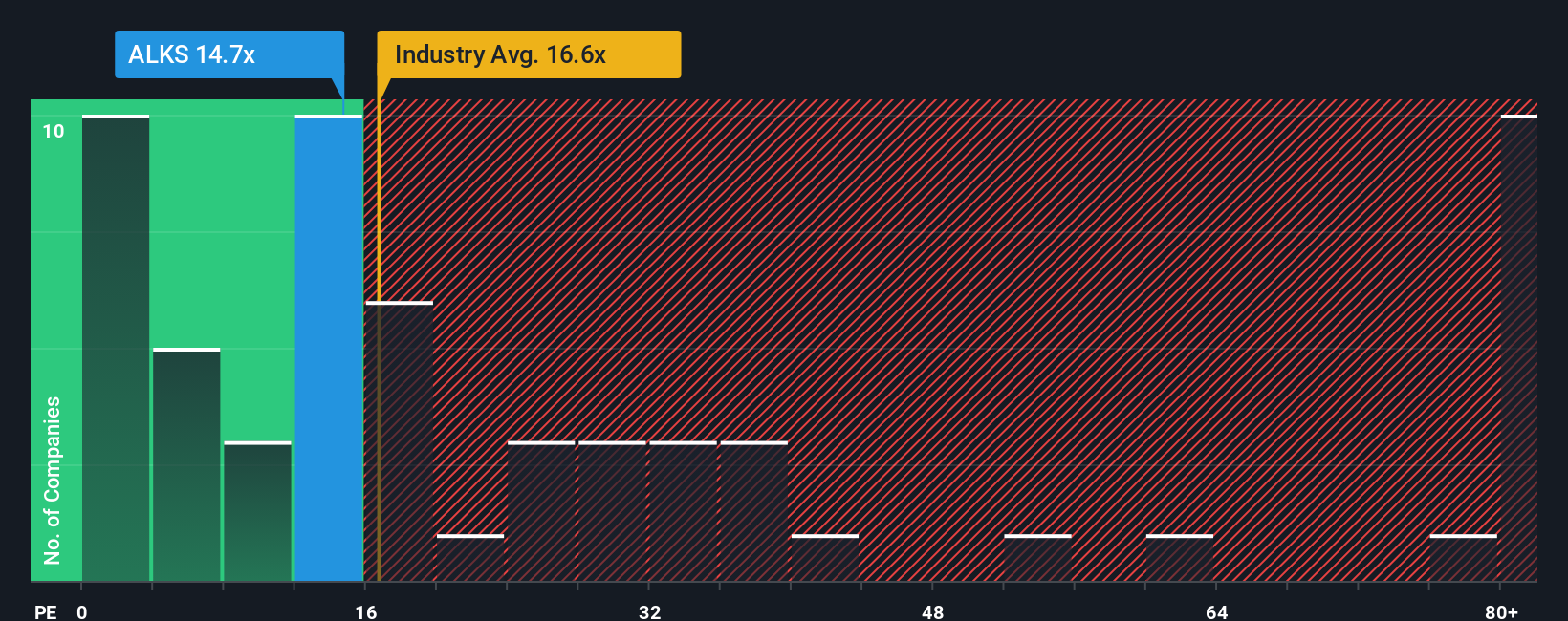

The price-to-earnings (PE) ratio is a widely used valuation metric for profitable companies like Alkermes because it directly relates the company’s current share price to its annual earnings per share. This allows investors to gauge how much they’re paying for each dollar of earnings, making it especially useful when steady profits and clear growth are in play.

What’s considered a “normal” or “fair” PE ratio varies depending on how quickly a company is growing and how risky its earnings are. Higher PE ratios are typically given to faster-growing, more resilient businesses, while slower growth or higher risk can bring that ratio down toward average levels.

Currently, Alkermes trades at a PE ratio of 14.13x. This is below both the Biotechs industry average of 17.31x and the peer average of 37.18x, suggesting the market places less of a growth or quality premium on Alkermes compared to similar companies. However, Simply Wall St’s proprietary “Fair Ratio” for Alkermes is calculated at 14.68x. The Fair Ratio is more insightful than simple peer or industry comparisons because it adjusts for the company’s earnings growth prospects, risk factors, profit margins, overall industry conditions, and even market cap, delivering a nuanced view of what Alkermes should reasonably be valued at today.

With a current PE of 14.13x versus a Fair Ratio of 14.68x, Alkermes’ valuation is very close to perfectly aligned with its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alkermes Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your story about a company, a personalized viewpoint that explains why you believe Alkermes is worth more (or less) than the market thinks, informed by your assumptions about its future revenue, earnings, and margins.

Narratives are powerful because they connect your perspective on the company's business model, market trends, and upcoming catalysts directly to detailed financial forecasts. This leads you to your own calculated fair value for Alkermes. On Simply Wall St’s Community page, millions of investors can use Narratives to frame their thinking and easily see how their outlook compares with others in real time.

With Narratives, deciding when to buy or sell is simplified. You compare your personal fair value with the current price and make a choice based on your unique thesis. Every Narrative updates automatically as new news, earnings, or analysis emerges, so you’re always factoring in the latest information.

For example, among current Narratives for Alkermes, the most bullish investors expect a fair value of $54.00 per share, while the most cautious see just $30.00. This reflects very different stories and assumptions about revenue growth, earnings, and risk.

Do you think there's more to the story for Alkermes? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALKS

Alkermes

A biopharmaceutical company, researches, develops, and commercializes pharmaceutical products to address unmet medical needs of patients in therapeutic areas in the United States, Ireland, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives