- United States

- /

- Biotech

- /

- NasdaqGS:ACLX

Assessing Arcellx (ACLX) Valuation Following New CAR-T Therapy Competition from Kelonia Therapeutics

Reviewed by Simply Wall St

Arcellx (ACLX) shares came under pressure following early-stage trial data from Kelonia Therapeutics. Kelonia's CAR-T therapy KLN-1010 for multiple myeloma showed strong signals of efficacy, raising questions about Arcellx’s competitive positioning.

See our latest analysis for Arcellx.

With the renewed spotlight on CAR-T therapies, Arcellx shares have come under pressure, dropping nearly 19% over the past week after Kelonia’s new trial data stirred concerns about future competition. While that short-term share price return looks rough, Arcellx’s three-year total shareholder return sits at an impressive 266%. However, recent volatility hints that investor sentiment could be shifting.

If you’re keeping an eye on biotech shakeups like this, it’s the perfect time to explore more breakthroughs with our healthcare stocks screener. See the full list for free.

With shares now trading at a steep discount to analyst targets, and strong underlying growth figures, the question is whether Arcellx presents a compelling entry point or if the market has already factored in all the risks and rewards.

Price-to-Book Ratio of 9.6x: Is it justified?

Arcellx currently trades at a price-to-book ratio of 9.6x, meaning the market is valuing the shares significantly above the company’s book value and peer group averages.

The price-to-book (P/B) ratio compares a company’s market value to its net assets. In biotechnology, investors may pay a premium due to growth expectations. However, a high P/B also invites questions about whether such optimism is warranted for a still unprofitable business.

Compared to the US Biotechs industry, which trades at a 2.7x average, Arcellx’s 9.6x ratio stands out as expensive. The company is also priced above its peer average of 9.1x. Without improved profitability or clearer paths to sustained growth, this premium could be difficult to justify long-term.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 9.6x (OVERVALUED)

However, clinical setbacks or slower than expected revenue growth could quickly overshadow Arcellx's upside, making the current valuation harder to defend.

Find out about the key risks to this Arcellx narrative.

Another View: Discounted Cash Flow Tells a Different Story

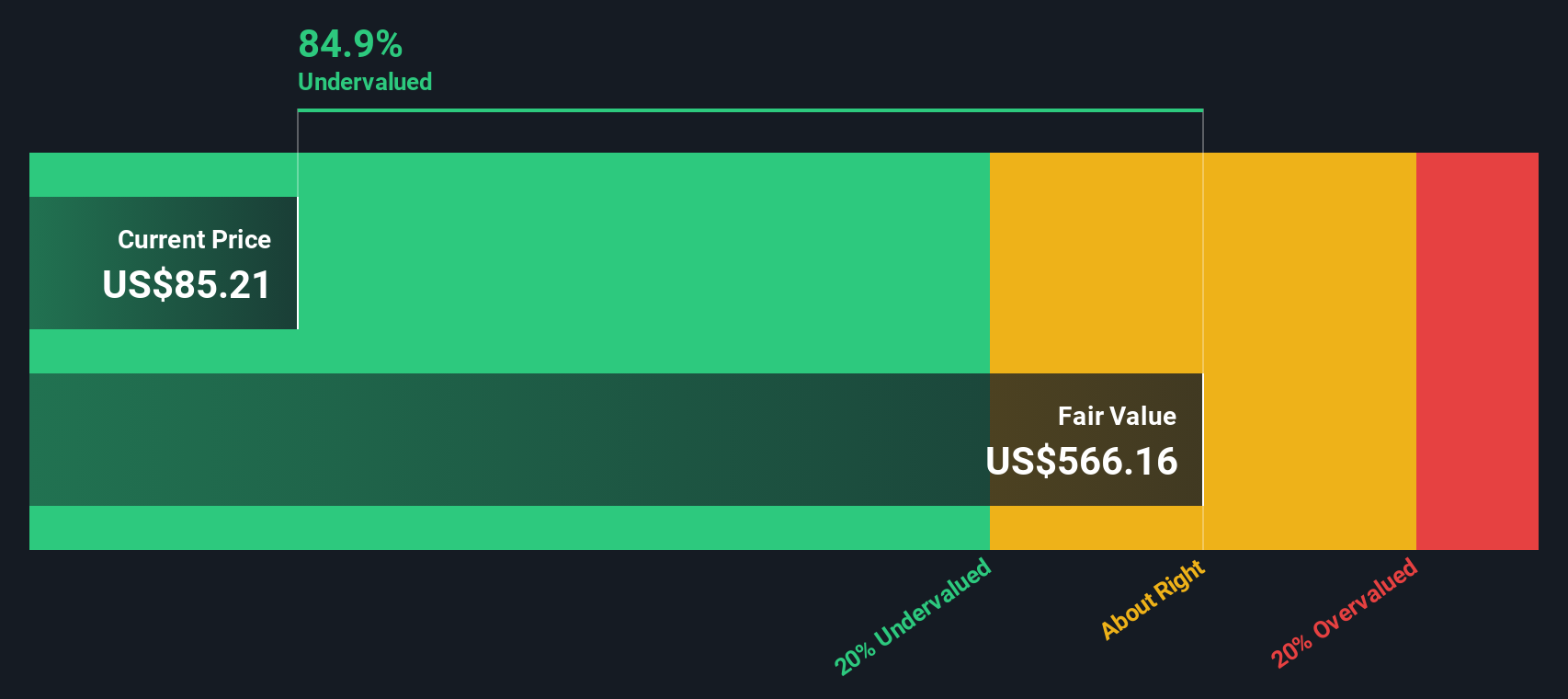

While Arcellx looks expensive on a price-to-book basis, our DCF model paints a strikingly different picture. According to this method, shares are trading 86% below their estimated fair value, which suggests there could be significant potential upside. Could the market be overly cautious, or is there a reason behind this disconnect?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arcellx for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arcellx Narrative

If you see the numbers differently or want to dive deeper into the details yourself, you can build your own view in just a few minutes. Do it your way

A great starting point for your Arcellx research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let market noise keep you on the sidelines when exciting opportunities are just a click away. Your next portfolio win might be closer than you think.

- Capture the growth potential of artificial intelligence by tapping into companies positioned at the forefront with these 26 AI penny stocks.

- Get ahead of the curve with value stocks that the market has overlooked when you scan these 923 undervalued stocks based on cash flows.

- Secure your cash flow with steady returns by targeting high-yield picks via these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLX

Arcellx

Together with its subsidiary, engages in the development of various immunotherapies for patients with cancer and other incurable diseases in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success