- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Reddit (RDDT): Evaluating Valuation After Major Ad Revenue Surge and AI-Driven Monetization Boost

Reviewed by Simply Wall St

Reddit (RDDT) is making headlines after reporting a 74% jump in advertising revenue over the past year, fueled by new AI features like Reddit Answers and core search upgrades that are boosting platform monetization.

See our latest analysis for Reddit.

Despite some recent volatility, with a 1-day share price dip of nearly 3% and a tougher 90-day stretch, Reddit’s 1-year total shareholder return of 44.92% shows that momentum is still firmly on its side. Investors seem to be warming up to the company’s AI-fueled growth story and expanding monetization opportunities.

If Reddit’s rapid transformation has you wondering what other fast-movers are out there, this could be an ideal moment to broaden your discovery and explore fast growing stocks with high insider ownership

But with the stock trading below analyst price targets and showing robust revenue growth, is Reddit still flying under the radar? Or are investors already pricing in every ounce of its future potential?

Most Popular Narrative: 21.9% Undervalued

Reddit’s narrative-backed fair value of $240.27 is significantly higher than its last close of $187.55. This gap reflects strong earnings momentum, expanding monetization, and a bullish consensus on future potential.

As digital advertising budgets increasingly prioritize highly engaged, niche communities, Reddit's 84% year-over-year ad revenue growth, broader advertiser base, and introduction of formats such as Dynamic Product Ads position it to capture a greater share of this ongoing trend. This could potentially lift revenue and net margins over time, particularly as ad stack improvements enhance advertiser ROI.

Want to know the secret sauce behind Reddit’s premium valuation? Analysts are focusing on a combination of revenue acceleration and significant margin expansion. Curious which growth drivers and potential profit multiples set this price apart? See what’s fueling the boldest forecasts yet.

Result: Fair Value of $240.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges such as slowing U.S. user growth and ongoing content moderation hurdles could spark shifts in Reddit’s growth outlook going forward.

Find out about the key risks to this Reddit narrative.

Another View: Market Multiples Raise Eyebrows

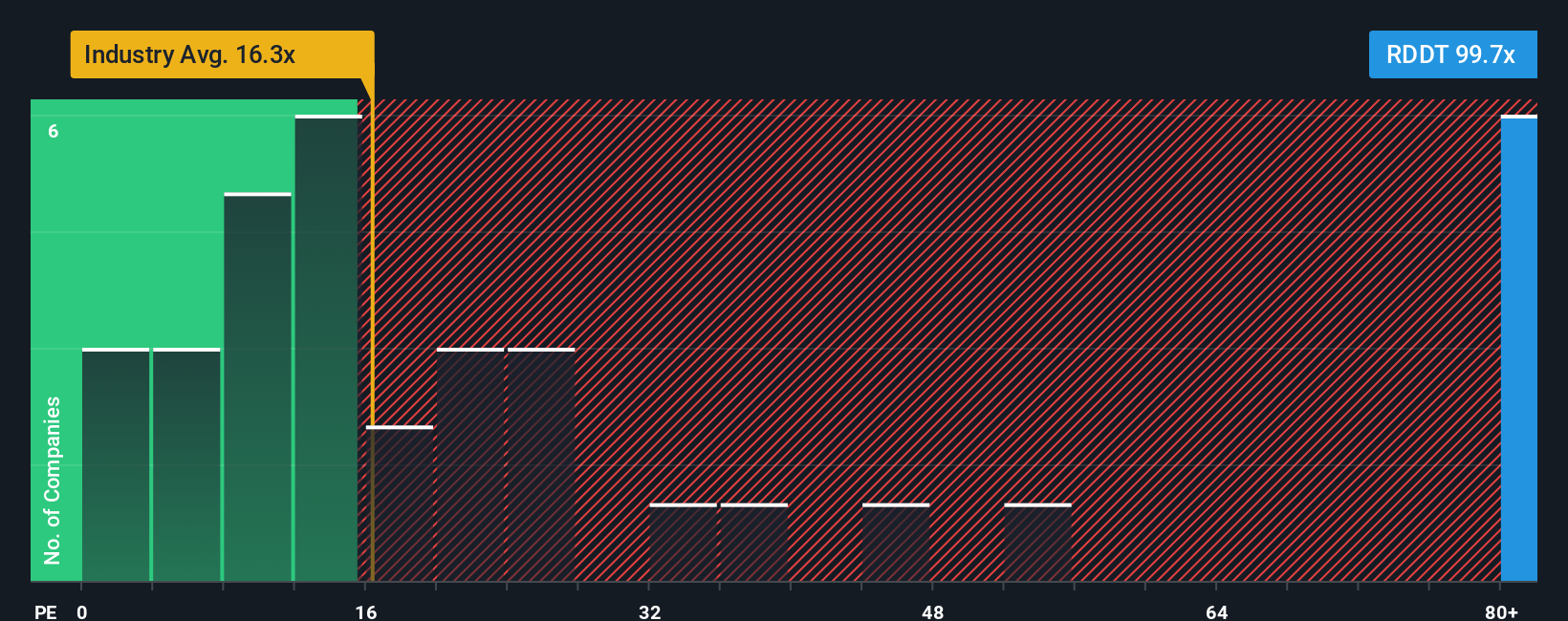

While the previous analysis points to Reddit trading below its fair value, a look at its price-to-earnings ratio paints a different picture. Reddit currently trades at 101.8x earnings, far above the industry average of 16.6x, its peer average of 33x, and even the fair ratio of 39.9x. This significant difference suggests that the market is pricing in a lot of future success, leaving little room for error. Is market optimism running too far ahead of actual results?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Reddit Narrative

If you see things differently or want to dig into the data on your own terms, it’s easy to craft your own perspective in just a few minutes, so why not Do it your way?

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Reddit.

Looking for More Smart Investment Ideas?

Your next standout stock might already be on your radar. Use the Simply Wall Street Screener to spot opportunities most investors are missing and turbocharge your portfolio now.

- Start building income by scanning these 18 dividend stocks with yields > 3% that currently offer reliable yields above 3% and steady payout histories.

- Tap into innovation with these 27 AI penny stocks shaping the future of artificial intelligence and automation across industries.

- Stay ahead by searching for value in these 894 undervalued stocks based on cash flows poised for price growth based on strong underlying financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives