- United States

- /

- Biotech

- /

- NasdaqGS:ACLX

What Arcellx (ACLX)'s Rising Losses and Upcoming Clinical Data Could Mean for Shareholders

Reviewed by Sasha Jovanovic

- Arcellx recently reported its third quarter 2025 earnings, highlighting a net loss of US$55.78 million and a basic loss per share of US$0.99, both higher than the prior year, while also announcing upcoming presentations of updated clinical data for its lead therapy at the December ASH Annual Meeting in Orlando.

- This combination of increased losses and anticipation for new trial results reflects heightened expectations and evolving risk considerations for the company in the biotechnology sector.

- With the upcoming clinical data release for its Phase 2 multiple myeloma study, we'll examine how these developments impact Arcellx's investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Arcellx's Investment Narrative?

To be a shareholder in Arcellx right now, you have to believe in the promise and commercial potential of its lead CAR-T therapy for multiple myeloma, despite the company’s mounting net losses. With the latest earnings showing a net loss of US$55.78 million for the quarter, more than double the prior year, the bar for clinical success feels even higher. However, the upcoming Phase 2 trial data announcement at the ASH meeting is the real short-term needle-mover on most investors’ minds. While the elevated losses could sharpen focus on Arcellx’s cash runway and operational risk, the major risks and main catalyst essentially remain unchanged: clinical trial results will likely exert the biggest impact on the stock in the near-term. In my view, the recent financials heighten urgency for positive trial outcomes, but don’t fundamentally alter the key drivers for Arcellx’s story right now.

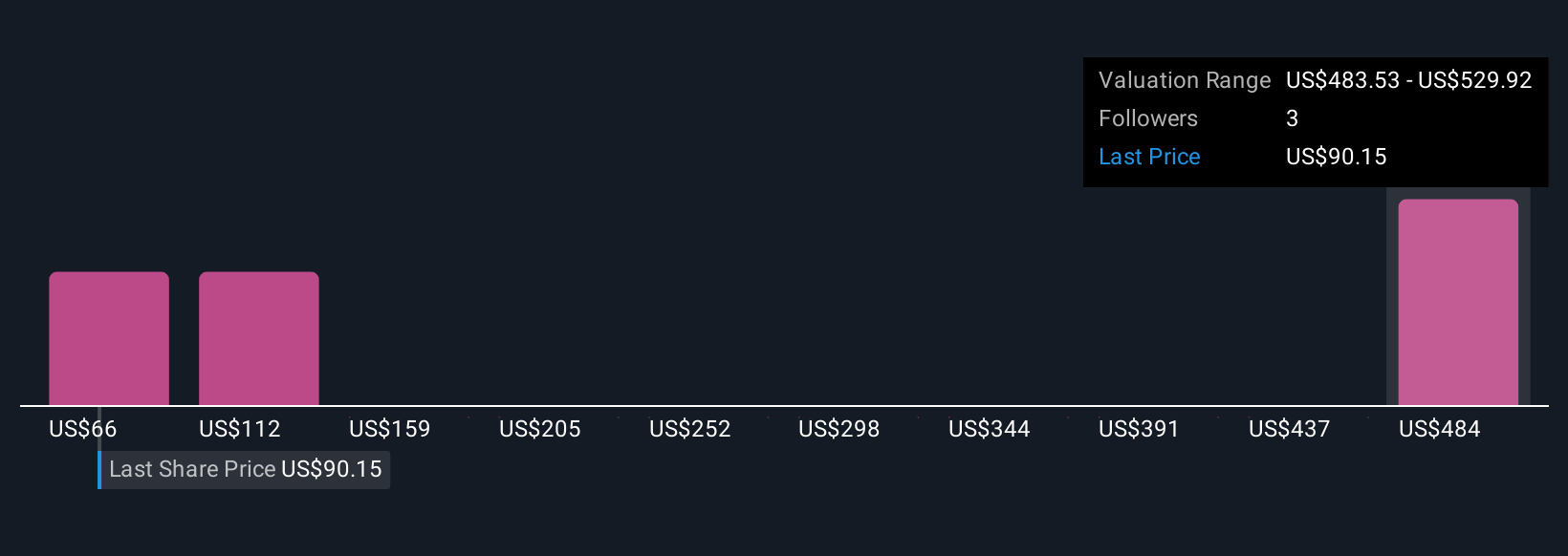

But keep in mind, an accelerated cash burn could present a major risk for current holders. Arcellx's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on Arcellx - why the stock might be worth over 5x more than the current price!

Build Your Own Arcellx Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arcellx research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arcellx research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arcellx's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLX

Arcellx

Together with its subsidiary, engages in the development of various immunotherapies for patients with cancer and other incurable diseases in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives