- United States

- /

- Entertainment

- /

- NYSE:TKO

TKO Group Holdings (TKO): Evaluating Valuation After Launching Real-Time Fan Prediction Markets With Polymarket

Reviewed by Simply Wall St

Earlier this week, TKO Group Holdings revealed a new multi-year partnership with Polymarket. This partnership brings prediction market technology directly into UFC and Zuffa Boxing broadcasts and social channels for the first time.

See our latest analysis for TKO Group Holdings.

TKO’s new partnership news comes after a busy few months, including a significant buyback, raised full-year guidance, and continued momentum from high-profile media rights deals. The 1-year total shareholder return sits at 48.56%, well outpacing the share price’s year-to-date rise of 28.98%. Long term, all signals point to building momentum, with recent moves aimed clearly at setting up further growth.

If the sports and media shake-up at TKO has you curious, now’s a great time to broaden your investing horizon and discover fast growing stocks with high insider ownership

With shares outperforming the broader market and analysts raising their targets, investors now face a crucial question: is TKO’s next leg of growth still trading at a discount, or is the growth story already priced in?

Price-to-Earnings of 63.5x: Is it justified?

TKO shares recently closed at $184.09, and its price-to-earnings (P/E) ratio of 63.5x stands out in the entertainment sector. This suggests a premium valuation, so the question is whether the company's fundamentals warrant this level.

The price-to-earnings ratio measures how much investors are willing to pay for every dollar of current earnings, reflecting expectations for future growth and profitability. For a growing media and sports powerhouse like TKO, a higher ratio can signal belief in strong future performance and unique market positioning.

Compared to peer companies, TKO’s 63.5x P/E is well below the peer average of 86.4x. This hints at relative value among similar high-growth names. However, when compared to the broader US Entertainment industry’s average P/E of 20x, TKO appears expensive. Also noteworthy is the estimated fair P/E based on Simply Wall St’s data, which is 36.1x. This suggests the market might be getting ahead of itself if sector headwinds arise.

Explore the SWS fair ratio for TKO Group Holdings

Result: Price-to-Earnings of 63.5x (OVERVALUED)

However, slowing revenue growth or a shift in media rights sentiment could challenge TKO’s premium. This could potentially trigger a reassessment of its valuation.

Find out about the key risks to this TKO Group Holdings narrative.

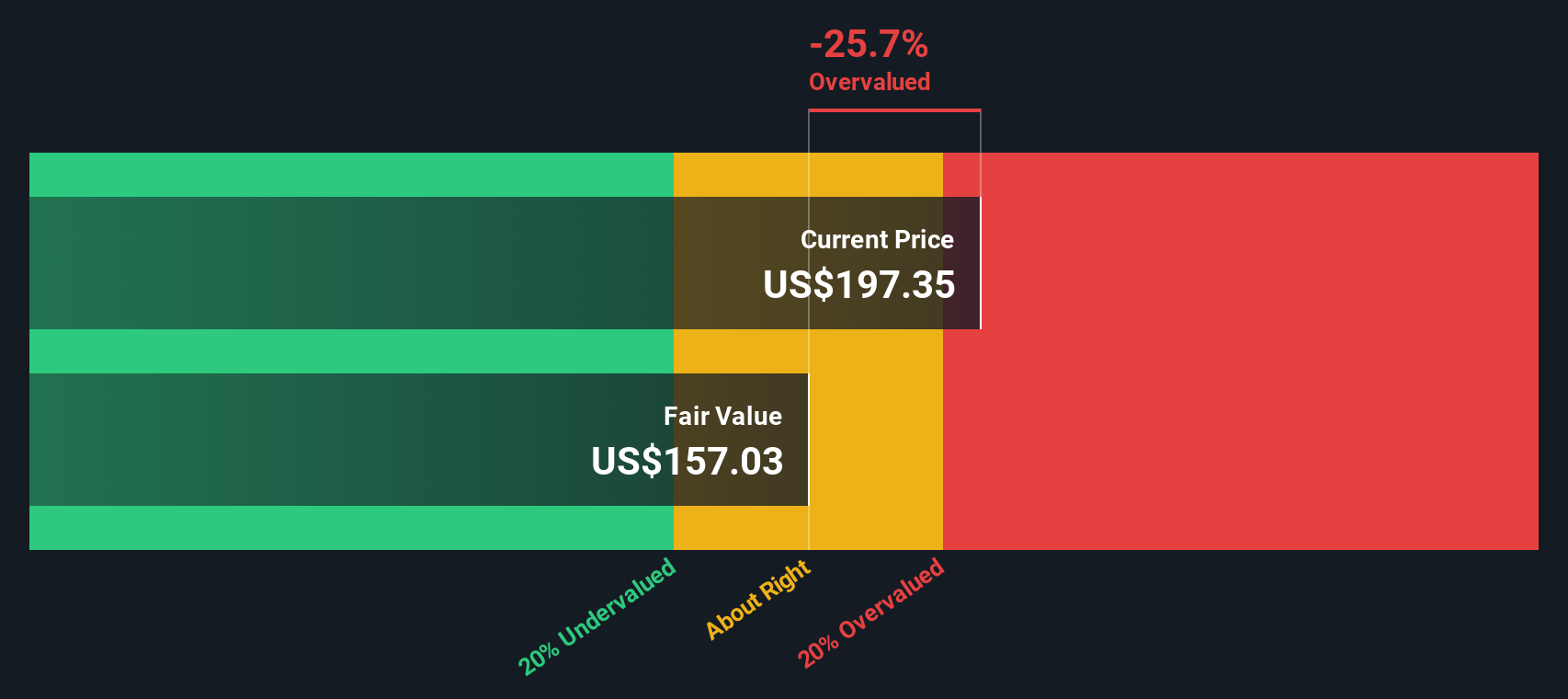

Another View: Discounted Cash Flow Perspective

Looking through the lens of our SWS DCF model, TKO’s current share price of $184.09 is actually trading about 14.7% below fair value. This amounts to $215.82. This method points to TKO being undervalued, which contrasts with its rich price-to-earnings ratio. Which method should investors trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TKO Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TKO Group Holdings Narrative

Feel free to dive into the latest numbers and build a TKO story that reflects your research and insight. With our tools, building your own view takes less than three minutes. Do it your way

A great starting point for your TKO Group Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities are everywhere, so make your next move count. Don’t miss out on the hottest trends and smartest investments with our top handpicked stock ideas:

- Capitalize on the future of smart medicine by checking out these 31 healthcare AI stocks, where companies are leading innovation in AI-driven healthcare.

- Maximize your income with steady cash flow by exploring these 16 dividend stocks with yields > 3% to uncover businesses that offer reliable yields above 3%.

- Seize the next wave of technology by exploring these 26 quantum computing stocks, where you will find companies advancing breakthroughs in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

High growth potential with adequate balance sheet.

Market Insights

Community Narratives