Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that ABVC BioPharma, Inc. (NASDAQ:ABVC) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for ABVC BioPharma

What Is ABVC BioPharma's Debt?

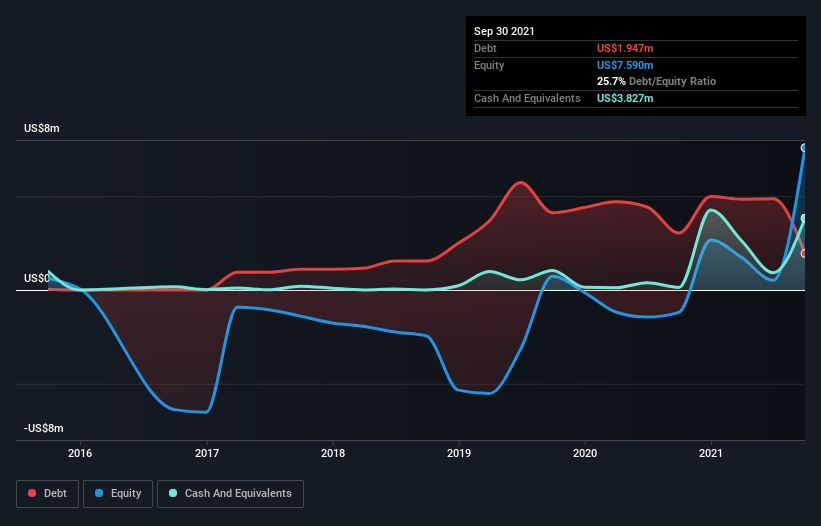

The image below, which you can click on for greater detail, shows that ABVC BioPharma had debt of US$1.95m at the end of September 2021, a reduction from US$3.04m over a year. But on the other hand it also has US$3.83m in cash, leading to a US$1.88m net cash position.

How Strong Is ABVC BioPharma's Balance Sheet?

According to the last reported balance sheet, ABVC BioPharma had liabilities of US$3.44m due within 12 months, and liabilities of US$1.33m due beyond 12 months. On the other hand, it had cash of US$3.83m and US$882.9k worth of receivables due within a year. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

This state of affairs indicates that ABVC BioPharma's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the US$93.5m company is short on cash, but still worth keeping an eye on the balance sheet. Despite its noteworthy liabilities, ABVC BioPharma boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine ABVC BioPharma's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Given its lack of meaningful operating revenue, ABVC BioPharma shareholders no doubt hope it can fund itself until it has a profitable product.

So How Risky Is ABVC BioPharma?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months ABVC BioPharma lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of US$8.7m and booked a US$9.8m accounting loss. With only US$1.88m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 6 warning signs we've spotted with ABVC BioPharma (including 3 which are a bit concerning) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ABVC

ABVC BioPharma

A clinical-stage biopharmaceutical company, develops drugs and medical devices to fulfill unmet medical needs in the United States.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026