With the business potentially at an important milestone, we thought we'd take a closer look at Townsquare Media, Inc.'s (NYSE:TSQ) future prospects. Townsquare Media, Inc. operates as a radio, digital media, entertainment, and digital marketing solutions company in small and mid-sized markets. The US$162m market-cap company announced a latest loss of US$82m on 31 December 2020 for its most recent financial year result. Many investors are wondering about the rate at which Townsquare Media will turn a profit, with the big question being “when will the company breakeven?” In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

Check out our latest analysis for Townsquare Media

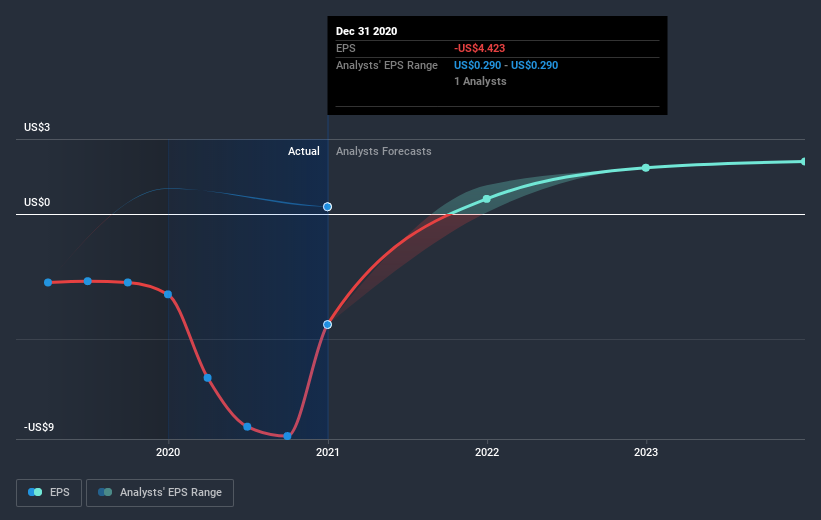

Townsquare Media is bordering on breakeven, according to the 3 American Media analysts. They expect the company to post a final loss in 2020, before turning a profit of US$11m in 2021. Therefore, the company is expected to breakeven roughly a year from now or less! How fast will the company have to grow to reach the consensus forecasts that anticipate breakeven by 2021? Working backwards from analyst estimates, it turns out that they expect the company to grow 103% year-on-year, on average, which signals high confidence from analysts. Should the business grow at a slower rate, it will become profitable at a later date than expected.

We're not going to go through company-specific developments for Townsquare Media given that this is a high-level summary, but, take into account that by and large a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

Before we wrap up, there’s one issue worth mentioning. Townsquare Media currently has a debt-to-equity ratio of over 2x. Typically, debt shouldn’t exceed 40% of your equity, which in this case, the company has significantly overshot. A higher level of debt requires more stringent capital management which increases the risk in investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis on Townsquare Media, so if you are interested in understanding the company at a deeper level, take a look at Townsquare Media's company page on Simply Wall St. We've also compiled a list of pertinent aspects you should further research:

- Valuation: What is Townsquare Media worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Townsquare Media is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Townsquare Media’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you decide to trade Townsquare Media, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Townsquare Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:TSQ

Townsquare Media

Operates as a digital and broadcast media, and digital marketing solutions company for small and medium-sized businesses in the United States.

Undervalued with moderate risk and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion