- United States

- /

- Biotech

- /

- NasdaqGS:ACAD

Do ACADIA Pharmaceuticals’ (ACAD) Pipeline Updates Reveal a Shifting Focus Beyond NUPLAZID?

Reviewed by Sasha Jovanovic

- Acadia Pharmaceuticals recently presented a late-breaker oral platform presentation and two poster sessions at the International Congress of Parkinson's Disease and Movement Disorders in Honolulu, Hawaii, showcasing new preclinical and clinical data on investigational drugs ACP-711 and ACP-204 for essential tremor and Lewy body dementia psychosis.

- These scientific updates offer further insight into Acadia's pipeline momentum, highlighting advancements in both preclinical and mid-stage programs targeting neurological and neuropsychiatric disorders.

- We’ll explore how these pipeline disclosures signal potential diversification beyond NUPLAZID, which remains a key focus for the company’s future outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

ACADIA Pharmaceuticals Investment Narrative Recap

To own shares in ACADIA Pharmaceuticals, investors should be confident in the company's ability to maintain leadership in CNS disorders while successfully diversifying revenue beyond NUPLAZID. The recent presentations in Honolulu underscore pipeline progress, but do not materially affect the immediate focus on NUPLAZID’s commercial trajectory or the concentration risk that remains Acadia’s most important short-term catalyst, and challenge, as revenues are still heavily reliant on this single product.

Among recent announcements, the clinical data update for ACP-711 for essential tremor showcased at the MDS Congress is the most relevant here, as it provides an early signal of pipeline strength. While this update may encourage optimism about long-term portfolio diversification, actual product launches and new revenue streams from this asset are still years away, so the near-term business remains closely tied to NUPLAZID’s performance and reimbursement profile.

In contrast, investors should be aware of the concentration risk that comes from depending on NUPLAZID’s Medicare-driven sales…

Read the full narrative on ACADIA Pharmaceuticals (it's free!)

ACADIA Pharmaceuticals' outlook forecasts $1.4 billion in revenue and $306.0 million in earnings by 2028. This scenario implies an annual revenue growth rate of 11.6% and an earnings increase of $83.8 million from current earnings of $222.2 million.

Uncover how ACADIA Pharmaceuticals' forecasts yield a $29.32 fair value, a 44% upside to its current price.

Exploring Other Perspectives

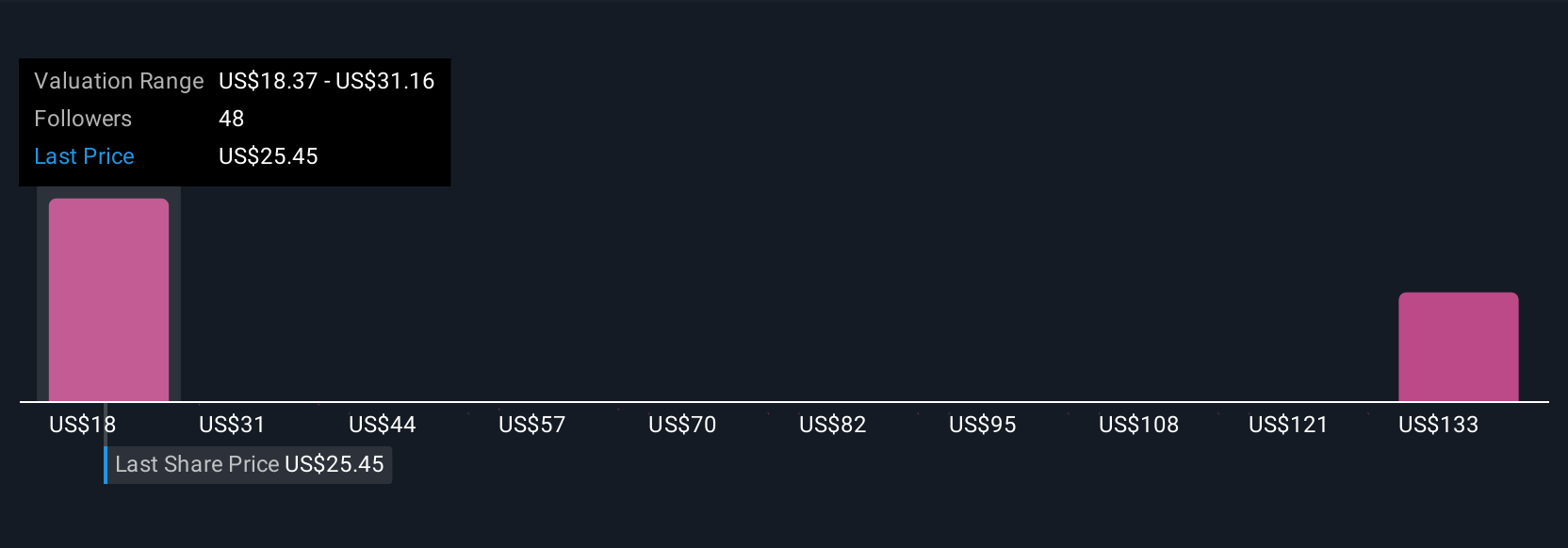

Seven different fair value estimates from the Simply Wall St Community range widely from US$18.12 to US$144.57 per share. Given this diversity, remember that evolving demand for NUPLAZID remains at the core of ACADIA's performance, which could impact how the market values the stock over time.

Explore 7 other fair value estimates on ACADIA Pharmaceuticals - why the stock might be worth over 7x more than the current price!

Build Your Own ACADIA Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ACADIA Pharmaceuticals research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ACADIA Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ACADIA Pharmaceuticals' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACAD

ACADIA Pharmaceuticals

A biopharmaceutical company, focuses on the development and commercialization of medicines for central nervous system (CNS) disorders and rare diseases in the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives