- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

ADMA Biologics, Inc. (NASDAQ:ADMA) Looks Just Right With A 25% Price Jump

ADMA Biologics, Inc. (NASDAQ:ADMA) shares have had a really impressive month, gaining 25% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.7% in the last twelve months.

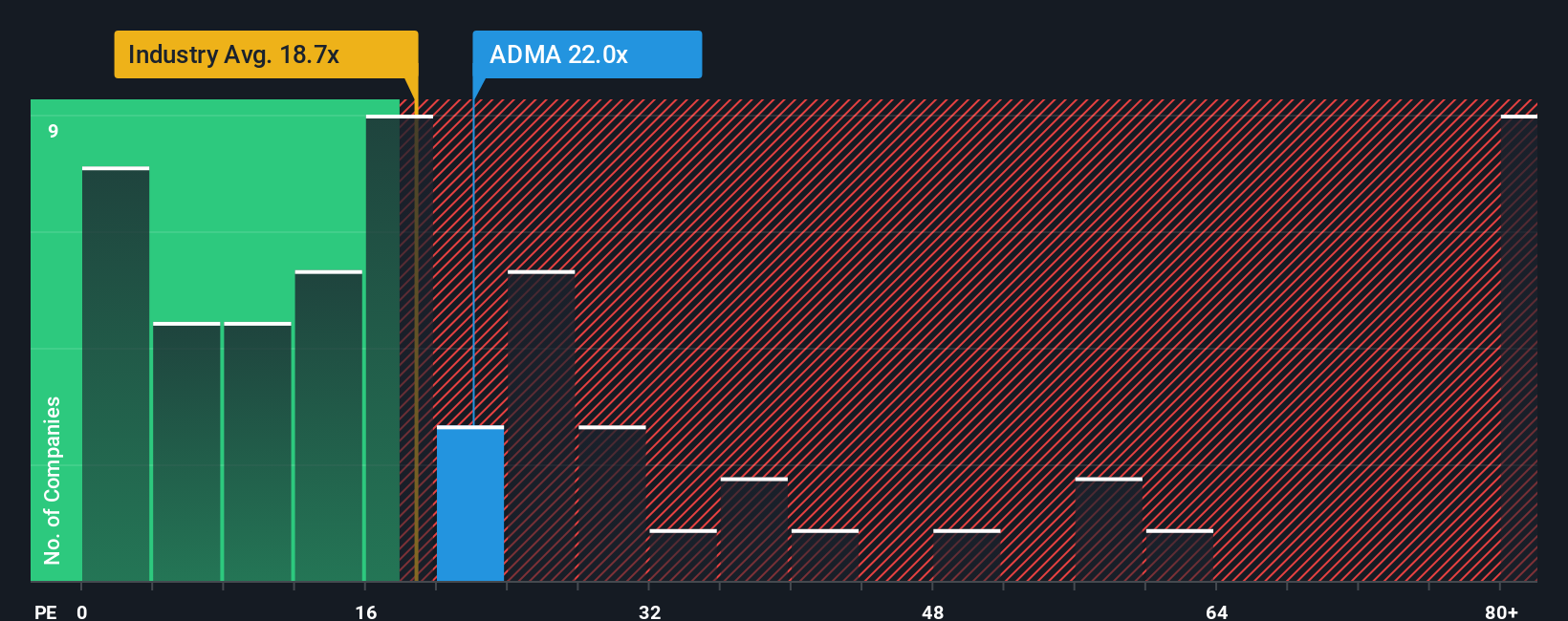

After such a large jump in price, given around half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider ADMA Biologics as a stock to potentially avoid with its 22x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been advantageous for ADMA Biologics as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for ADMA Biologics

How Is ADMA Biologics' Growth Trending?

In order to justify its P/E ratio, ADMA Biologics would need to produce impressive growth in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 198%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 21% per year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 11% per year, which is noticeably less attractive.

With this information, we can see why ADMA Biologics is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From ADMA Biologics' P/E?

ADMA Biologics' P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that ADMA Biologics maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware ADMA Biologics is showing 1 warning sign in our investment analysis, you should know about.

You might be able to find a better investment than ADMA Biologics. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, develops, manufactures, and markets specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026