- United States

- /

- Entertainment

- /

- NYSE:TME

Tencent Music Entertainment Group (NYSE:TME): Evaluating Valuation Following Global Data Integration With Luminate and Billboard

Reviewed by Simply Wall St

Tencent Music Entertainment Group (NYSE:TME) is making waves with a new partnership, as its streaming and sales data will now be integrated into Luminate’s CONNECT platform and Billboard’s global charts. This provides international exposure for the company and China’s music market.

See our latest analysis for Tencent Music Entertainment Group.

Tencent Music’s new global data partnership couldn’t have come at a more interesting moment for investors. After a stellar run, the share price sits at $22.45 and momentum is still strong. The stock's year-to-date share price return is a remarkable 98.32%. Over the past year, the total shareholder return clocks in at 95.56%, with a massive 526.37% over three years, clearly signaling growing investor confidence in the company’s evolving story.

If you’re curious about which other companies are building momentum in tech and media, now’s the perfect time to discover See the full list for free.

With shares near all-time highs and recent gains outpacing the market, investors now face a key question: Is Tencent Music still undervalued with more upside to come, or has the market already priced in its growth?

Most Popular Narrative: 20.8% Undervalued

With Tencent Music Entertainment Group’s closing price sitting below the narrative’s estimated fair value, attention is focused on the assumptions that power this gap. The narrative incorporates several bullish themes that explain the optimism reflected in the higher price target.

Strategic expansion into offline performances, artist merchandise, and cross-platform artist-fan interactions diversifies revenue streams and leverages the evolving "fan economy." This creates incremental revenue opportunities beyond traditional streaming and enhances the company's resilience and brand power.

What is fueling this attractive valuation? It is not just strong revenue growth or profit margins. The key factors include aggressive moves into new revenue streams and an optimistic outlook on the future of music fandom. Want the full story on the financial forecasts behind this price gap? Dive in to discover what could disrupt the market’s script.

Result: Fair Value of $28.34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory scrutiny and growing reliance on offline events could challenge Tencent Music’s profitable growth and stability in the years ahead.

Find out about the key risks to this Tencent Music Entertainment Group narrative.

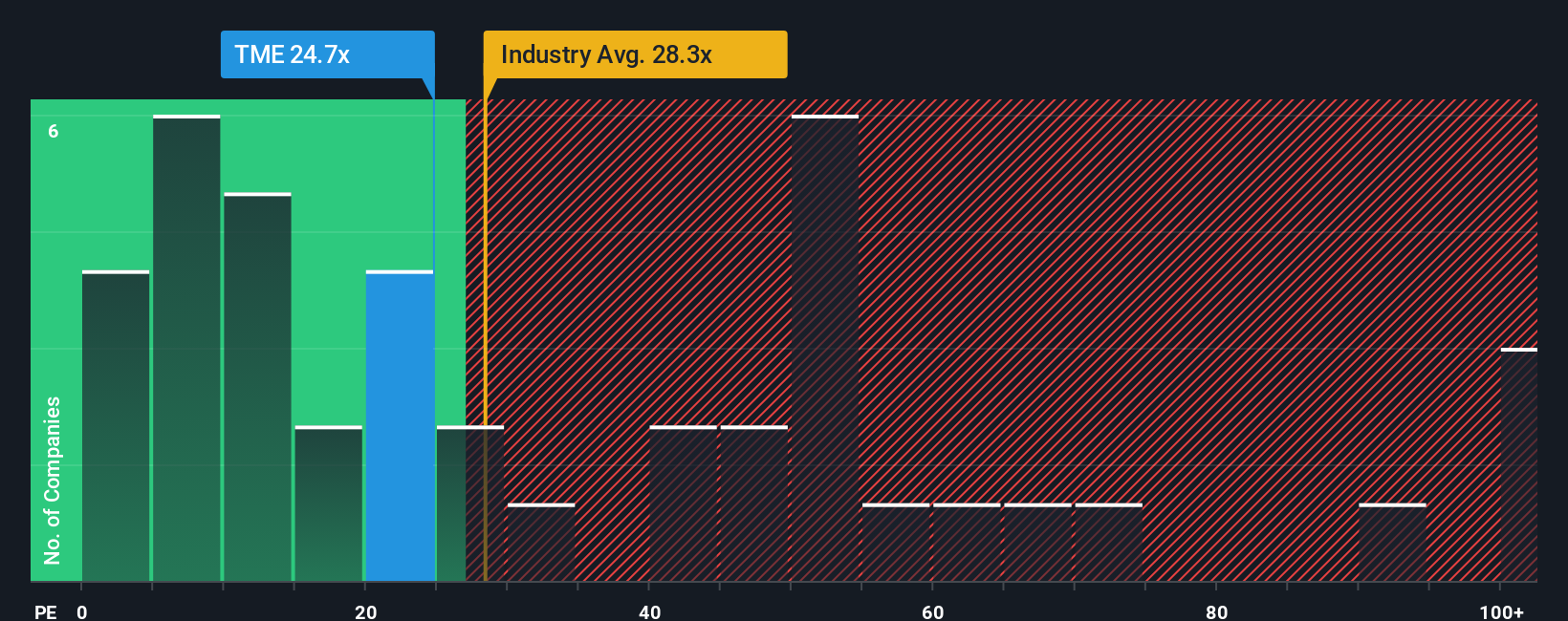

Another View: What Do Earnings Ratios Reveal?

Taking a step back from growth projections, Tencent Music’s price-to-earnings ratio of 24.7x stands out as a bargain compared to the peer average of 74x and nearly identical to the US Entertainment industry average of 24.8x. Yet, it is slightly higher than its own fair ratio of 22.9x, suggesting the market may be tacking on a slight premium for recent momentum. Is this narrow gap a sign of hidden value or a risk if growth expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tencent Music Entertainment Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tencent Music Entertainment Group Narrative

If you see things differently or want to dive into the numbers yourself, you can shape your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tencent Music Entertainment Group.

Looking for More Smart Investment Moves?

Opportunities do not wait and neither should you. Instantly uncover promising stocks matched to your strategy with the powerful Simply Wall Street Screener.

- Snap up exceptional value by checking out these 849 undervalued stocks based on cash flows with solid fundamentals and true long-term potential.

- Capitalize on the AI boom and see which trailblazers are setting the pace among these 26 AI penny stocks in innovation and profitability.

- Boost your portfolio’s income stream by picking from these 20 dividend stocks with yields > 3%, paying robust yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Music Entertainment Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TME

Tencent Music Entertainment Group

Operates online music entertainment platforms that provides music streaming, online karaoke, and live streaming services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives