- United States

- /

- Media

- /

- NYSE:NYT

Is New York Times Still a Smart Bet After Digital Subscriber Milestone?

Reviewed by Bailey Pemberton

- Wondering whether New York Times stock is the real deal or possibly overhyped? You are not alone if the recent buzz has you considering whether now is the right time to dive in or hold off.

- After a strong stretch, shares of New York Times are up 2.1% over the last week, gaining 13.5% in the past month, and notching an impressive 24.4% return year-to-date.

- Much of this momentum follows headlines about the company's digital subscriber milestones and evolving partnerships in the media landscape. These developments are helping shape market sentiment and may be fueling investor confidence in the brand's resilience and reach.

- The company's current valuation score is 2 out of 6, meaning it is presently undervalued in only two out of the six key checks. Next, we will break down what this means using several tried-and-true valuation approaches. Stick around, because there is a smarter way to look at valuation that we will reveal by the end of this article.

New York Times scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: New York Times Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today’s value. This method is based on the idea that an asset is worth what it can generate in cash over time, adjusted for risk and the time value of money.

For New York Times, the most recent Free Cash Flow (FCF) stands at $540.4 Million. Analysts provide detailed projections for the next several years, with FCF expected to grow modestly, reaching $548 Million by 2027. Beyond this horizon, further projections are extrapolated and, according to Simply Wall St, the company’s free cash flow could rise to approximately $667 Million in 2035, suggesting a steady upward trend.

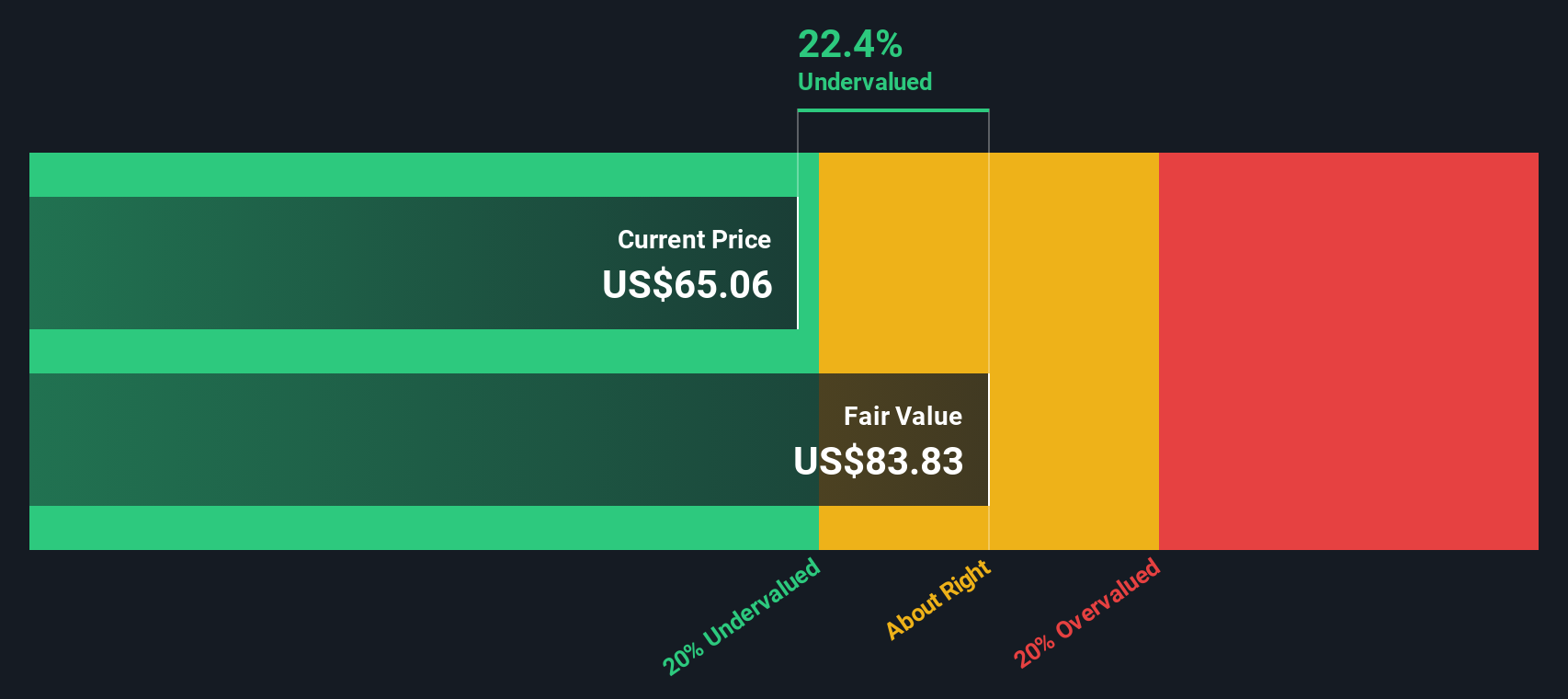

Using these projections, the model arrives at an intrinsic value of $83.83 per share. Compared with the current market price, the DCF model suggests New York Times stock is about 22.4% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests New York Times is undervalued by 22.4%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: New York Times Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like New York Times because it helps investors gauge how much they are paying for each dollar of earnings. It works particularly well here since the company generates consistent profits, allowing for a direct comparison with peers and the industry.

Growth expectations and risk play crucial roles in determining what a “normal” or “fair” PE ratio should be. High-growth companies often command higher PE ratios, as investors anticipate greater future earnings. Conversely, companies facing significant risks or slower growth generally trade at lower multiples to compensate for those uncertainties.

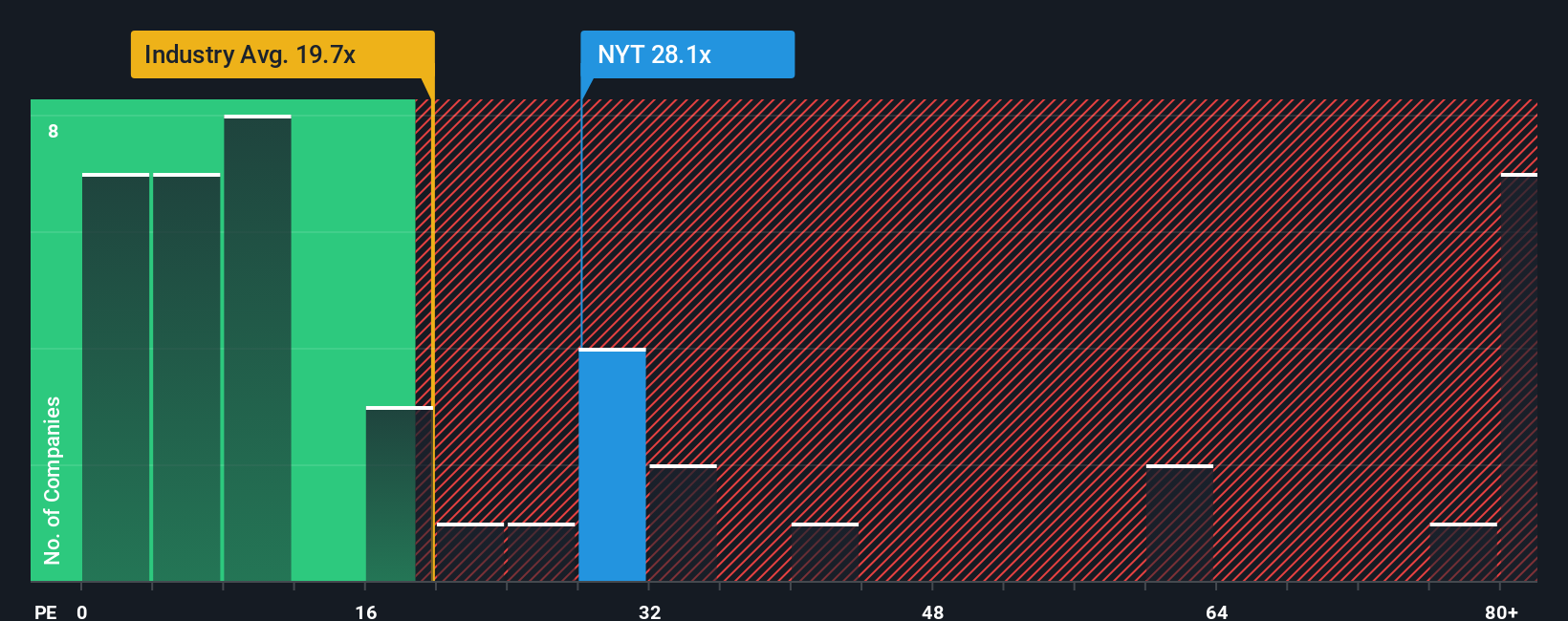

Currently, New York Times trades at a PE ratio of 31.26x. This is notably higher than both the Media industry average of 16.36x and the peer average of 16.93x. However, Simply Wall St’s “Fair Ratio” approach estimates that, given New York Times’s growth outlook, profit margins, industry landscape, and market capitalization, a fair PE multiple would be 20.47x. This proprietary metric is more comprehensive than comparing the company solely with peers or industry groups, as it holistically examines the factors that genuinely drive valuation premiums or discounts.

Since the company’s current PE is well above its fair value ratio, there is a reasonable case that New York Times stock may be trading at a premium based on current earnings.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your New York Times Narrative

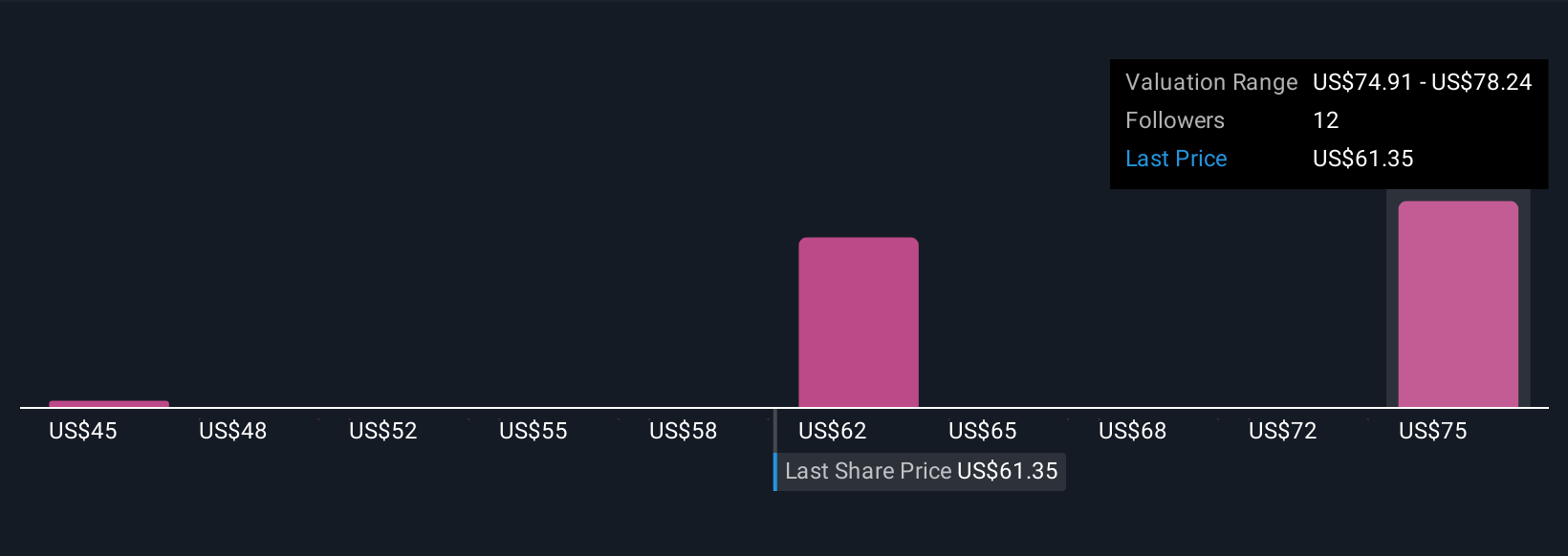

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a simple yet powerful tool that let you tell your story about a company, connecting your personal perspective to the numbers by outlining your expected future revenue, profit margins, and fair value estimate. Rather than relying solely on strict financial models or broad market sentiment, a Narrative grounds your thesis by linking the company’s business story to a tailored financial forecast and then to a specific fair value.

This approach, available right inside Simply Wall St’s Community page, makes it easy for any investor, regardless of experience, to set their expectations, update them as news or earnings are released, and compare their own fair value to the market price. Narratives help you quickly decide when a stock like New York Times may be a buy or a sell, and because they update in real time with every new development, your investment outlook stays as current as the news itself.

For example, one investor might believe strong digital growth will justify a price target of $70.00, while another sees risks from AI and competition, supporting a value closer to $52.00. This demonstrates just how personalized and dynamic your Narrative can be.

Do you think there's more to the story for New York Times? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New York Times might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NYT

New York Times

The New York Times Company, together with its subsidiaries, creates, collects, and distributes news and information worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success