- United States

- /

- Entertainment

- /

- NYSE:TKO

TKO Group Holdings (TKO): Evaluating Valuation as New Fan Prediction Partnership Ups Engagement in UFC and Boxing

Reviewed by Simply Wall St

TKO Group Holdings has teamed up with Polymarket to bring prediction market technology directly to live UFC and Zuffa Boxing experiences. This partnership introduces real-time fan sentiment tracking and creates an innovative interactive layer within TKO’s sports entertainment portfolio.

See our latest analysis for TKO Group Holdings.

TKO’s latest move comes as momentum has remained strong overall, with a 27.3% year-to-date share price return and total shareholder return of 34% over the past year. Despite some short-term pullbacks, these numbers suggest investors have bought into TKO’s vision for growth, particularly as it expands innovative partnerships and engagement strategies.

If sports tech is on your radar, take the next step and check out See the full list for free.

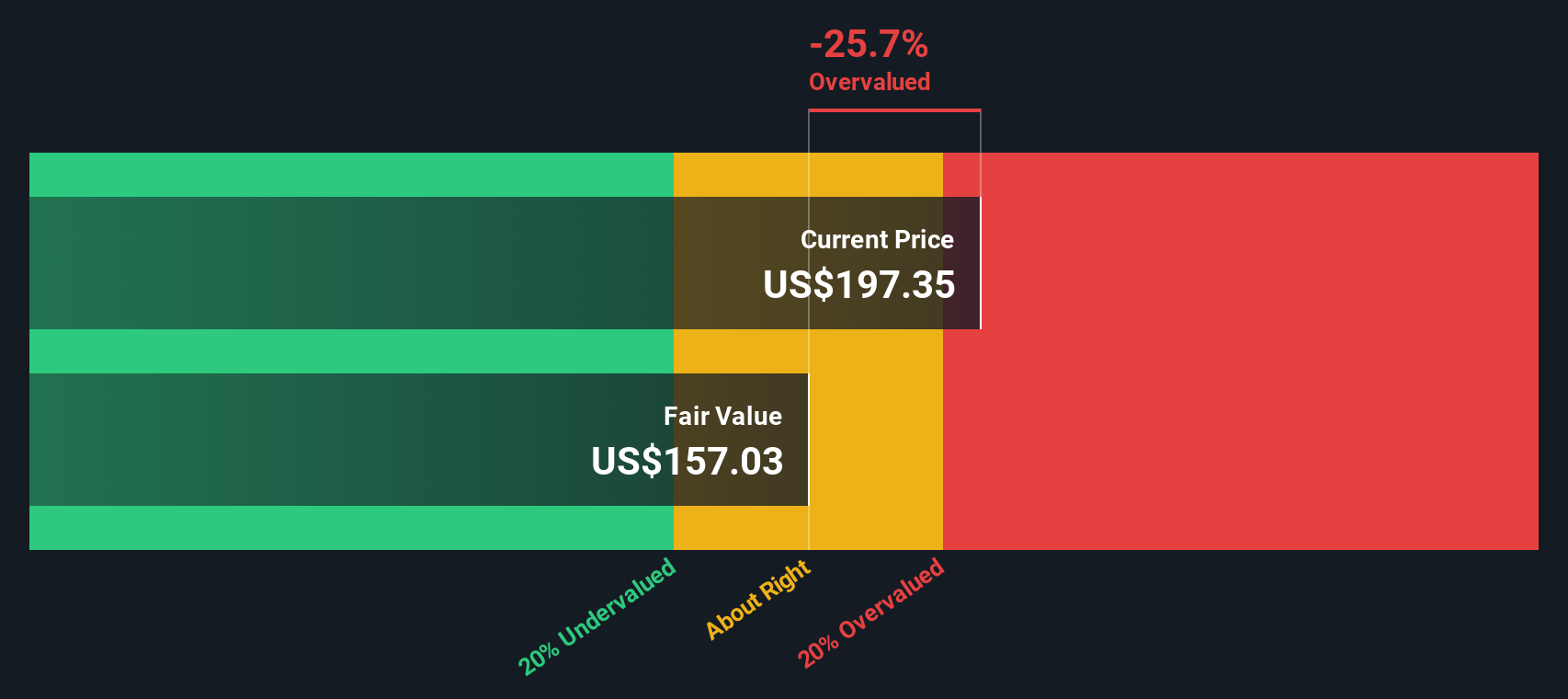

But after this string of successes and new initiatives, the question remains: is TKO’s growth story still undervalued by the market, or is every bit of future upside already reflected in its stock price?

Price-to-Earnings of 62.7x: Is it justified?

TKO Group Holdings currently trades at a price-to-earnings (P/E) ratio of 62.7x, which is sharply above several benchmarks and its own recent profitability shift. At its last close of $181.73, this puts the valuation firmly in growth-stock territory, signaling that investors are pricing in substantial ongoing expansion.

The price-to-earnings ratio reflects how much investors are willing to pay today for a dollar of TKO's future earnings. For a company that has just turned profitable and is forecasting rapid bottom-line growth, this multiple can indicate belief in transformational performance ahead. However, it also elevates future expectations and execution risk.

When comparing TKO's 62.7x P/E to the US Entertainment industry average of 20x, the company appears expensive. The fair P/E ratio for TKO, estimated using broader historical and sector data, is 36x, suggesting that the market is currently pricing TKO at a lofty premium well above levels it could eventually gravitate toward.

Explore the SWS fair ratio for TKO Group Holdings

Result: Price-to-Earnings of 62.7x (OVERVALUED)

However, slowing revenue growth or missed profit targets could quickly challenge the strong momentum and high valuation that TKO now commands.

Find out about the key risks to this TKO Group Holdings narrative.

Another View: Discounted Cash Flow Shows a Different Picture

Looking beyond traditional multiples, the SWS DCF model estimates TKO’s fair value at $216.84, about 16% above the current share price. This suggests the stock is potentially undervalued if our cash flow assumptions play out. So which story wins out: lofty multiples or a discounted opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TKO Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TKO Group Holdings Narrative

If you have your own take or want to analyze the numbers for yourself, it's easy to dive in and create a custom story. Do it your way.

A great starting point for your TKO Group Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart opportunities are everywhere if you know where to look. Get ahead of the curve and make your next winning move with these handpicked investment themes:

- Capitalize on the future of healthcare by starting your search with these 30 healthcare AI stocks for companies transforming patient care with artificial intelligence.

- Position yourself for reliable income by checking out these 14 dividend stocks with yields > 3% to find businesses offering strong yields above 3%.

- Ride the momentum in cutting-edge technology when you access these 26 AI penny stocks for a list of emerging leaders in the AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success