- United States

- /

- Biotech

- /

- NasdaqCM:WHWK

Here's Why We're Watching Aadi Bioscience's (NASDAQ:AADI) Cash Burn Situation

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Aadi Bioscience (NASDAQ:AADI) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Aadi Bioscience

Does Aadi Bioscience Have A Long Cash Runway?

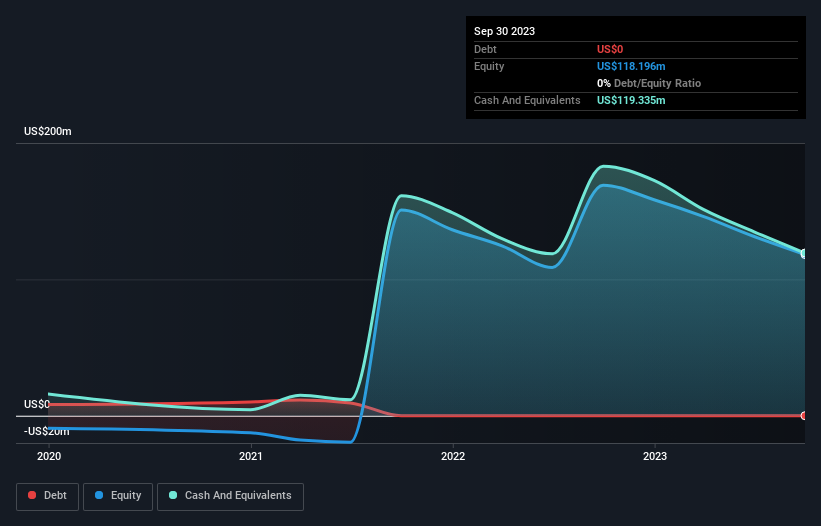

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at September 2023, Aadi Bioscience had cash of US$119m and no debt. In the last year, its cash burn was US$65m. Therefore, from September 2023 it had roughly 22 months of cash runway. Importantly, analysts think that Aadi Bioscience will reach cashflow breakeven in 5 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Aadi Bioscience Growing?

At first glance it's a bit worrying to see that Aadi Bioscience actually boosted its cash burn by 26%, year on year. Given that its operating revenue increased 112% in that time, it seems the company has reason to think its expenditure is working well to drive growth. If revenue is maintained once spending on growth decreases, that could well pay off! It seems to be growing nicely. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Aadi Bioscience To Raise More Cash For Growth?

Aadi Bioscience seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of US$46m, Aadi Bioscience's US$65m in cash burn equates to about 141% of its market value. Given just how high that expenditure is, relative to the company's market value, we think there's an elevated risk of funding distress, and we would be very nervous about holding the stock.

Is Aadi Bioscience's Cash Burn A Worry?

On this analysis of Aadi Bioscience's cash burn, we think its revenue growth was reassuring, while its cash burn relative to its market cap has us a bit worried. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. Separately, we looked at different risks affecting the company and spotted 3 warning signs for Aadi Bioscience (of which 1 is a bit concerning!) you should know about.

Of course Aadi Bioscience may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Whitehawk Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:WHWK

Whitehawk Therapeutics

An oncology therapeutics company that develops technologies to establish tumor biology for cancer treatments.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success