- United States

- /

- Biotech

- /

- NasdaqGS:AGIO

EMA Committee’s Positive Opinion on PYRUKYND Might Change The Case For Investing In Agios Pharmaceuticals (AGIO)

Reviewed by Sasha Jovanovic

- Agios Pharmaceuticals recently announced that the European Medicines Agency’s Committee for Medicinal Products for Human Use adopted a positive opinion for PYRUKYND® (mitapivat) as a treatment for anemia in adults with transfusion-dependent and non-transfusion-dependent alpha- or beta-thalassemia.

- This regulatory milestone highlights the potential for PYRUKYND® to reach new patient populations in Europe, broadening Agios’s commercial opportunities in rare blood disorders.

- We’ll examine how this key regulatory advance for PYRUKYND® could shape Agios Pharmaceuticals’ growth outlook and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

Agios Pharmaceuticals Investment Narrative Recap

To invest in Agios Pharmaceuticals, you need conviction in the company’s ability to expand PYRUKYND® into additional rare blood disorder indications, driving material revenue growth while mitigating risks from competition, regulatory hurdles, and high spending. The recent positive opinion from Europe’s CHMP for PYRUKYND® in thalassemia adds weight to the company’s expansion strategy, but the central short-term catalyst remains the anticipated FDA approval in the US; ongoing safety-related regulatory scrutiny is still the key near-term risk and remains unresolved by this European development.

Among recent announcements, the US FDA’s decision to extend its review of PYRUKYND® for thalassemia, linked to new safety monitoring plans, stands out. This extension echoes the complex risk landscape around label restrictions and post-approval requirements, directly impacting how investors should weigh the latest European progress against upcoming regulatory milestones. However, should new regulatory stipulations emerge for PYRUKYND® in key markets, investors should be aware that …

Read the full narrative on Agios Pharmaceuticals (it's free!)

Agios Pharmaceuticals' narrative projects $416.9 million revenue and $67.0 million earnings by 2028. This requires 116.9% yearly revenue growth and a $583.1 million earnings decrease from $650.1 million today.

Uncover how Agios Pharmaceuticals' forecasts yield a $47.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

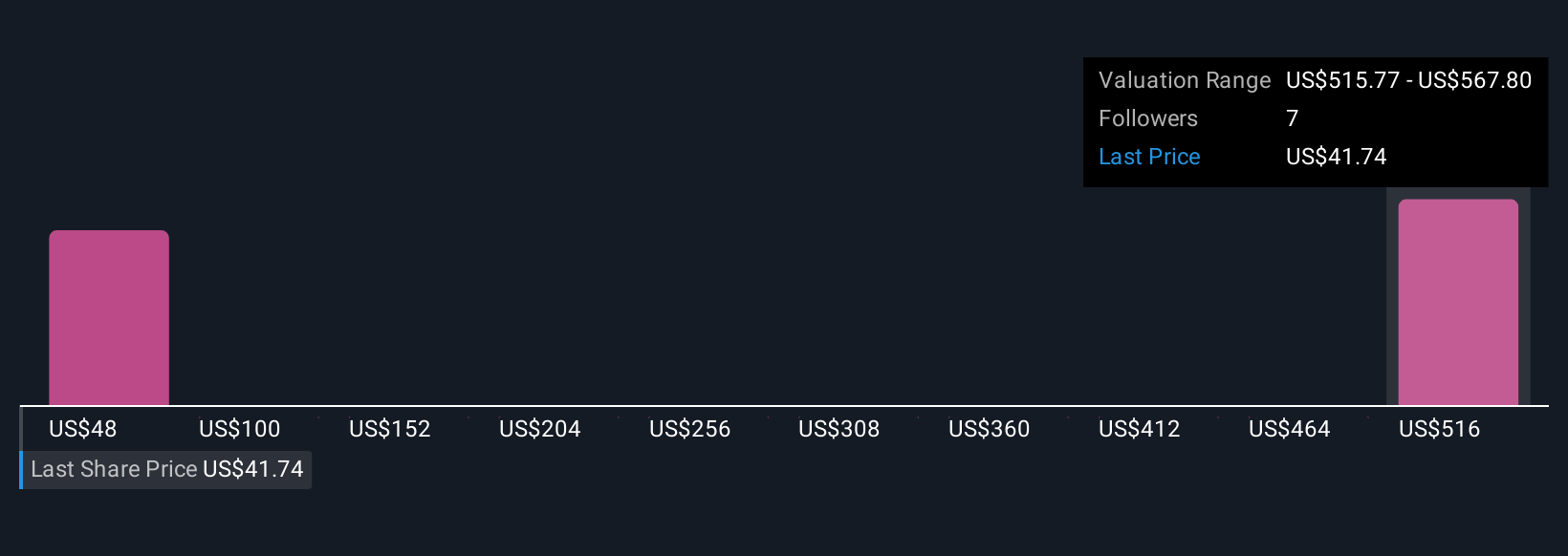

Community fair value estimates for Agios Pharmaceuticals span from US$47.50 to US$567.93, drawn from 2 individual perspectives within the Simply Wall St Community. While optimism about global market expansion persists, ongoing regulatory reviews on product safety may influence future earnings and sentiment, so consider these alternative viewpoints.

Explore 2 other fair value estimates on Agios Pharmaceuticals - why the stock might be worth just $47.50!

Build Your Own Agios Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agios Pharmaceuticals research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Agios Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agios Pharmaceuticals' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGIO

Agios Pharmaceuticals

A biopharmaceutical company, discovers and develops medicines in the field of cellular metabolism in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives