- United States

- /

- Media

- /

- NYSE:WLY

Will Wiley's (WLY) Earnings Turnaround and Anthropic AI Deal Shift Its Investment Narrative?

Reviewed by Simply Wall St

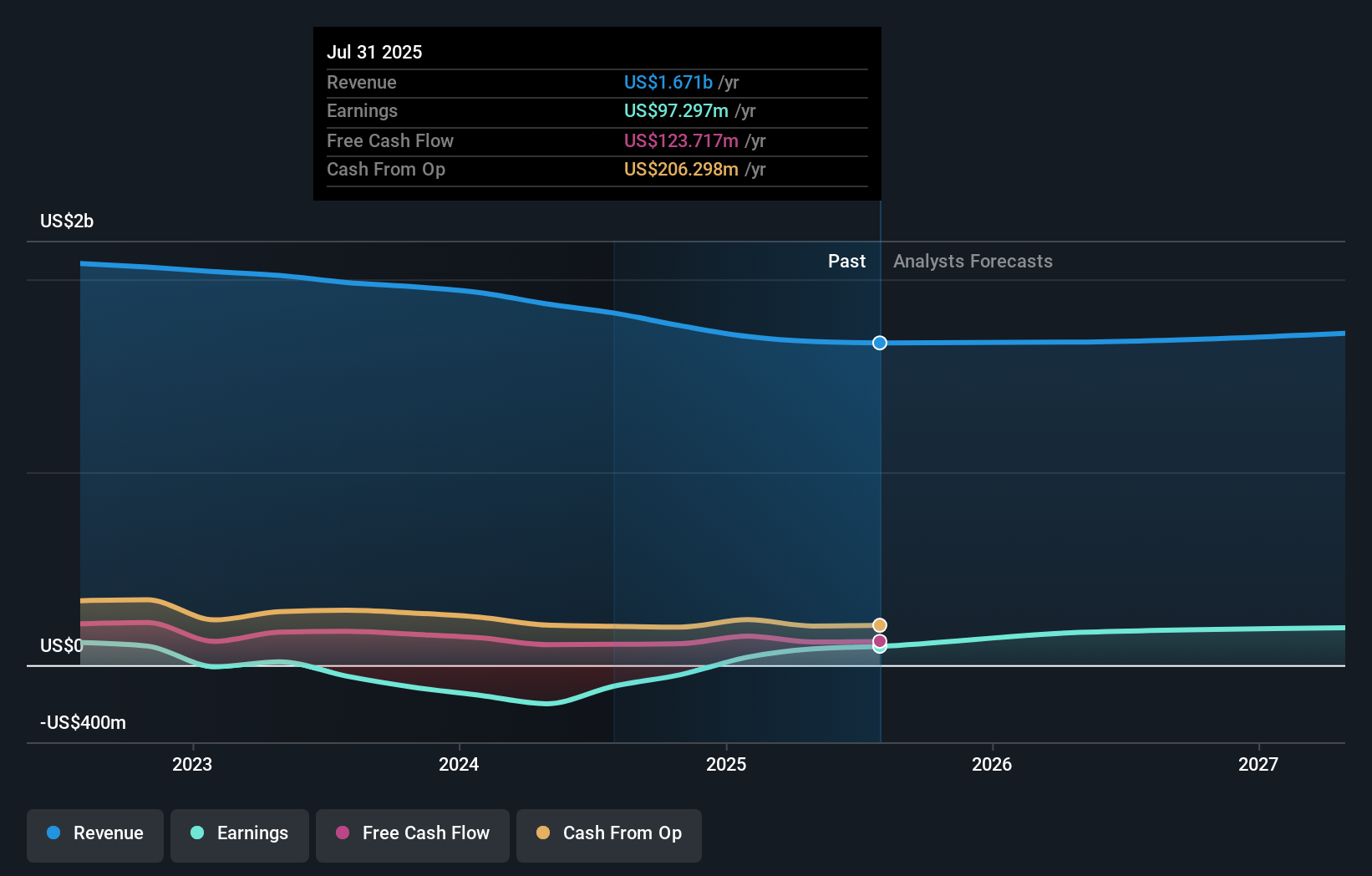

- John Wiley & Sons, Inc. reported first quarter earnings for the period ended July 31, 2025, with sales of US$396.8 million and net income of US$11.7 million, reversing a net loss from the previous year; EPS also returned to positive territory compared to the prior quarter.

- The company further underscored its technology focus by increasing AI licensing revenue and announcing a partnership with Anthropic to enhance AI capabilities in scholarly research, alongside continued dividend increases and share buybacks.

- Given this earnings turnaround and technology partnership news, we'll examine how these developments could influence Wiley's outlook and investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

John Wiley & Sons Investment Narrative Recap

To be a shareholder in John Wiley & Sons, you need to believe in its ability to leverage digital and AI-driven revenue streams while successfully managing ongoing disruptions in traditional academic publishing. The first-quarter return to profitability and positive EPS is encouraging, but with AI licensing revenues naturally volatile, the most important short-term catalyst remains further growth in technology-driven sales; however, the biggest risk is continued unpredictability in AI content licensing, which does not appear to be fully mitigated by the latest results.

Among the recent announcements, Wiley’s new partnership with Anthropic to integrate AI tools with scholarly content stands out. This move spotlights Wiley’s push to develop scalable, high-margin business lines in fast-growing digital research and licensing segments, directly tied to the single biggest current short-term catalyst: sustained momentum in AI and tech-related revenue to drive earnings growth and offset headwinds from legacy print declines.

But contrasting this renewed focus on technology, investors should also be aware of the revenue uncertainty tied to rapidly evolving AI licensing markets and how this feeds into potential swings in...

Read the full narrative on John Wiley & Sons (it's free!)

John Wiley & Sons' outlook anticipates $1.8 billion in revenue and $266.1 million in earnings by 2028. This scenario assumes a 1.5% annual revenue growth rate and an increase in earnings of $181.9 million from the current level of $84.2 million.

Uncover how John Wiley & Sons' forecasts yield a $60.00 fair value, a 45% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community shared three fair value estimates for Wiley ranging from US$30.58 to US$60. With wide-ranging outlooks, you should consider how continued volatility in AI-driven revenue may shape these differing assessments.

Explore 3 other fair value estimates on John Wiley & Sons - why the stock might be worth as much as 45% more than the current price!

Build Your Own John Wiley & Sons Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your John Wiley & Sons research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free John Wiley & Sons research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate John Wiley & Sons' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WLY

John Wiley & Sons

A publisher, provides authoritative content, data-driven insights, and knowledge services for the advancement of science, innovation, and learning in the United States, China, the United Kingdom, Japan, Australia, and internationally.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives