- United States

- /

- Media

- /

- NYSE:NYT

A Look at New York Times (NYT) Valuation Following Recent Share Price Decline

Reviewed by Kshitija Bhandaru

See our latest analysis for New York Times.

NYT’s share price has dipped around 7.3% over the past month. However, the bigger story is its impressive 92% total shareholder return in the past three years, which shows that long-term gains are still holding up as short-term momentum cools.

If you’re curious about what’s next in the market, now is a good moment to broaden your search and discover fast growing stocks with high insider ownership

But with strong returns in the past and recent share price declines, investors are left debating whether NYT stock is currently undervalued and offering a bargain entry, or if the market is already anticipating all of its future growth.

Most Popular Narrative: 12% Undervalued

With New York Times closing at $54.66 and the most-followed narrative placing fair value at $62.25, the implied upside is noteworthy. The valuation is shaped by strong business momentum and key catalysts highlighted below.

Robust growth in digital subscriptions driven by an expanding portfolio of bundled offerings (news, Cooking, Games, The Athletic) and a focus on direct consumer relationships positions the company to capture more recurring revenue, strengthen ARPU, and reduce churn. This directly supports long-term revenue and margin expansion.

What projections fuel this bullish perspective? Are analysts banking on margin expansion or blockbuster subscriber growth to justify their numbers? Unlock the full financial breakdown and see what’s behind these high-stakes expectations.

Result: Fair Value of $62.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, headwinds such as slowing digital subscriber growth or increased content competition could quickly shift this outlook and make future gains less certain.

Find out about the key risks to this New York Times narrative.

Another View: The Market’s Multiple Is a Red Flag

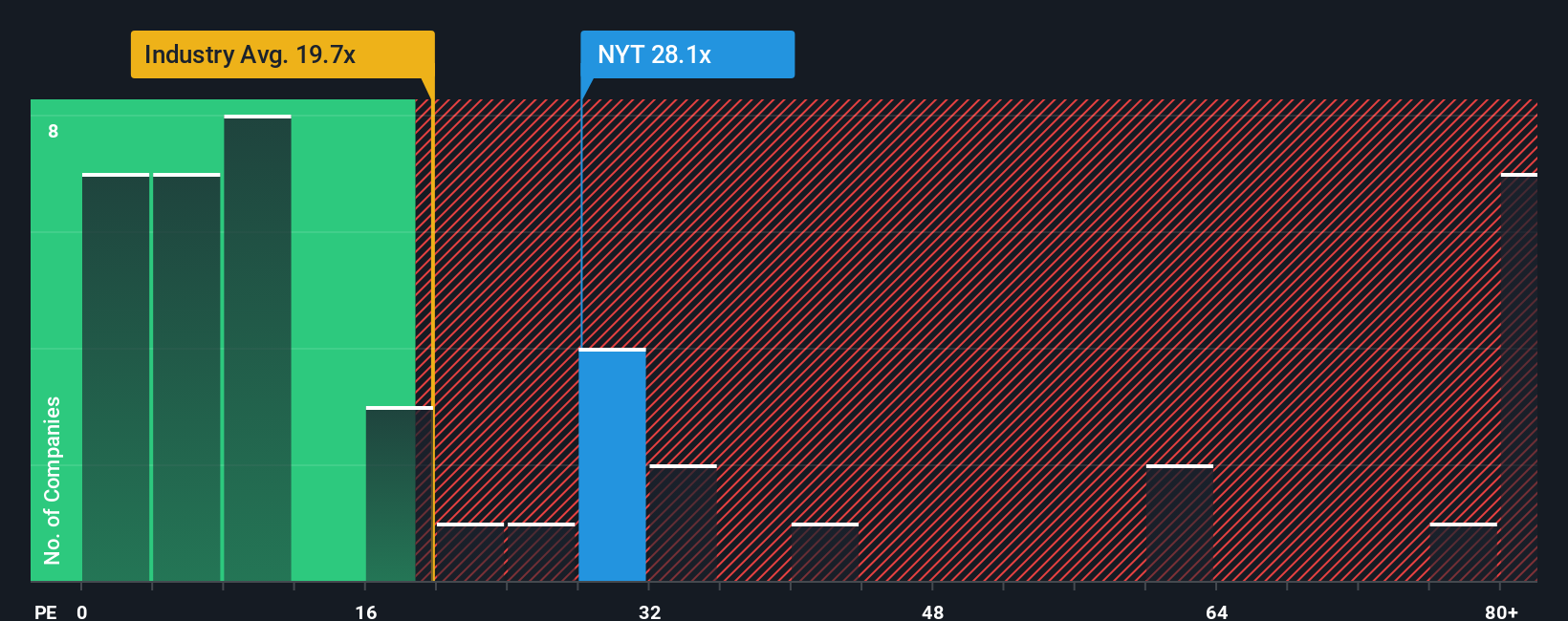

Valuing New York Times by its price-to-earnings ratio paints a different picture. The stock trades at 27.8x earnings, well above both the industry average of 18.8x and its own fair ratio of 21.7x. This makes shares look pricey compared to peers. Could this premium persist, or is there correction risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own New York Times Narrative

If you’d like to reach your own conclusions or want to investigate different angles, you can easily craft your own narrative in just a few minutes with Do it your way.

A great starting point for your New York Times research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for smarter decisions by examining the top opportunities shaping tomorrow's markets. Don’t wait to gain an edge before the crowd recognizes these trends.

- Capture stronger yields by targeting these 19 dividend stocks with yields > 3% offering payouts above 3% and combining steady income with solid business fundamentals.

- Tap into rapid breakthroughs and growth with these 24 AI penny stocks at the forefront of artificial intelligence innovation across industries.

- Uncover hidden growth potential among these 892 undervalued stocks based on cash flows that the market may have overlooked, giving you a chance to act before prices catch up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New York Times might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NYT

New York Times

The New York Times Company, together with its subsidiaries, creates, collects, and distributes news and information worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026