- United States

- /

- Entertainment

- /

- NYSE:TKO

What Recent Media Deal Talks Mean for TKO Group Holdings Stock Valuation in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with TKO Group Holdings stock? If you own shares or are sizing up an entry, you’re probably weighing not only its impressive run but also wondering whether there is real value left or just excitement. TKO has certainly been hard to ignore. The stock has surged 63.6% over the past year, and it is up 30.9% year-to-date, showing strength most markets would envy. Even after a recent dip of 1.3% in the last week and a 6.1% slide over the last month, it is clear that the long-term momentum has caught investors’ eyes.

What has been fueling the conversation? In recent weeks, anticipation around expansion efforts in the sports entertainment space, plus speculation on new media deals, has helped frame TKO as a company with tangible growth levers. While the market is digesting what these changes could mean for future revenue, price shifts suggest investors are recalibrating their risk and reward expectations as the story unfolds.

But let’s get down to brass tacks: valuation. According to our framework, TKO Group Holdings is currently undervalued in 0 out of 6 key checks, earning a flat value score of 0. That might seem sobering at first, but each metric tells its own story, and understanding how these checks stack up is where things get interesting. Next, we will break down each approach in detail. And before you make any moves, stick around. We will share a smarter lens for looking at valuation that could change your perspective entirely.

TKO Group Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: TKO Group Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation method that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps investors gauge whether a stock's current price reflects its true long-term value.

For TKO Group Holdings, the model starts with the latest Twelve Month Free Cash Flow (FCF) of $721.8 Million. Analysts provide projections for the coming years, with FCF expected to steadily grow, reaching nearly $2.0 Billion by the end of 2029. For the years beyond, Simply Wall St applies a moderate rate of extrapolation to continue the forecast through 2035, which suggests a consistent expansion in TKO's cash-generating power.

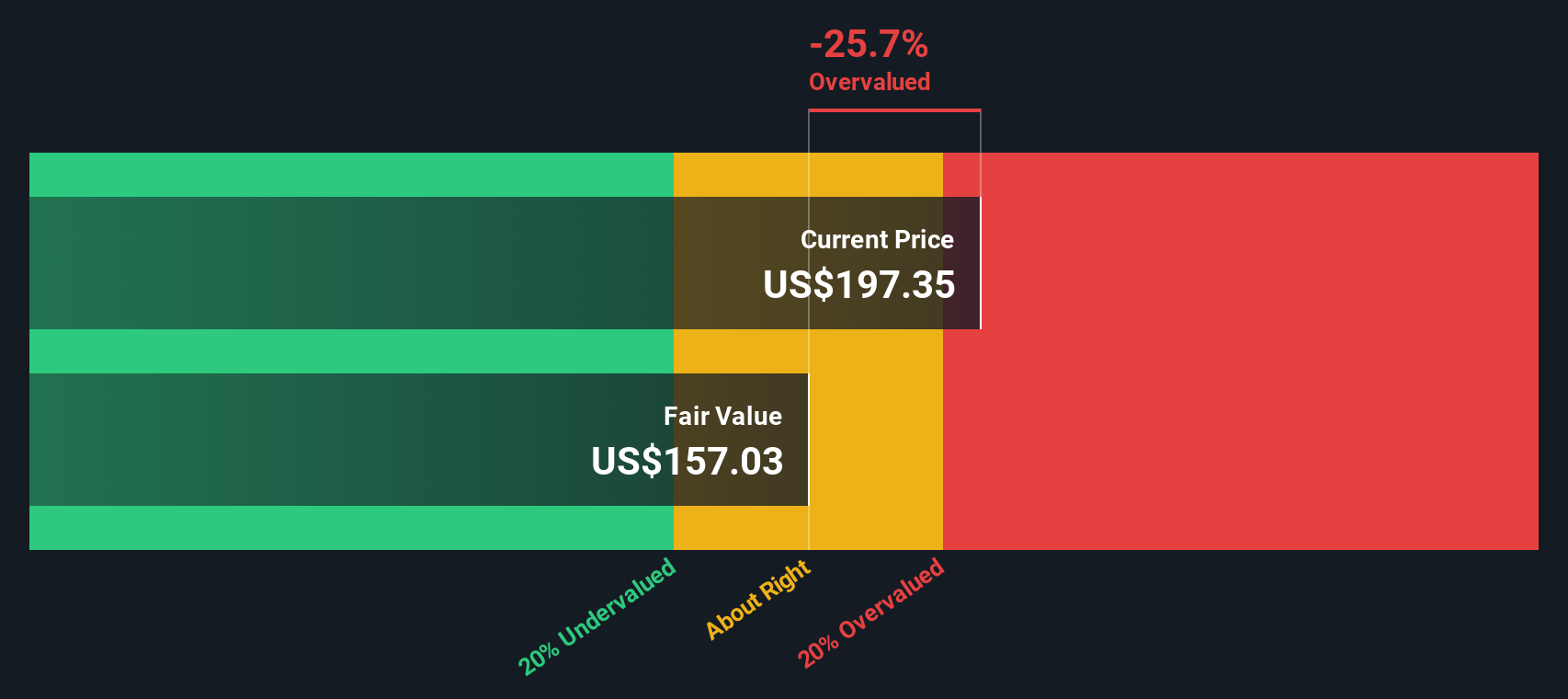

Currently, the DCF model calculates an intrinsic value of $157.40 per share. However, when comparing that figure to the prevailing market price, it implies the stock is trading about 18.7% above its fair value benchmark. This signals a notable premium and suggests investors are pricing in a lot of optimism.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TKO Group Holdings may be overvalued by 18.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: TKO Group Holdings Price vs Earnings

For profitable companies like TKO Group Holdings, the Price-to-Earnings (PE) ratio is a cornerstone valuation metric. It helps investors see how much the market is willing to pay for each dollar of current earnings, offering a simple snapshot of expectations for growth, risk, and return. Typically, a higher PE signals strong confidence in future growth, while a lower PE may reflect lower expectations or higher perceived risks.

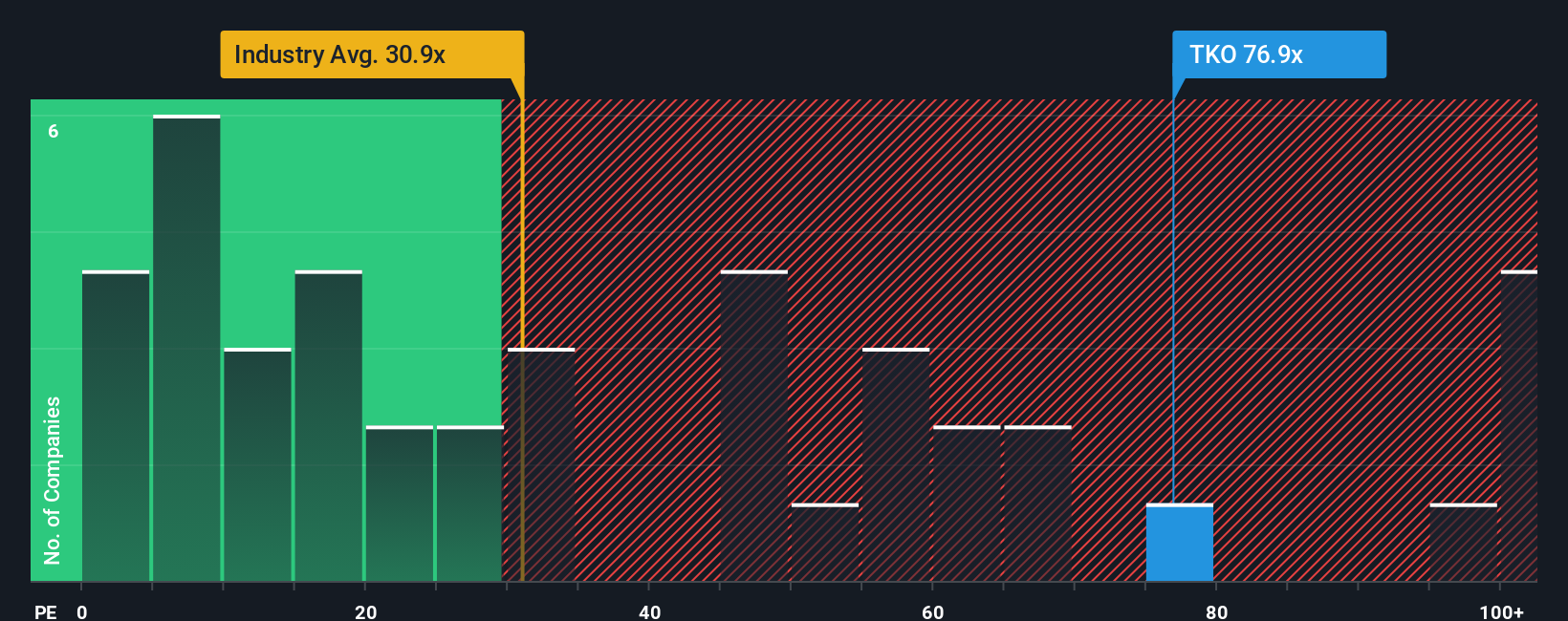

Currently, TKO trades at a PE ratio of 72.77x. This is well above the Entertainment industry average of 27.32x and ahead of its peer average at 61.11x. On face value, this elevated multiple means the market is paying a hefty premium for TKO's earnings today.

To cut through the noise of blanket peer or industry comparisons, Simply Wall St uses a “Fair Ratio”, a preferred multiple precisely tailored for each company. The Fair Ratio considers TKO's growth prospects, profit margins, scale, industry characteristics, and even unique business risks. This context-rich metric provides a more meaningful benchmark for valuation, especially compared to the blunt averages from peers or broad sectors.

TKO's Fair Ratio clocks in at 36.13x, putting the current PE at almost double what our framework deems reasonable. In other words, even after accounting for TKO's unique position and growth outlook, the stock’s valuation still looks stretched by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TKO Group Holdings Narrative

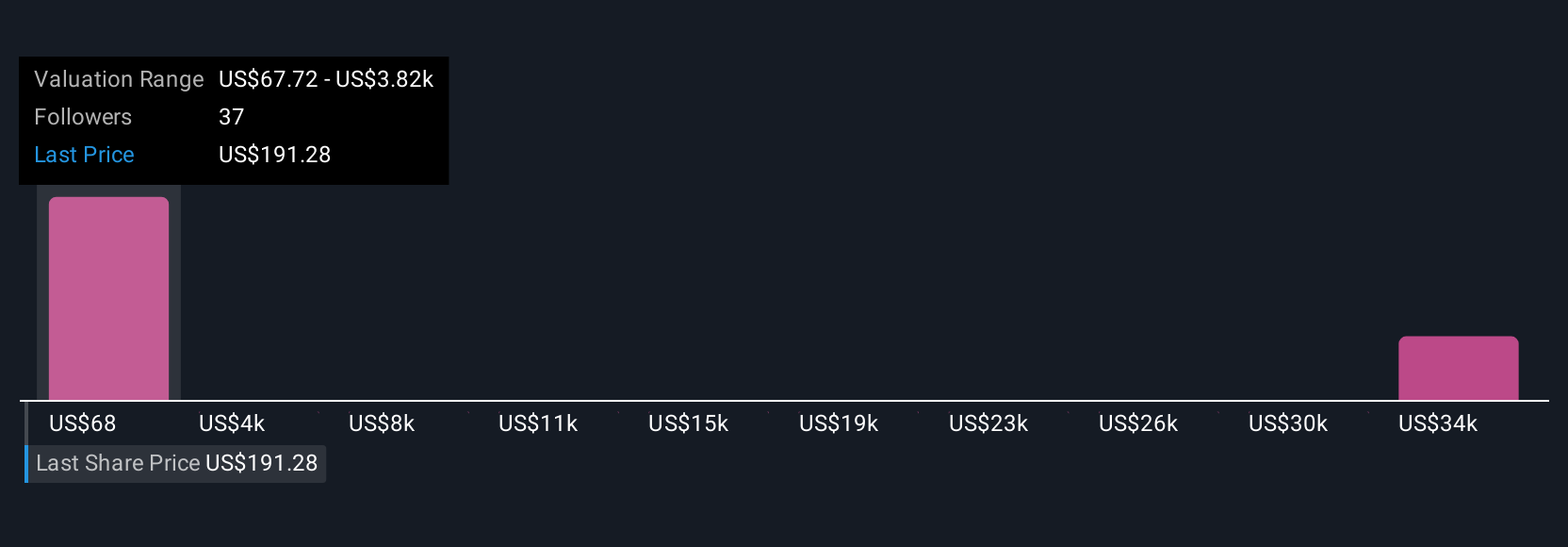

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company, captured in your own numbers, including your estimates for fair value, future revenue, earnings, and margins. Rather than just tracking statistics, Narratives connect a company’s story to a tailored financial forecast, ultimately revealing your view of its fair value and investment case.

Narratives are quick to set up, and on Simply Wall St’s Community page, used by millions, they become a powerful and accessible tool for every investor. They help you decide when to buy or sell by clearly comparing your Fair Value against the current market price. As new data, news, or earnings emerge, Narratives dynamically update, ensuring your perspective remains accurate and timely.

For example, you might see one Narrative for TKO Group Holdings projecting aggressive expansion and a higher Fair Value, while another assumes cautious growth and results in a much lower estimate. This highlights how different investor perspectives can shape decision-making.

Do you think there's more to the story for TKO Group Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives