- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

Does Snap’s Slump Signal Opportunity After Fresh Privacy and Partnership Moves?

Reviewed by Bailey Pemberton

- If you're wondering whether Snap is a bargain or a risk right now, you're in good company. This stock always sparks debates about value.

- After a rocky run, Snap shares have fallen 1.9% over the last week and are down a hefty 30.6% year-to-date, signaling shifts in how investors see its growth story and risk profile.

- Recent headlines have highlighted Snap's evolving approach to privacy and creative partnerships, with several deals aimed at expanding its user engagement and advertising options. These moves have gotten both fans and critics talking, giving context to the stock’s recent volatility.

- Our valuation score for Snap is 4 out of 6. This means it looks undervalued in several areas, but not across the board. Next, we’ll break down the different ways analysts put a value on Snap, and share one more method at the end that could give you the clearest picture yet.

Find out why Snap's -37.7% return over the last year is lagging behind its peers.

Approach 1: Snap Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today’s dollars. This approach helps reveal what Snap might truly be worth, based on its expected ability to generate cash.

For Snap, the latest reported Free Cash Flow is $365 million. Analysts expect this number to grow over time, with projections reaching $1.43 billion by the year 2029. It’s important to note that estimates are only available for the next five years, so forecasts beyond that are extrapolations rather than analyst consensus. The DCF model looks at these future cash flows, both analyst-driven and extrapolated, to arrive at an intrinsic value today.

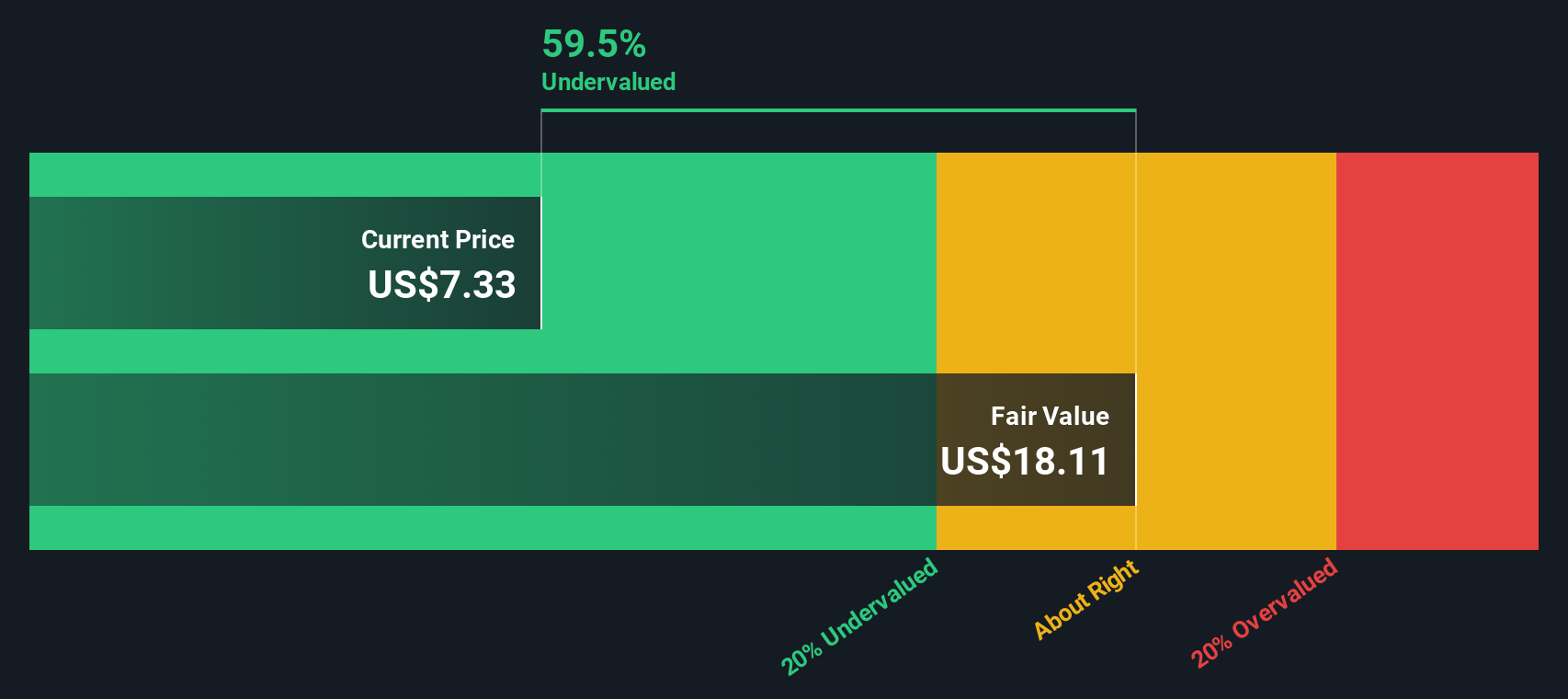

According to this model, Snap’s estimated intrinsic value is $19.02 per share. At current market prices, this suggests the stock is about 59% undervalued compared to its DCF-calculated worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Snap is undervalued by 59.0%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Snap Price vs Sales

The price-to-sales (P/S) ratio is often a preferred tool for valuing companies like Snap, which are not consistently profitable but are focused on rapid revenue growth. For businesses still scaling up, sales multiples provide a way to gauge value without requiring steady earnings.

What counts as a “fair” P/S ratio varies. Higher growth expectations or stronger competitive positions can justify a higher ratio, while greater risks or weaker growth might pull it lower. Market sentiment and industry trends also play a role in where these ratios settle.

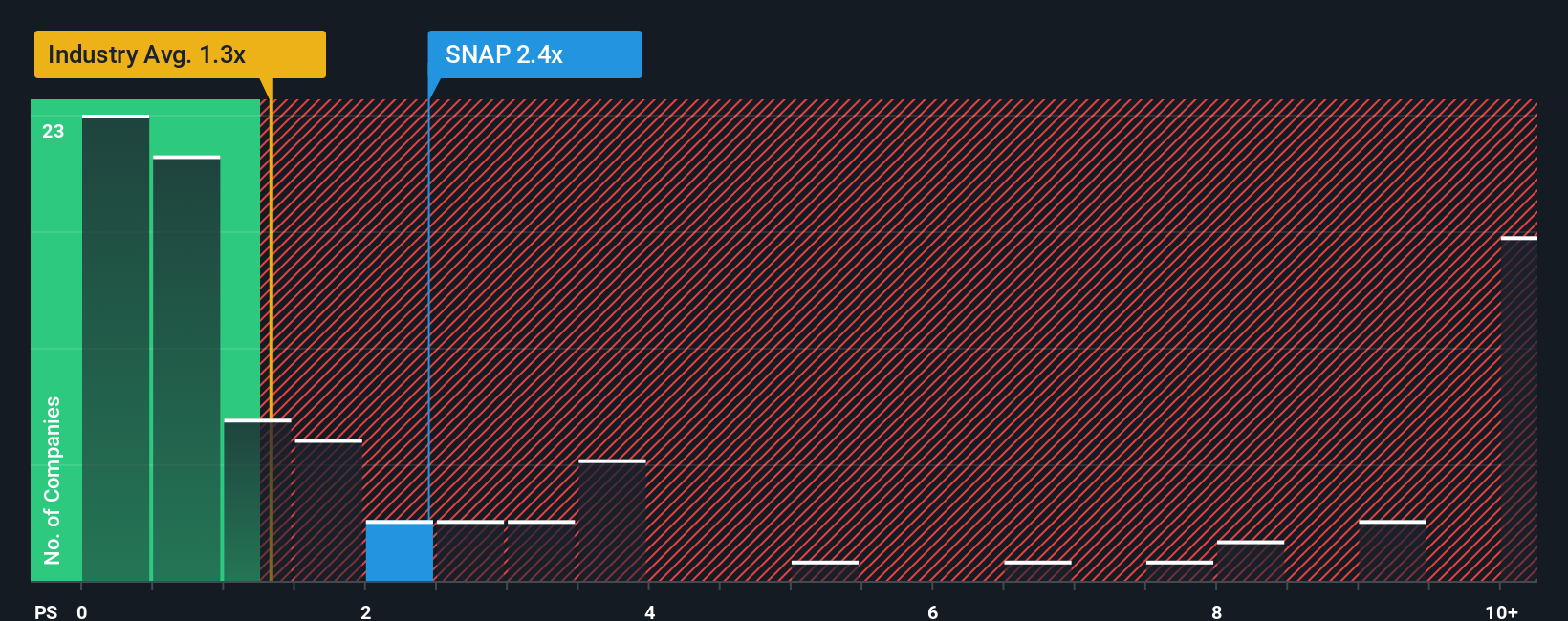

Currently, Snap is trading at a P/S ratio of 2.34x. That is higher than the industry average of 1.28x but below the average of its peer group, which sits at 3.32x. At first glance, this suggests that Snap is priced more aggressively than its wider industry but more modestly when compared to direct peers.

Simply Wall St’s proprietary “Fair Ratio” for Snap adjusts for important factors like expected earnings growth, profit margin, business risks, industry dynamics and company size. By considering these elements, the Fair Ratio for Snap is 2.68x and offers a more nuanced benchmark than using crude averages alone, which can miss crucial context.

Comparing Snap’s current P/S of 2.34x to its Fair Ratio of 2.68x, the difference is not dramatic. This indicates that, by this yardstick, Snap is trading at a reasonable value relative to its unique characteristics and outlook.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Snap Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story behind the numbers; it is a way to tie together your perspective on Snap's future with your own assumptions for revenue growth, margins, and what you think is a fair value.

Narratives link Snap's business story to a financial forecast, connecting what you believe about its prospects directly to your estimate of what the company is worth today. This isn't just another complex investing tool, but a simple, accessible feature on Simply Wall St's Community page, used by millions of investors to shape their decisions.

With Narratives, you can quickly compare your Fair Value to the latest Share Price, helping you decide if it is the right time to buy or sell. Because Narratives update dynamically with important news and earnings releases, your view stays current as new information comes in.

For example, among Snap investors today, some see huge opportunity in AR and international growth and set a Bull Narrative with a Fair Value as high as $16.00. Others factor in heavy losses and rising competition to reach a Bear Narrative as low as $7.00.

Do you think there's more to the story for Snap? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives