- United States

- /

- Entertainment

- /

- NYSE:TKO

Is TKO's Dividend Hike and T-Mobile Arena Deal Shaping a Stronger Case for TKO (TKO)?

Reviewed by Simply Wall St

- On September 3, 2025, TKO Group Holdings, Inc. announced a very large 100% increase in its quarterly cash dividend and the extension of its multi-year T-Mobile Arena partnership, securing a minimum of four annual UFC events and two WWE events in Las Vegas through 2030.

- This combined development not only highlights TKO’s strong shareholder return approach but also strengthens its leadership in live sports entertainment by ensuring prime venue access for flagship events.

- We'll explore how the expanded T-Mobile Arena partnership reinforces TKO's investment narrative and prospects for recurring premium event revenue.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is TKO Group Holdings' Investment Narrative?

For anyone interested in TKO Group Holdings, the story typically hinges on believing in the enduring global appeal of live combat sports, ongoing expansion in media rights, and the company's ability to convert flagship events into recurring premium revenue. The recent doubling of the dividend and the long-term extension with T-Mobile Arena powerfully reinforce these points, signaling confidence in cash flows and locking in access to physical venues that consistently host sold-out, high-grossing events. Short term, the raised dividend might boost sentiment, but the real catalyst is securing predictable scheduling for UFC and WWE in Las Vegas, which could strengthen projections for future event-driven revenue. That said, risks like the ongoing antitrust lawsuit and expensive valuation remain, with the board's relative inexperience and high P/E ratio drawing scrutiny. The latest news reduces venue risk but doesn't offset regulatory or valuation concerns. However, unresolved legal pressures could still shape future profits.

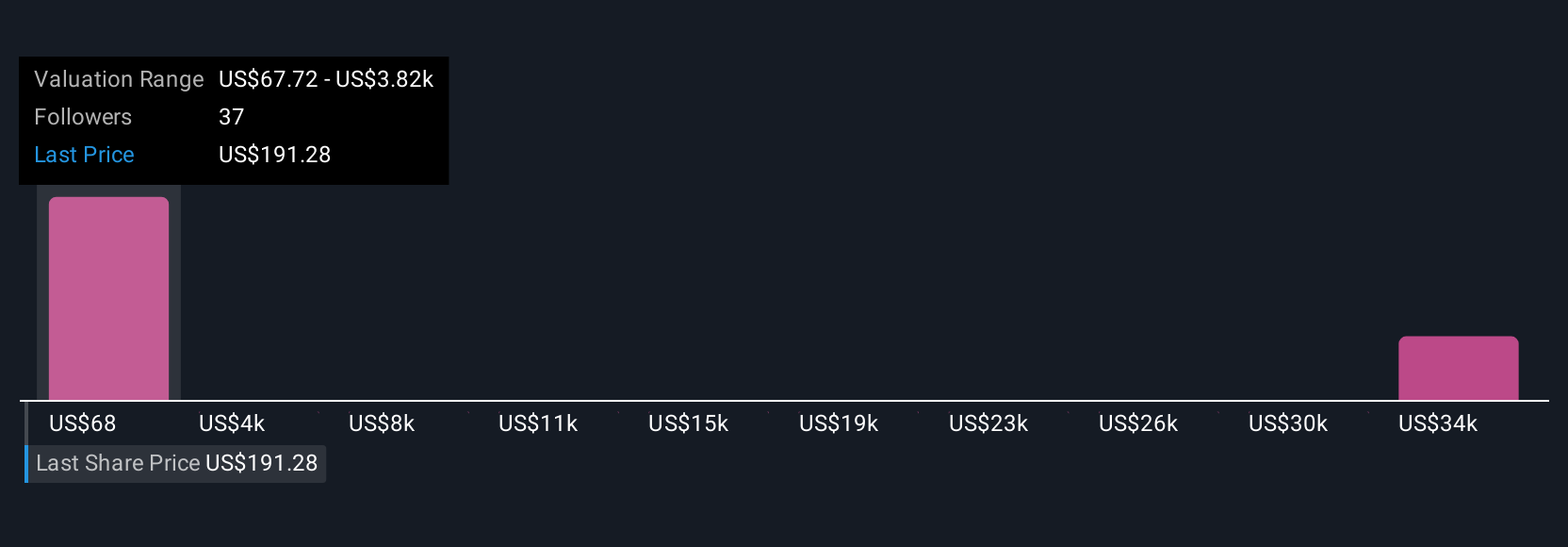

TKO Group Holdings' shares are on the way up, but they could be overextended by 36%. Uncover the fair value now.Exploring Other Perspectives

Explore 9 other fair value estimates on TKO Group Holdings - why the stock might be worth less than half the current price!

Build Your Own TKO Group Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TKO Group Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TKO Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TKO Group Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

High growth potential with adequate balance sheet.

Market Insights

Community Narratives