- United States

- /

- Life Sciences

- /

- NasdaqGS:ADPT

Adaptive Biotechnologies Corporation's (NASDAQ:ADPT) P/S Is Still On The Mark Following 25% Share Price Bounce

Adaptive Biotechnologies Corporation (NASDAQ:ADPT) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 29%.

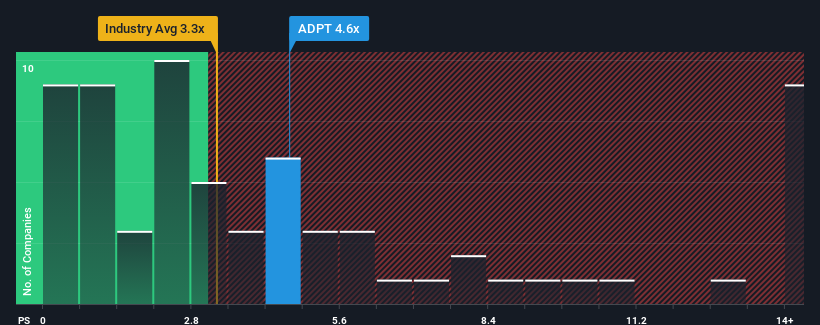

Since its price has surged higher, when almost half of the companies in the United States' Life Sciences industry have price-to-sales ratios (or "P/S") below 3.3x, you may consider Adaptive Biotechnologies as a stock probably not worth researching with its 4.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Adaptive Biotechnologies

How Has Adaptive Biotechnologies Performed Recently?

Adaptive Biotechnologies could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Adaptive Biotechnologies will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Adaptive Biotechnologies would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 1.3% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 21% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 14% as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 5.2%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Adaptive Biotechnologies' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Adaptive Biotechnologies' P/S

The large bounce in Adaptive Biotechnologies' shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Adaptive Biotechnologies maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Life Sciences industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Adaptive Biotechnologies that you should be aware of.

If these risks are making you reconsider your opinion on Adaptive Biotechnologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ADPT

Adaptive Biotechnologies

A commercial-stage company, develops an immune medicine platform for the diagnosis and treatment of various diseases.

Adequate balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives