- United States

- /

- Interactive Media and Services

- /

- NYSE:YELP

Yelp (NYSE:YELP) Projects 2024 Revenue Drop Despite Q3 Earnings Growth and Product Innovations

Reviewed by Simply Wall St

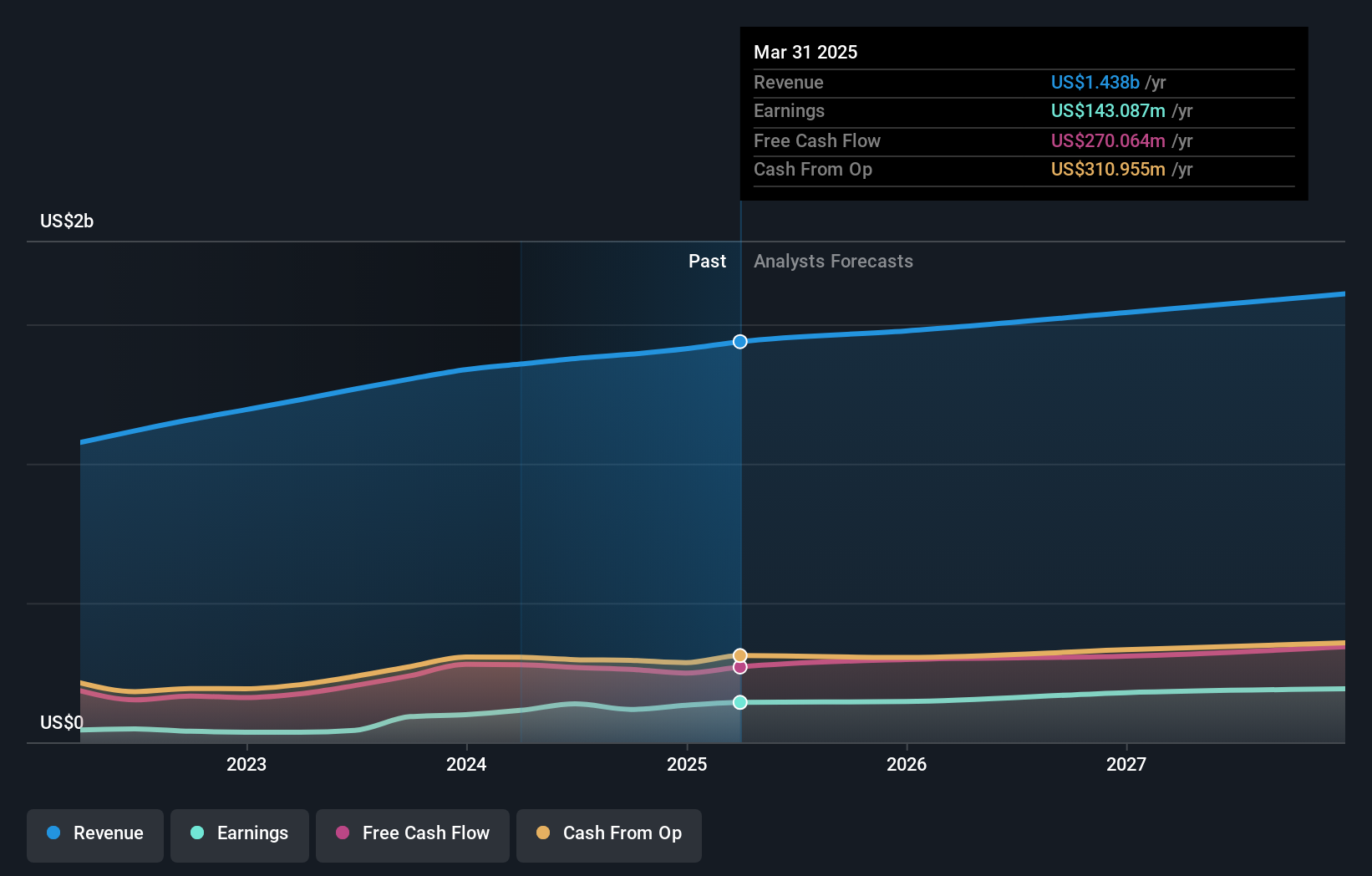

Yelp (NYSE:YELP) has recently provided earnings guidance for 2024, anticipating net revenue between $1.397 billion and $1.402 billion, reflecting a slight decrease at the midpoint. Despite a challenging third quarter with net income down to $38.44 million from $58.22 million the previous year, Yelp's strong customer relationships and focus on product innovation continue to drive user engagement and financial stability. In the following discussion, we will explore Yelp's competitive advantages, operational vulnerabilities, and future market prospects, alongside the regulatory challenges it faces.

Unlock comprehensive insights into our analysis of Yelp stock here.

Competitive Advantages That Elevate Yelp

Yelp has demonstrated significant earnings growth, with a remarkable 42.6% annual increase over the past five years, surpassing the industry average. The company's focus on product innovation, such as personalized recommendations and enhanced review capabilities, has significantly improved user engagement. This strategic enhancement, as highlighted by CFO David Schwarzbach, is crucial for attracting and retaining users. Furthermore, Yelp's strong customer relationships are evident in its high satisfaction scores, which CEO Jeremy Stoppelman noted remain above 90%. These factors contribute to Yelp's financial health, alongside its debt-free status, ensuring stability. Notably, Yelp's current trading at a P/E ratio of 20.4x, below the industry average, suggests potential undervaluation.

Vulnerabilities Impacting Yelp

Operational inefficiencies present challenges, as acknowledged by Schwarzbach, who emphasized the need to streamline processes to support growth. Additionally, Yelp faces intense competition from larger players in the digital advertising space, which CEO Stoppelman admits is pressuring market share. Rising operational costs further strain margins, necessitating effective cost-control measures. The company's revenue growth forecast of 5% per year lags behind the broader market, highlighting a need for strategic adjustments to maintain competitive edge.

Future Prospects for Yelp in the Market

Yelp is exploring market expansion opportunities by targeting underserved small businesses, which could open new revenue streams. The shift towards digital solutions presents further growth potential, as more businesses move online, increasing the relevance of Yelp's advertising offerings. Proactively addressing regulatory changes could also position Yelp as a leader in compliance and innovation. The company's earnings forecast to grow at 15.96% annually underscores its potential for future profitability.

Regulatory Challenges Facing Yelp

Economic uncertainties pose a threat to advertising budgets, as noted by Schwarzbach, potentially impacting Yelp's revenue. Broader supply chain issues, although not directly affecting Yelp, could disrupt its advertising partners' operations, indirectly influencing business performance. Continuous evaluation of competitive positioning is crucial for maintaining market share amid these challenges. Recent insider selling may also indicate wavering confidence, necessitating strategic reassessment to ensure long-term sustainability.

Conclusion

Yelp's impressive earnings growth and innovative product offerings have significantly bolstered user engagement and customer satisfaction, contributing to its financial stability and debt-free status. However, operational inefficiencies and intense competition necessitate strategic adjustments to sustain growth, especially as revenue projections lag behind the market. The company's exploration of new markets and digital solutions presents promising avenues for future profitability, with an expected earnings growth of 15.96% annually. Trading at a P/E ratio of 20.4x, Yelp is priced below both the industry and peer averages, suggesting it may offer a compelling investment opportunity, provided it effectively addresses its operational and competitive challenges.

Where To Now?

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:YELP

Yelp

Operates a platform that connects consumers with local businesses in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives