- United States

- /

- Entertainment

- /

- NYSE:SPOT

Spotify (SPOT): Evaluating Valuation After Strong Annual Growth and Recent Share Price Dip

Reviewed by Simply Wall St

Spotify Technology (SPOT) shares are drawing attention after the company reported annual net income growth of 28% and revenue growth of 12%. These numbers come amid growing competition in the streaming space, prompting fresh discussion around Spotify's valuation.

See our latest analysis for Spotify Technology.

After soaring in the first half of the year, Spotify’s share price has cooled off recently, with a 14.5% drop over the past month and a 28.7% gain so far in 2024. Even with short-term volatility, long-term shareholders are still sitting on a 25.2% total return over the past year and triple-digit gains over three and five years. This shows that growth momentum is taking a breather but not stalling out.

If big moves in media stocks have you wondering where the next standout could be, it might be time to broaden your search and discover fast growing stocks with high insider ownership

With shares still well below Wall Street’s average price target and annual results showing strong growth, investors are left to wonder whether Spotify is trading at an attractive discount or if its future success is already reflected in the price.

Most Popular Narrative: 16% Undervalued

Spotify's narrative fair value of $703 per share stands over 16% above the most recent close of $589. Investor focus is shifting from rapid growth to long-term cash generation and market dominance, and the assumptions baked into the popular narrative set a high bar for future performance.

“Spotify is wisely focusing on long-term objectives over short-term profitability. Leverage will shift from labels (suppliers) to Spotify (the aggregator) as scale continues to grow.”

Curious which key assumptions are driving this bullish price? One forecast about shifting industry power could change everything for Spotify’s margins. The growth, profits and dominance behind this fair value may surprise you. The details reveal bold predictions and a market thesis you have to see to believe.

Result: Fair Value of $703 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition from emerging streaming platforms or unexpected slowdowns in user growth could still present challenges for Spotify as it seeks to achieve its ambitious long-term targets.

Find out about the key risks to this Spotify Technology narrative.

Another View: High Market Valuation Raises Questions

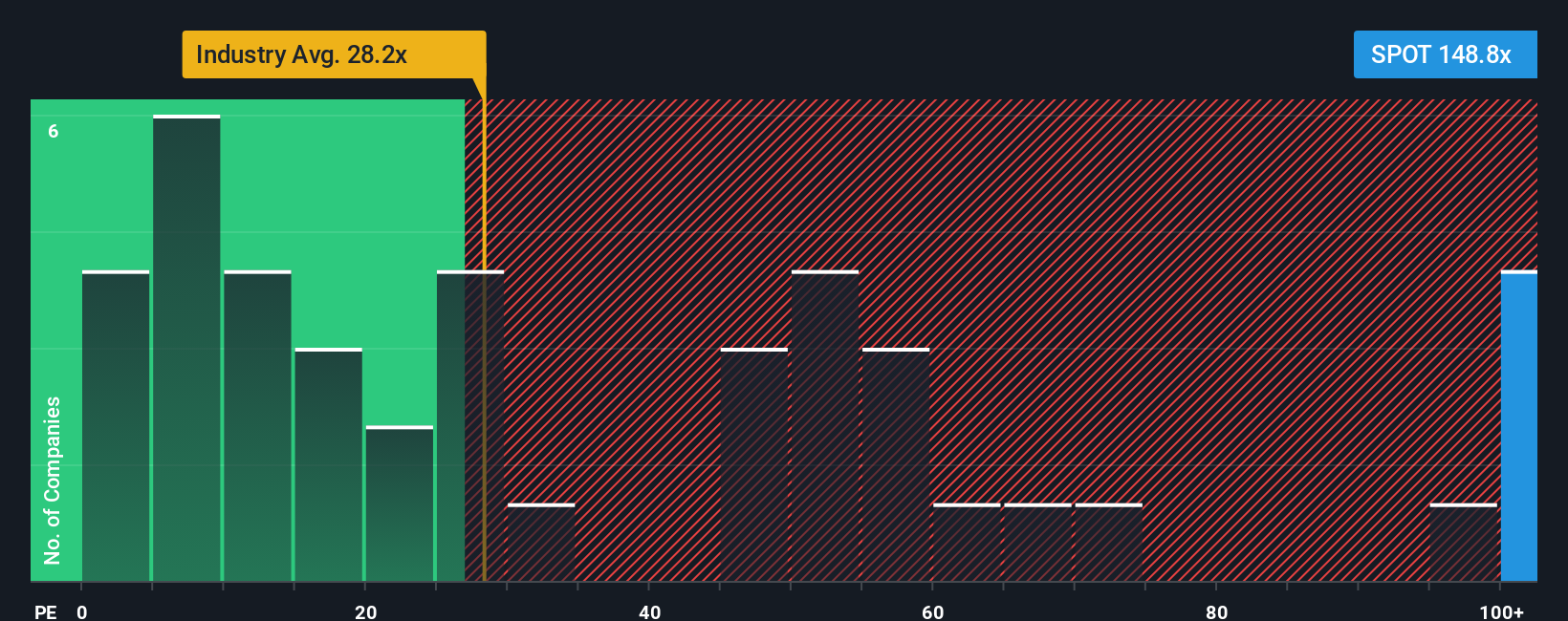

While the narrative approach suggests Spotify could be undervalued, a hard look at its price-to-earnings multiple tells a different story. The company trades at 78.7x earnings, which is well above the industry average of 19.7x and even higher than its peer average of 67.6x. In comparison, the fair ratio of 37.2x highlights that the current premium signals possible valuation risk if growth slows or expectations are missed. Could investor optimism be overstating the opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Spotify Technology Narrative

If you see things differently or want a hands-on approach, you can dive into the numbers and shape your own Spotify story in minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Spotify Technology.

Looking for more investment ideas?

Don’t let great investment opportunities pass you by. Make your next smart move with three handpicked stock ideas tailored for ambitious investors like you:

- Supercharge your portfolio by tapping into income potential with these 15 dividend stocks with yields > 3%, offering yields above 3% and robust payout track records.

- Boost your exposure to groundbreaking innovation by checking out these 26 quantum computing stocks, featuring companies pioneering quantum computing advancements and shaping tomorrow’s technology landscape.

- Capitalize on rapid growth trends by exploring these 26 AI penny stocks, which are making waves in artificial intelligence, automation, and next-generation software.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives