- United States

- /

- Biotech

- /

- NasdaqGS:ACLX

Arcellx (ACLX): Assessing Valuation Following Deeper Losses and Anticipated Clinical Data Release

Reviewed by Simply Wall St

Arcellx (ACLX) just released its third quarter earnings, reporting a bigger net loss than last year. Investors are also watching for updates from upcoming clinical data presentations at a major hematology conference in December.

See our latest analysis for Arcellx.

Arcellx’s share price has seen some volatility lately, reflecting a tug-of-war between concerns about deeper quarterly losses and optimism ahead of December’s pivotal clinical data presentations. While the stock has delivered an impressive 18% share price gain over the past three months, its one-year total shareholder return is still down 8%. Despite this, the company has achieved a standout three-year total return of over 340%. Momentum appears to be slowly rebuilding as expectations rise around its experimental therapies.

If you’re tracking breakthroughs in biopharma and want to discover what’s next, take a look at the latest opportunities in our healthcare stocks screener: See the full list for free.

With Arcellx still trading nearly 30% below analyst price targets and investors weighing both larger net losses and next month’s critical clinical updates, the key question remains: is there a buying opportunity here, or is growth already priced in?

Price-to-Book Ratio of 11.5x: Is it justified?

Arcellx currently trades at a price-to-book ratio of 11.5x, a level that stands far above both its biotech peers and industry benchmarks. This suggests investors are paying a steep premium relative to the company’s net assets.

The price-to-book ratio compares a company’s market value to its book value, essentially what shareholders would theoretically receive if all assets were sold and liabilities paid. For early-stage biotech companies like Arcellx, high ratios can reflect expectations of breakthrough innovations rather than near-term profitability or tangible assets.

However, Arcellx’s price-to-book ratio is significantly higher than the US Biotechs industry average of 2.6x and also above the peer group average of 8.3x. This highlights the market’s elevated growth expectations for the company's pipeline. Despite the unprofitability and the premium valuation, investors appear to be betting on future clinical success as a major catalyst for value creation.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 11.5x (OVERVALUED)

However, weaker clinical trial results or unexpected regulatory setbacks could quickly dampen investor optimism regarding Arcellx’s premium valuation.

Find out about the key risks to this Arcellx narrative.

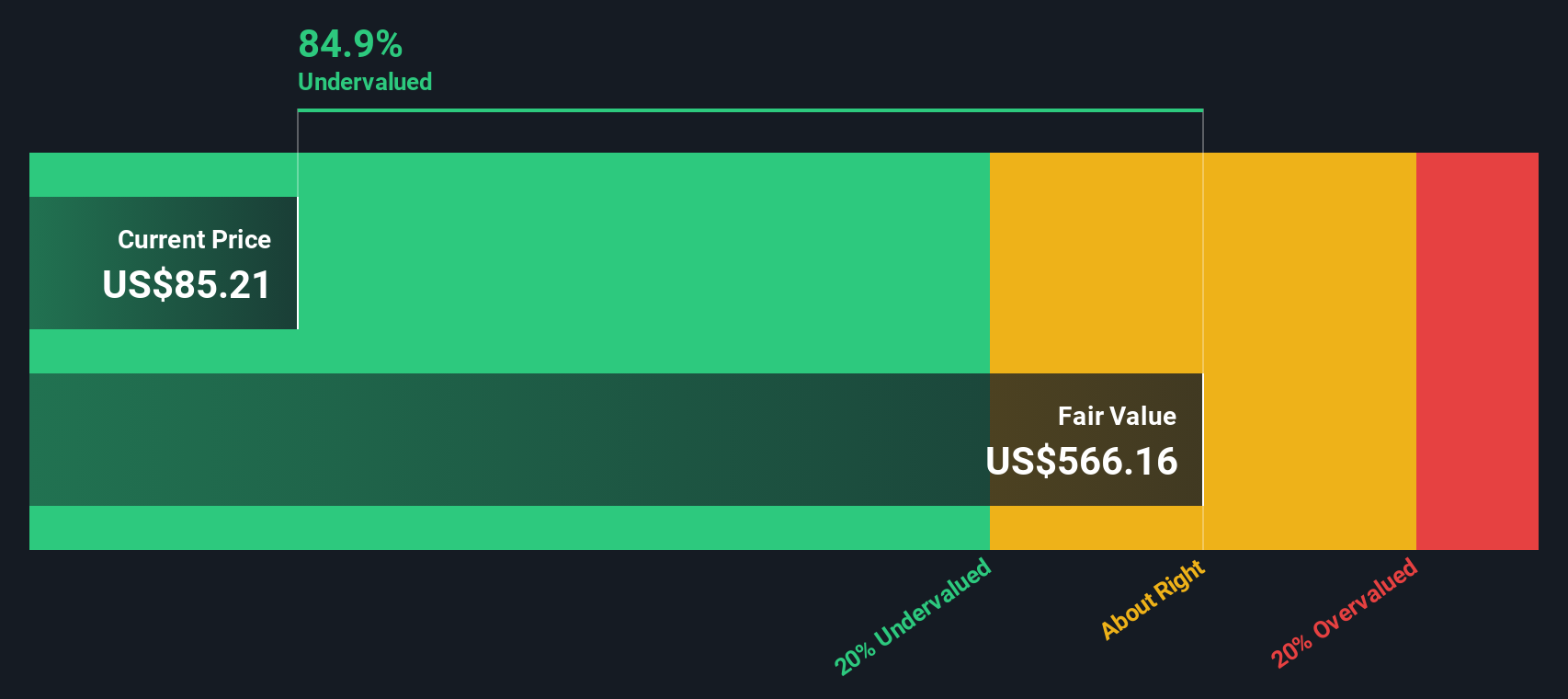

Another View: Discounted Cash Flow Tells a Different Story

While Arcellx appears expensive based on its price-to-book ratio, our DCF model estimates the stock’s fair value at $530.22, which is over six times its current price. This sharp gap suggests that if cash flows materialize, the market may be significantly undervaluing the company’s future potential. But can long-term projections outweigh present risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arcellx for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arcellx Narrative

If our analysis doesn't fully reflect your perspective, you can dive into the data yourself and craft your own Arcellx outlook in just a few minutes. Do it your way

A great starting point for your Arcellx research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity pass you by. The next standout investment might be just one smart move away. Use these targeted lists to give your portfolio a fresh edge.

- Capture the explosive potential in artificial intelligence by targeting leaders among these 27 AI penny stocks who are driving medical and tech innovation right now.

- Maximize your income streams by picking from these 15 dividend stocks with yields > 3% that offer consistent yields above 3 percent and strong fundamentals.

- Get ahead of market inefficiencies and discover great deals with these 870 undervalued stocks based on cash flows identified as underpriced based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLX

Arcellx

Together with its subsidiary, engages in the development of various immunotherapies for patients with cancer and other incurable diseases in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives