- United States

- /

- Interactive Media and Services

- /

- OTCPK:LOVL.Q

How Much Did Spark Networks'(NYSEMKT:LOV) Shareholders Earn From Share Price Movements Over The Last Three Years?

Spark Networks SE (NYSEMKT:LOV) shareholders should be happy to see the share price up 11% in the last quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. In that time, the share price dropped 66%. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

See our latest analysis for Spark Networks

Given that Spark Networks didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Spark Networks saw its revenue grow by 31% per year, compound. That is faster than most pre-profit companies. In contrast, the share price is down 18% compound, over three years - disappointing by most standards. This could mean hype has come out of the stock because the losses are concerning investors. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

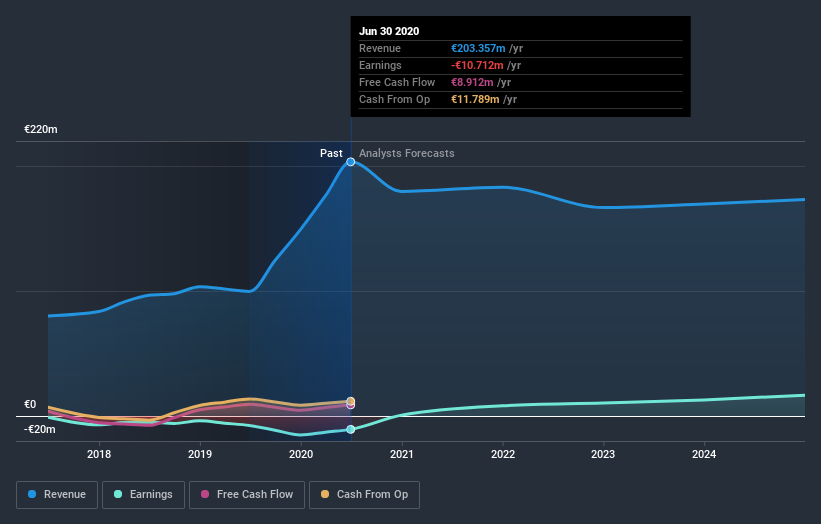

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Spark Networks stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Over the last year Spark Networks shareholders have received a TSR of 17%. It's always nice to make money but this return falls short of the market return which was about 39% for the year. The silver lining is that the recent rise is far preferable to the annual loss of 18% that shareholders have suffered over the last three years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Spark Networks has 2 warning signs we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Spark Networks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:LOVL.Q

Spark Networks

Operates online dating sites and mobile applications in the he United States, Canada, Australia, the United Kingdom, and France.

Medium and slightly overvalued.

Similar Companies

Market Insights

Community Narratives