- United States

- /

- Life Sciences

- /

- NasdaqGS:ABCL

AbCellera (ABCL) Valuation Check After Bruker Patent Settlement, New Royalty Stream and Legal Overhang Removal

Reviewed by Simply Wall St

AbCellera Biologics (ABCL) just took a legal overhang off the table by signing a global settlement and patent license deal with Bruker that brings in $36 million upfront plus future royalties.

See our latest analysis for AbCellera Biologics.

The legal clean up helps explain why the 1 day share price return jumped 5.37 percent, even as the 90 day share price return is still down 21.73 percent. With a 23.86 percent 1 year total shareholder return versus a deeply negative 3 year total shareholder return, momentum appears to be stabilising off a low base rather than fully turning yet.

If you are weighing up AbCellera alongside other biotech names, this is a good moment to explore healthcare stocks as potential alternatives or complementary ideas.

With litigation risk reduced, a fresh royalty stream emerging and the stock still trading at a steep discount to analyst targets, is AbCellera quietly undervalued here, or is the market already discounting all of its future growth?

Most Popular Narrative Narrative: 64.1% Undervalued

With AbCellera closing at $3.53 and the most followed narrative implying fair value near $9.83, the gap to that target remains strikingly wide.

The completion of AbCellera's integrated clinical manufacturing capabilities by the end of 2025 is likely to enhance operational efficiency and reduce COGS, potentially improving net margins as the company begins utilization of these capabilities. Financial backing with over $630 million in liquidity and additional funding commitments provides AbCellera with the necessary resources to support long-term pipeline development, enhancing potential future earnings through successful commercialization of their clinical candidates.

Want to see why rapid revenue expansion, margin repair and a steep future earnings multiple all sit at the heart of this story? The narrative walks through bold growth assumptions, an aggressive profit margin shift and a rich valuation hurdle that has to be cleared for that upside case to hold. Curious how those moving parts combine into one ambitious fair value number? Dive in to unpack the full playbook behind this projection.

Result: Fair Value of $9.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, clinical setbacks for ABCL635 or prolonged revenue pressure from partner programs could quickly puncture those upbeat growth and margin assumptions.

Find out about the key risks to this AbCellera Biologics narrative.

Another Lens on Valuation

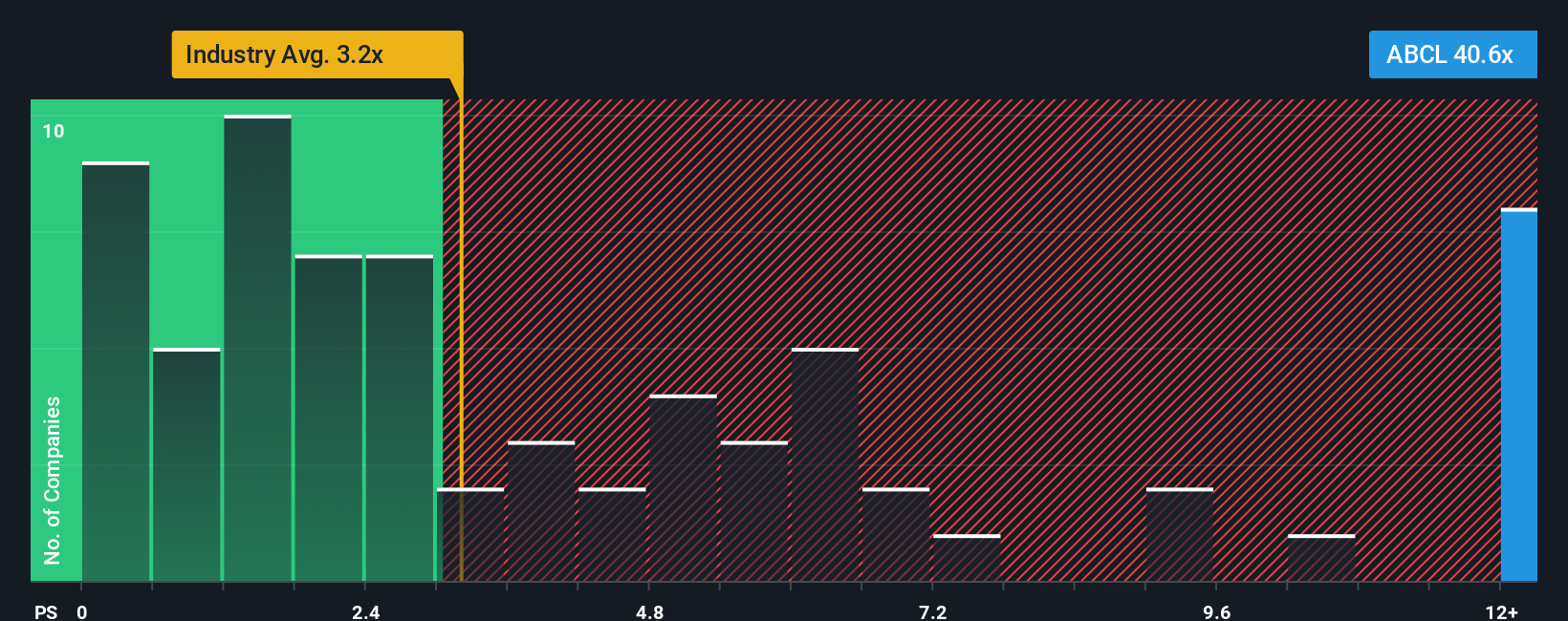

Step back from the narrative fair value, and AbCellera suddenly looks pricey. On a price to sales basis it trades around 29.9 times, versus about 3.5 times for the US Life Sciences industry and 4.5 times for peers, while the fair ratio points to 0 times. Is the market paying far too much for still distant growth, or are these multiples just the cost of optionality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AbCellera Biologics Narrative

If you are not convinced by this view or want to dig into the numbers yourself, you can shape a personalized thesis in just a few minutes, Do it your way.

A great starting point for your AbCellera Biologics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall Street’s screener, so you are not relying on just one story.

- Capture potential market mispricings by targeting companies flagged as undervalued through these 916 undervalued stocks based on cash flows, built on discounted cash flow fundamentals.

- Position yourself at the heart of an innovation wave by focusing on these 24 AI penny stocks that could reshape entire industries.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3%, which can help support long term returns through regular payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABCL

AbCellera Biologics

Engages in discovering and developing antibody-based medicines for indications with unmet medical need in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion