- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Is This the Right Time to Reevaluate Reddit After Its Recent 11.8% Price Dip?

Reviewed by Bailey Pemberton

- Wondering if Reddit's stock is worth a look? You're not alone, especially as its market buzz seems louder than ever.

- Despite an impressive 53.2% gain over the past year, Reddit’s share price has dipped 11.8% in the last week and is down 9.4% over the past month. This hints at shifting investor sentiment.

- Recent headlines spotlight Reddit’s strategic partnerships and product updates, which are driving conversation across forums. At the same time, analysts and investors continue to debate the platform’s growth narrative. The resulting volatility has made Reddit one of the most closely watched names in digital media this quarter.

- Reddit currently scores 2 out of 6 on our valuation checks, so a deeper dive is needed. Stick with us as we explore how traditional valuation methods stack up and why there might be an even better way to assess Reddit’s real worth by the end of this article.

Reddit scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Reddit Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. For Reddit, this means taking forecasts of how much actual cash the business will generate in the coming years and then calculating what those cash flows are worth in today's dollars.

As of the latest figures, Reddit’s Free Cash Flow (FCF) stands at $503.6 million. Analyst consensus suggests significant growth ahead, projecting FCF to surpass $2.45 billion by 2029. Although analyst estimates are available for the next five years, Simply Wall St provides further projections out to 2035, indicating a sustained increase in cash generation over time.

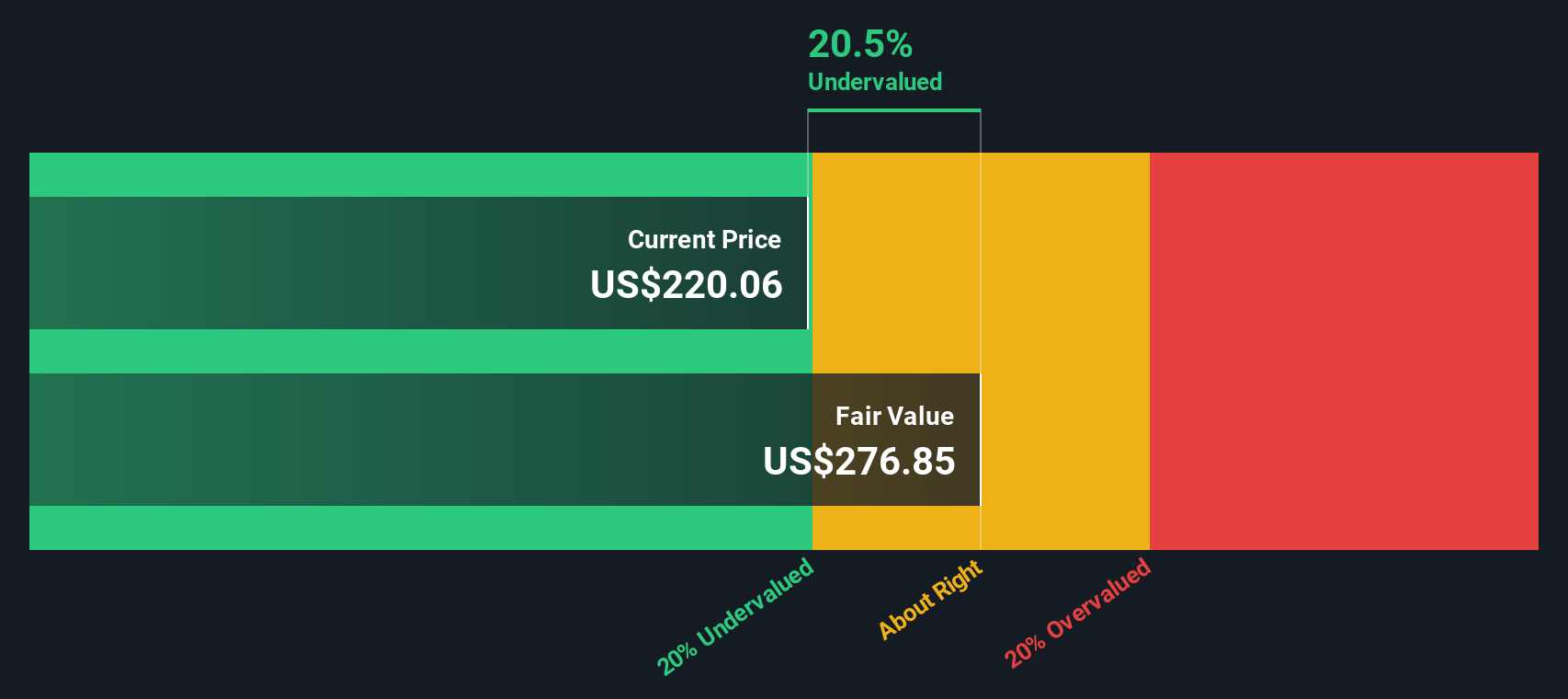

Based on the 2 Stage Free Cash Flow to Equity model, Reddit’s calculated fair value is $308.90 per share. This suggests the current share price is trading at a 39.2% discount to intrinsic value, which may indicate Reddit is substantially undervalued based on this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Reddit is undervalued by 39.2%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Reddit Price vs Earnings

For profitable companies like Reddit, the Price-to-Earnings (PE) ratio is a popular tool for gauging valuation. The PE ratio captures what investors are willing to pay today for a dollar of future earnings, making it especially relevant for businesses that have already turned the corner on profitability.

However, what counts as a “fair” PE depends on multiple factors. High expected growth justifies a higher PE, since investors anticipate earnings will rise rapidly. Conversely, greater risks or slower growth trends usually mean a lower fair multiple. Industry benchmarks help set context, but they do not always capture a company’s unique dynamics.

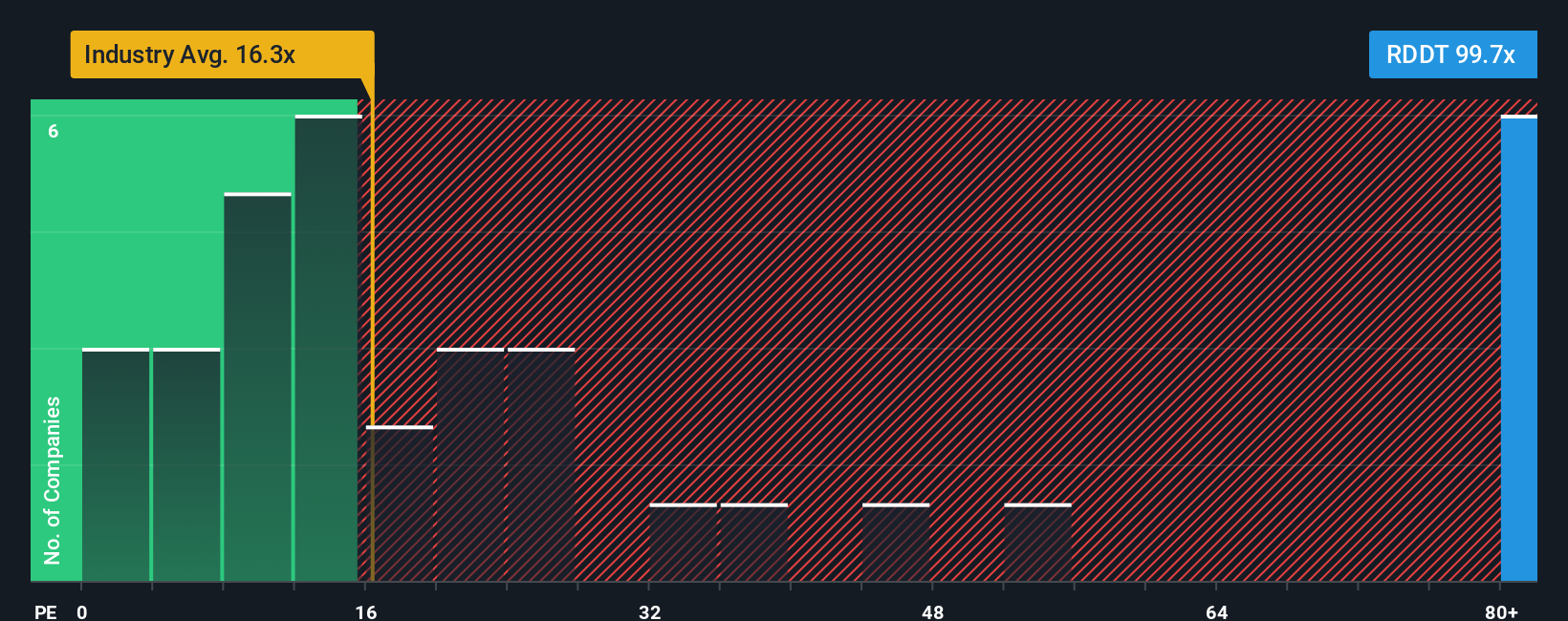

Reddit currently trades at a PE ratio of 101.9x. This stands out compared to the Interactive Media and Services industry average of 16.1x, and the peer average of 18.9x. That is a substantial premium, signaling that the market sees strong future potential in Reddit’s business model or is pricing in higher risk.

To provide a more tailored assessment, Simply Wall St assigns Reddit a proprietary “Fair Ratio” of 40.1x. Unlike standard benchmarks, this Fair Ratio factors in Reddit’s specifics such as earnings growth potential, market cap, profit margins, and risk exposure, offering a more nuanced anchor for valuation.

Comparing Reddit’s actual PE of 101.9x to its Fair Ratio of 40.1x, the stock appears significantly overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Reddit Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are an intuitive and dynamic tool that let you tell your own story about Reddit, connecting your perspective about the company's future to a financial forecast and, ultimately, an estimated fair value.

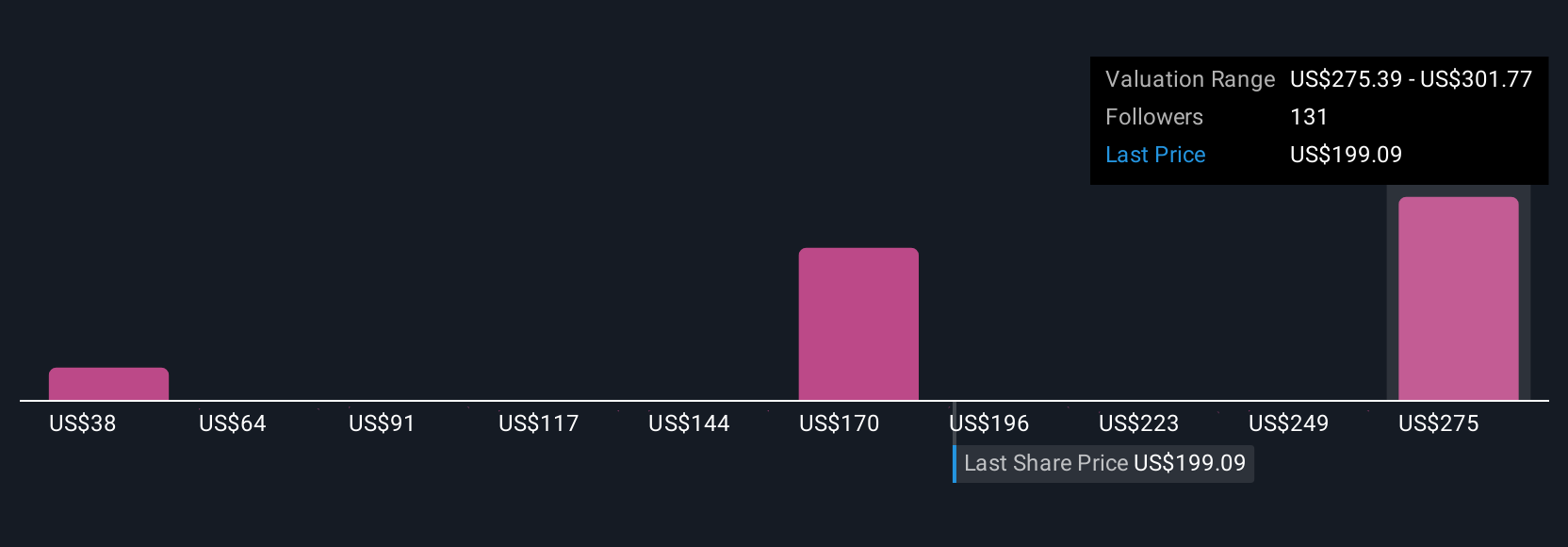

Rather than just relying on what the numbers say, Narratives help you express the reasoning behind those numbers. You can share what you believe about Reddit’s user growth, advertising potential, and risks, and how these factors could impact future revenue, earnings, and margins. Narratives make it easy to translate your expectations and insights into a concrete valuation, bridging the gap between a company’s story and its financial outlook.

On Simply Wall St’s Community page, used by millions of investors, you can easily browse or create Narratives for Reddit and see how other investors are interpreting the latest news or data. Narratives are always up to date, automatically adjusting when fresh information or earnings reports are released, so your viewpoint stays relevant and actionable.

For example, some users expect Reddit’s earnings to surge, justifying a fair value above $300 per share, while others see major risks ahead and estimate fair value as low as $75. This gives you a range of perspectives to compare against the current price before making your next move.

Do you think there's more to the story for Reddit? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives