- United States

- /

- Biotech

- /

- NasdaqGS:ALEC

The Market Doesn't Like What It Sees From Alector, Inc.'s (NASDAQ:ALEC) Revenues Yet As Shares Tumble 27%

The Alector, Inc. (NASDAQ:ALEC) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 31% in that time.

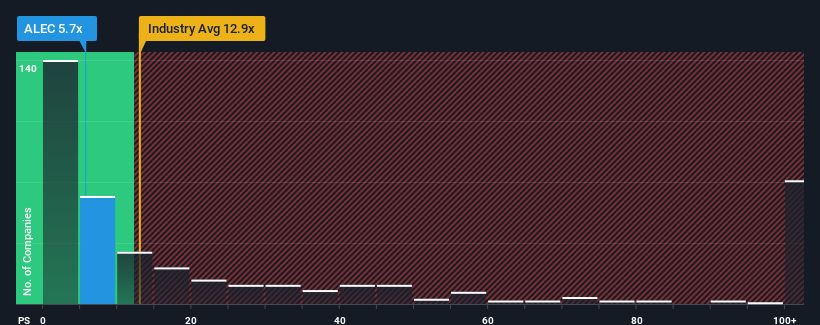

After such a large drop in price, Alector may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 5.7x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 12.9x and even P/S higher than 50x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Alector

What Does Alector's Recent Performance Look Like?

Alector could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Alector will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Alector?

Alector's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 28%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 14% per year during the coming three years according to the eleven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 238% per annum, which is noticeably more attractive.

With this in consideration, its clear as to why Alector's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Alector's P/S looks about as weak as its stock price lately. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Alector's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Alector, and understanding these should be part of your investment process.

If you're unsure about the strength of Alector's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ALEC

Alector

A late-stage clinical biotechnology company, develops therapies that is focused on counteracting the devastating progression of neurodegenerative diseases.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives