The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that ABVC BioPharma, Inc. (NASDAQ:ABVC) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for ABVC BioPharma

What Is ABVC BioPharma's Net Debt?

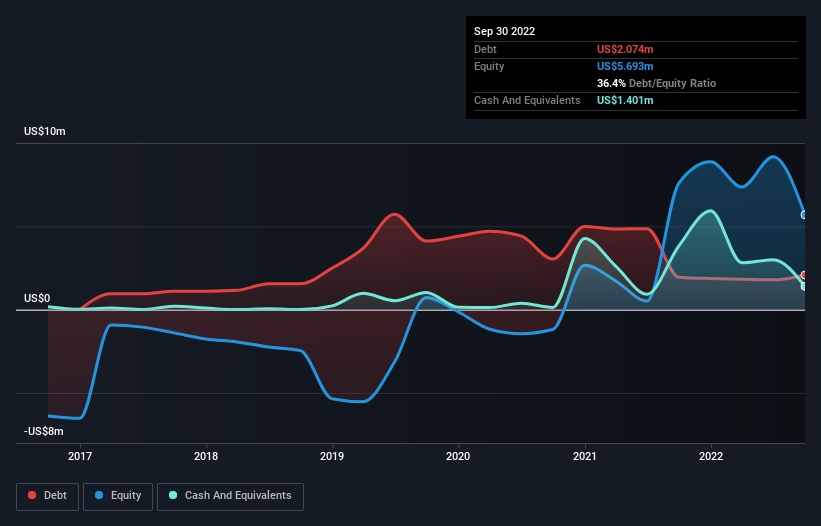

The image below, which you can click on for greater detail, shows that at September 2022 ABVC BioPharma had debt of US$2.07m, up from US$1.95m in one year. On the flip side, it has US$1.40m in cash leading to net debt of about US$672.6k.

How Healthy Is ABVC BioPharma's Balance Sheet?

According to the last reported balance sheet, ABVC BioPharma had liabilities of US$3.89m due within 12 months, and liabilities of US$893.1k due beyond 12 months. On the other hand, it had cash of US$1.40m and US$547.7k worth of receivables due within a year. So its liabilities total US$2.84m more than the combination of its cash and short-term receivables.

Of course, ABVC BioPharma has a market capitalization of US$19.3m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if ABVC BioPharma can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Given its lack of meaningful operating revenue, ABVC BioPharma shareholders no doubt hope it can fund itself until it has a profitable product.

Caveat Emptor

Not only did ABVC BioPharma's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping US$18m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled US$9.6m in negative free cash flow over the last twelve months. So in short it's a really risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 6 warning signs for ABVC BioPharma (3 are potentially serious) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ABVC

ABVC BioPharma

A clinical-stage biopharmaceutical company, develops drugs and medical devices to fulfill unmet medical needs in the United States.

Excellent balance sheet slight.

Market Insights

Community Narratives