The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Affimed N.V. (NASDAQ:AFMD) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Affimed

How Much Debt Does Affimed Carry?

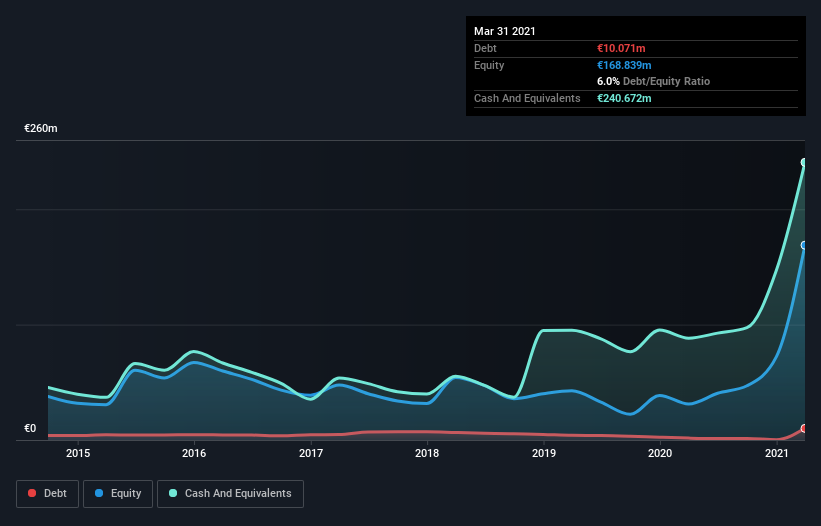

You can click the graphic below for the historical numbers, but it shows that as of March 2021 Affimed had €10.1m of debt, an increase on €1.66m, over one year. However, it does have €240.7m in cash offsetting this, leading to net cash of €230.6m.

How Healthy Is Affimed's Balance Sheet?

We can see from the most recent balance sheet that Affimed had liabilities of €62.5m falling due within a year, and liabilities of €39.2m due beyond that. Offsetting this, it had €240.7m in cash and €2.77m in receivables that were due within 12 months. So it actually has €141.7m more liquid assets than total liabilities.

This surplus suggests that Affimed is using debt in a way that is appears to be both safe and conservative. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Simply put, the fact that Affimed has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Affimed can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Affimed reported revenue of €36m, which is a gain of 136%, although it did not report any earnings before interest and tax. So its pretty obvious shareholders are hoping for more growth!

So How Risky Is Affimed?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Affimed had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of €20m and booked a €32m accounting loss. While this does make the company a bit risky, it's important to remember it has net cash of €230.6m. That kitty means the company can keep spending for growth for at least two years, at current rates. The good news for shareholders is that Affimed has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. High growth pre-profit companies may well be risky, but they can also offer great rewards. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Affimed you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Affimed, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:AFMD.Q

Affimed

A clinical-stage biopharmaceutical company, focuses on discovering and developing cancer immunotherapies in the United States and Germany.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026