- United States

- /

- Entertainment

- /

- NYSE:TKO

A Look at TKO Group Holdings's Valuation Following Dividend Hike and Expanded Las Vegas Arena Deal

Reviewed by Simply Wall St

TKO Group Holdings (NYSE:TKO) has made a splash with two moves that should give investors something to consider. First, the company doubled its quarterly dividend, a clear signal of confidence in its financial strength and commitment to rewarding shareholders. Just as investors were processing that news, TKO also announced an extended partnership with T-Mobile Arena in Las Vegas, securing a steady flow of high-profile UFC and WWE events through 2030. For shareholders wondering what this combination means, these developments address both immediate returns and longer-term growth strategy.

In the bigger picture, TKO has already been experiencing significant momentum, with shares rising about 75% over the past year and gaining traction in recent months. The stock increased 23% this past month alone as enthusiasm around both live event expansion and stronger financials grew. These new agreements add to a series of strong event announcements and follow the most successful WrestleMania in WWE history, which was held in Las Vegas earlier this year. The sustained uptick in both price and business milestones suggests that optimism is running high.

After such a strong run, the essential question is whether investors are encountering a rare buying window or if the market is already pricing in all of TKO’s future growth potential.

Price-to-Earnings of 78.1x: Is it justified?

Based on its price-to-earnings ratio, TKO appears expensive compared both to its industry peers and the broader entertainment sector average. This means investors are currently paying a significant premium for each dollar of the company’s earnings.

The price-to-earnings ratio measures how much investors are willing to pay per dollar of earnings. It is widely used to compare valuation among companies in the same sector. For a fast-growing firm or one with unique assets, a higher multiple can sometimes be warranted if the market expects significant future profit growth.

However, TKO’s current ratio stands at 78.1x, well above the industry average of 38.8x and the peer average of 57.9x. Unless the company can justify this premium through accelerated earnings growth or sustainable competitive advantages, the market might be overvaluing its near-term profit potential.

Result: Fair Value of $152.34 (OVERVALUED)

See our latest analysis for TKO Group Holdings.However, any slowdown in revenue growth or a failure to meet earnings expectations could quickly shift sentiment and impact TKO’s high valuation.

Find out about the key risks to this TKO Group Holdings narrative.Another View: What Does the SWS DCF Model Suggest?

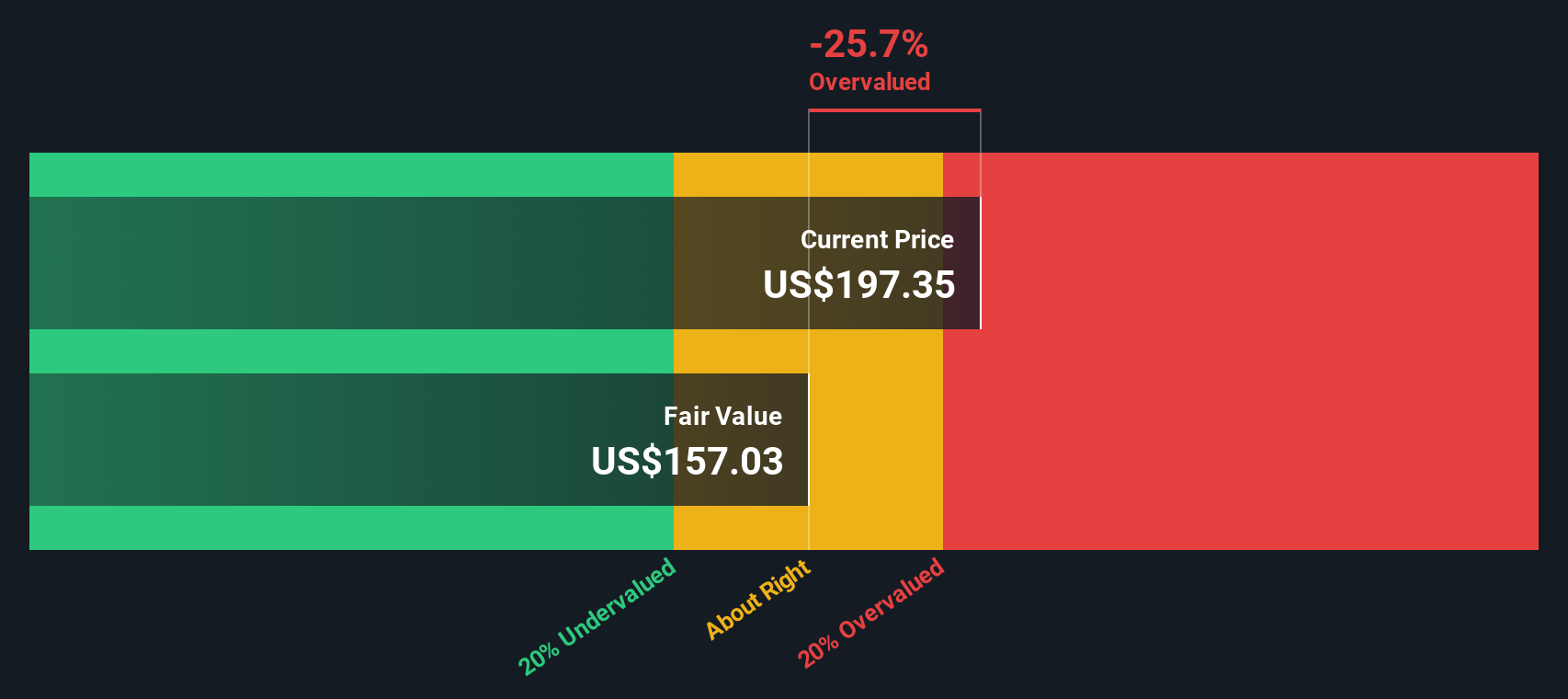

Looking from a different angle, the SWS DCF model also sees shares as priced above fair value. This reinforces the concerns raised by traditional valuation multiples. Could the market be betting on even faster growth?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own TKO Group Holdings Narrative

If you feel there is more to the story or would like to analyze the numbers on your own terms, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your TKO Group Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next opportunity slip away. Take action with these handpicked themes and get ahead of the market using Simply Wall Street’s powerful screener tools.

- Catch tomorrow’s tech breakthroughs by checking out emerging innovators in quantum computing with quantum computing stocks.

- Earn while you invest by tracking companies offering robust income potential using dividend stocks with yields > 3%.

- Spot overlooked gems trading below their intrinsic value and get a jump on the competition through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:TKO

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion