- United States

- /

- Entertainment

- /

- NYSE:TME

Tencent Music Entertainment Group (NYSE:TME) Q1 2025 Earnings Report Shows Revenue Growth

Reviewed by Simply Wall St

Tencent Music Entertainment Group (NYSE:TME) recently announced its first-quarter 2025 financial results, showing impressive revenue growth and increased earnings per share, despite a slight decline in monthly active users. The company's stock price rose 36% over the past month, significantly outperforming the broader market's 1.6% increase in the last seven days and its 12% rise over the past year. This substantial price movement may reflect positive investor sentiment fueled by strong financial performance, ongoing merger discussions with Ximalaya, and the company's efforts to strengthen its market position, serving as a counterbalance to the market's generally moderate gains.

The recent announcement of Tencent Music Entertainment Group's strong financial results for Q1 2025, alongside ongoing merger discussions with Ximalaya, reinforces the company's dual-engine strategy. This focus on content and platform innovation could bolster subscriber conversions and revenue growth, aligning with analyst expectations. Over the past three years, the company's total shareholder returns, inclusive of share price performance and dividends, was very large, highlighting substantial long-term growth. During the past year, however, TME underperformed the US Entertainment industry, which registered a 55.3% increase, demonstrating mixed performance dynamics.

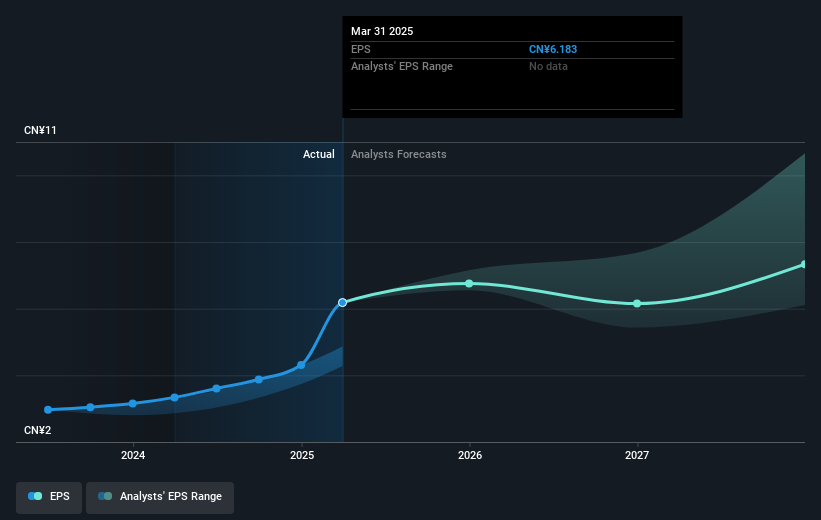

Despite a slight decline in monthly active users, positive developments in AI integration and SVIP expansion are expected to drive user engagement, supporting future revenue and earnings potential. Analysts forecast revenue to rise from CN¥28.99 billion in 2025 to CN¥37.8 billion by 2028, while earnings are predicted to increase from CN¥9.51 billion to CN¥10.5 billion within the same period. The current share price at US$14.41 suggests a 12.5% discount to the consensus analyst price target of US$16.47, indicating potential upside if revenue and earnings projections are met. These factors together could sustain favorable investor sentiment and impact TME's market valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Music Entertainment Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TME

Tencent Music Entertainment Group

Operates online music entertainment platforms that provides music streaming, online karaoke, and live streaming services in the People’s Republic of China.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives