- United States

- /

- Entertainment

- /

- NYSE:TKO

TKO Group Holdings (TKO): A Fresh Look at Valuation Following Recent Stock Swings

Reviewed by Simply Wall St

Shares of TKO Group Holdings (TKO) have shown some swings over the past month, catching the interest of investors who track the company's stock performance closely. The stock closed at $186.85, down about 8% over the past month.

See our latest analysis for TKO Group Holdings.

While the recent 8% slide in TKO’s share price over the past month has sparked some questions, zooming out reveals stronger momentum overall. Year-to-date, the shares have surged more than 30 percent, and total shareholder return sits at a striking 63.9 percent for the last year. This suggests that enthusiasm for the company’s growth story is still outweighing short-term jitters about market swings or valuation.

If you’re wondering what other fast-moving companies stand out right now, it might be the perfect moment to discover fast growing stocks with high insider ownership

With the stock sitting below analyst price targets but already logging impressive gains, investors are left wondering: does TKO still have room to run, or is the market fully valuing its future potential?

Price-to-Earnings of 72.8x: Is it justified?

TKO Group Holdings currently trades with a price-to-earnings (P/E) ratio of 72.8x, considerably higher than comparable peers and the broader market. At the last close of $186.85, this lofty valuation places TKO well above sector norms.

The price-to-earnings ratio compares a company's current share price to its earnings per share and serves as a quick gauge for how much investors are willing to pay for every dollar of profit. In high-growth or newly profitable companies, a high P/E may reflect optimism about future earnings potential, but it can also raise questions about sustainability unless future results quickly justify the price.

Looking at TKO, the market appears to be heavily pricing in aggressive earnings growth and ongoing momentum. The current P/E is not only at a premium to US Entertainment industry peers (26.4x), but also surpasses the estimated "fair" P/E ratio of 36.1x that regression analysis suggests. This divide implies investors are betting on the company outpacing both historical norms and industry benchmarks, though it also leaves little margin for error.

Explore the SWS fair ratio for TKO Group Holdings

Result: Price-to-Earnings of 72.8x (OVERVALUED)

However, slowing revenue or earnings growth, or a shift in investor sentiment, could quickly challenge the high expectations that are currently priced into TKO shares.

Find out about the key risks to this TKO Group Holdings narrative.

Another View: What Does Our DCF Model Suggest?

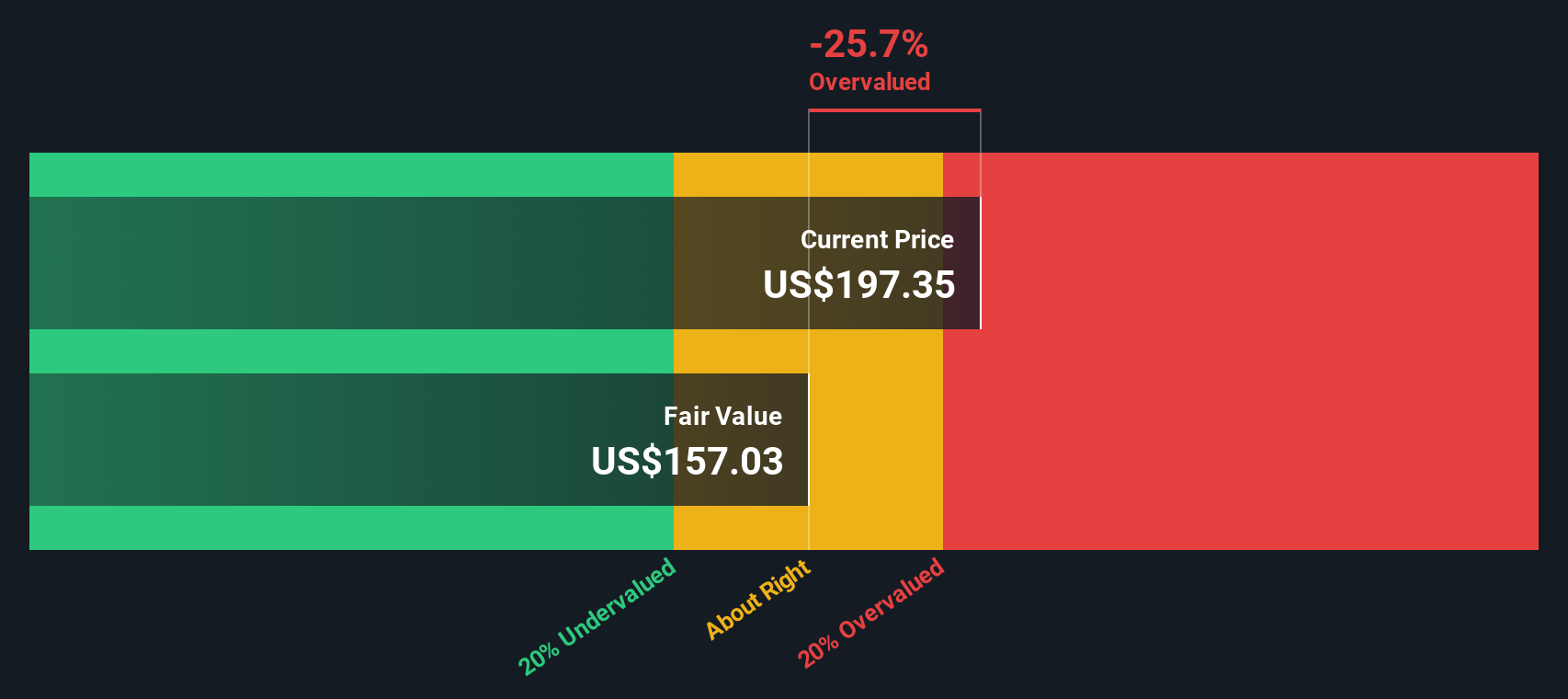

Switching gears from looking at valuation ratios, the SWS DCF model estimates TKO’s fair value at $157.17 per share. This is noticeably lower than its recent trading price of $186.85. This suggests the share price could be running ahead of its underlying cash flow potential. Could the optimism in the market be overextended, or does it reflect strengths the model can’t capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TKO Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TKO Group Holdings Narrative

Feel free to dive into the numbers yourself. If our take doesn’t match your outlook, you can easily craft your own TKO narrative right here in just a few minutes. Do it your way

A great starting point for your TKO Group Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stop waiting for tomorrow’s opportunities. Turn your curiosity into action and see what’s making waves in different corners of the market today.

- Uncover high-growth potential by checking out these 875 undervalued stocks based on cash flows and spot companies where the market might be missing the real story.

- Zero in on steady cash flow by reviewing these 17 dividend stocks with yields > 3%, filled with stocks offering robust yields for reliable returns.

- Get ahead of emerging trends in technology by exploring these 27 AI penny stocks and see the standouts poised to lead the AI boom.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives