- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Reddit (RDDT): Assessing Valuation After Blowout Q3 Earnings and First-Time Profitability

Reviewed by Simply Wall St

Reddit posted a strong third-quarter earnings report that surprised many investors. The company achieved 68% sales growth compared to last year and reached GAAP profitability for the first time, with user engagement increasing worldwide.

See our latest analysis for Reddit.

This upbeat report was the spark behind Reddit’s recent rally, with shares initially jumping more than 13% on the day of earnings. Despite some short-term cooling such as a 1.90% drop in the share price over the past day and a 6.50% pullback this week, the stock is still up 23.55% year-to-date. Most notably, Reddit’s total shareholder return over the past year is a hefty 88%, reflecting strong confidence in its growth story despite the usual volatility seen around recent news and earnings.

If Reddit’s surge has you curious about other fast-moving opportunities, now is a great time to discover fast growing stocks with high insider ownership.

But with shares surging after Reddit’s earnings beat and forward guidance, investors are now weighing whether the stock reflects all the good news or if the recent pullback offers a real buying opportunity.

Most Popular Narrative: 10.3% Undervalued

Reddit’s most widely followed narrative suggests its fair value sits at $228.50, which is above the latest closing price of $204.98 and indicates room for upside. Market watchers are examining whether growth tailwinds can help justify this valuation amid volatile sentiment and shifting expectations.

As digital advertising budgets increasingly prioritize highly engaged, niche communities, Reddit's 84% YoY ad revenue growth, broadening advertiser base, and introduction of formats like Dynamic Product Ads position it to capture a greater share of this secular trend. This could potentially lift revenue and net margins over time, especially as ad stack improvements enhance advertiser ROI.

Want to see what powers this premium? The boldest financial assumptions in this story hinge on an aggressive profit ramp and a sustained surge in sales. Curious which forecasts make that fair value number a reality? You’ll have to dig deeper into the narrative for the full picture.

Result: Fair Value of $228.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. If Reddit's ad growth slows or international expansion falters, the current bullish narrative could quickly lose momentum.

Find out about the key risks to this Reddit narrative.

Another View: Looking at the P/E Ratio

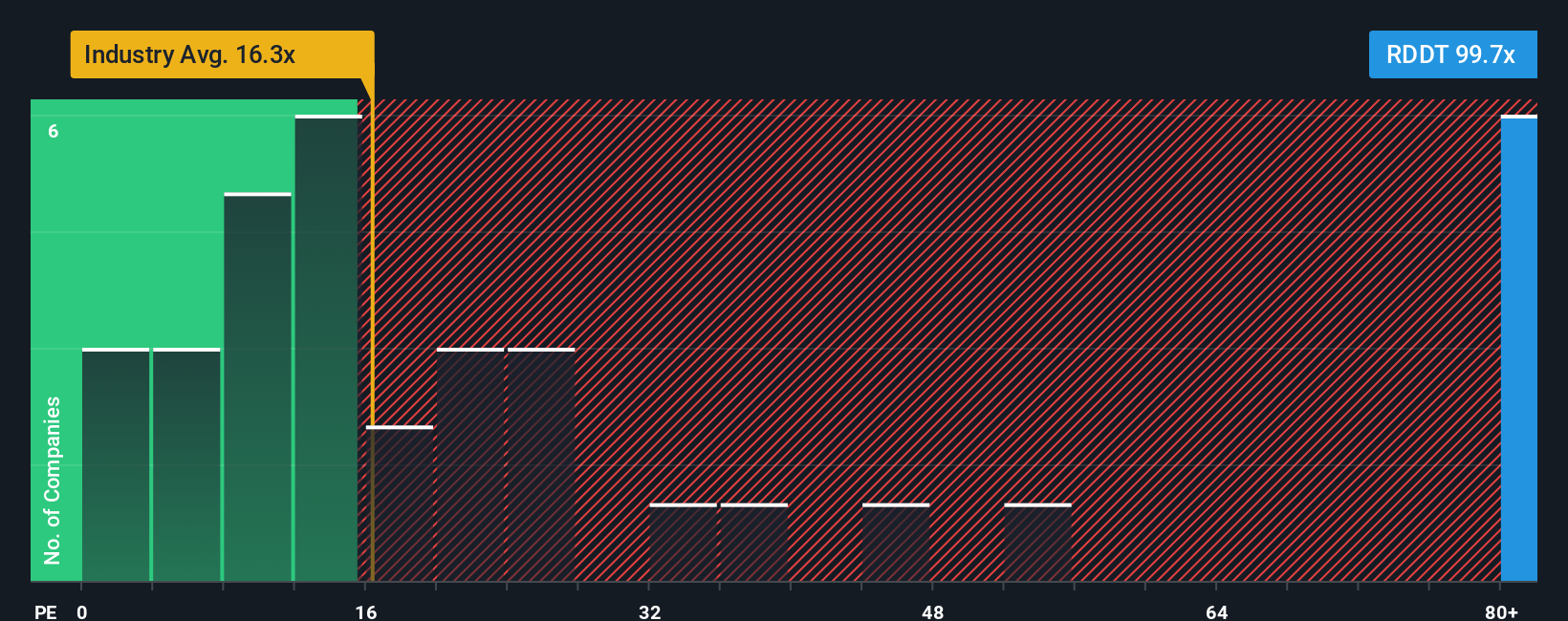

While Reddit looks undervalued from a fair value perspective, its price-to-earnings ratio tells another story. The stock is trading at 111.2 times earnings, which is much higher than both the industry average of 16.5 and the fair ratio of 40.3. This big gap could mean more risk if sentiment cools. Does this premium make sense, or is it a warning sign for buyers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Reddit Narrative

If you have your own take on Reddit’s story or like to follow the numbers your way, you can craft a unique view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Reddit.

Looking for more investment ideas?

Don’t sit on the sidelines while big opportunities pass by. Uncover stocks with breakout momentum, future-shaping technology, and reliable income streams using the Simply Wall Street Screener.

- Snag a front-row seat to the next wave of AI innovation with these 27 AI penny stocks, targeting breakthroughs in machine learning and automation.

- Strengthen your portfolio’s resilience as you tap into these 18 dividend stocks with yields > 3% for consistent yields above 3% from established performers.

- Catch early-stage gems shaking up markets with these 3590 penny stocks with strong financials, offering huge upside potential alongside higher risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives