- United States

- /

- Entertainment

- /

- NYSE:MSGE

How Revenue Growth and Share Buybacks at MSGE Shape Its Investment Narrative After Leadership Change

Reviewed by Sasha Jovanovic

- Madison Square Garden Entertainment recently reported first-quarter fiscal 2026 earnings, showing revenue growth to US$158.26 million from US$138.71 million last year, alongside a widening net loss and the departure of its Senior Vice President, Controller, and Principal Accounting Officer, Layth Taki, earlier in November 2025.

- The company also revealed the completion of its share buyback program, retiring over 12% of outstanding shares since March 2023, which could impact future per-share metrics and shareholder returns.

- We will explore how continued revenue growth and an active share repurchase program influence the company's current investment thesis.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Madison Square Garden Entertainment Investment Narrative Recap

For investors considering Madison Square Garden Entertainment, the key belief centers on ongoing strong demand for live events and premium experiences at its flagship venues. The recent executive departure and first-quarter loss do not appear to materially affect the current primary catalyst, expected continued momentum in ticket sales and high-margin hospitality. The biggest near-term risk remains the company’s reliance on a concentrated portfolio of venues and attracting replacement blockbuster events at the Garden, especially as recurring residencies conclude.

Among the latest announcements, the completion of the company’s substantial share buyback program stands out, with over 12% of shares retired since March 2023. This development could significantly influence future per-share financial metrics, supporting the core investment case as the company seeks to upgrade its key venues and drive utilization, while maintaining free cash flow flexibility.

However, the increased dependence on a few marquee venues still means that an unexpected slowdown in high-profile event bookings could pose risks that investors need to keep in mind…

Read the full narrative on Madison Square Garden Entertainment (it's free!)

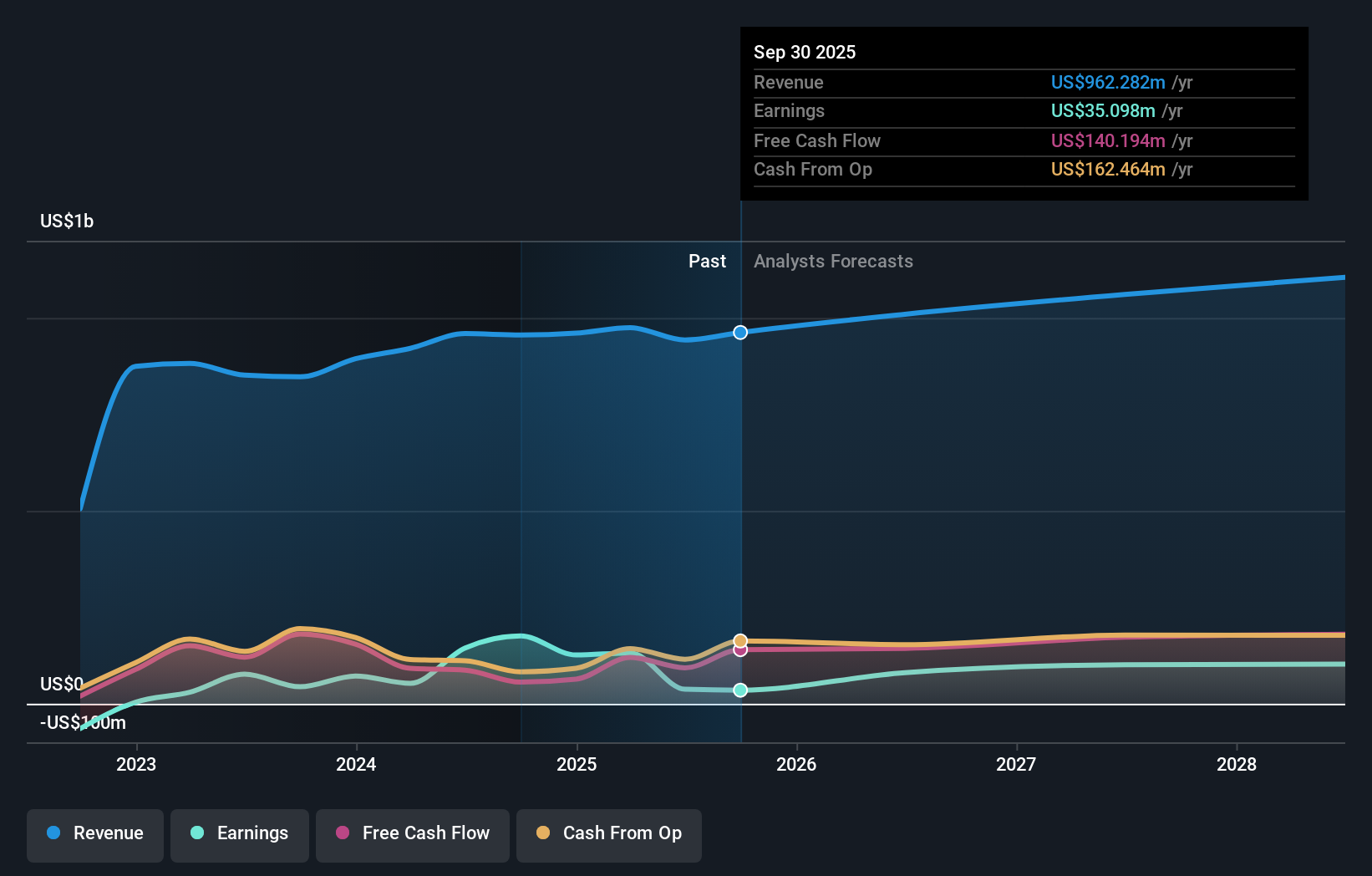

Madison Square Garden Entertainment's outlook forecasts $1.1 billion in revenue and $131.3 million in earnings by 2028. This is based on annual revenue growth of 5.5% and a $93.9 million increase in earnings from the current level of $37.4 million.

Uncover how Madison Square Garden Entertainment's forecasts yield a $49.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value estimates for MSG Entertainment are tightly clustered at US$46.93, based on 1 unique perspective. Despite this consensus, ongoing risks tied to event concentration highlight why your outlook may differ, review several viewpoints before forming your thesis.

Explore another fair value estimate on Madison Square Garden Entertainment - why the stock might be worth as much as $46.93!

Build Your Own Madison Square Garden Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Madison Square Garden Entertainment research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Madison Square Garden Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Madison Square Garden Entertainment's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSGE

Madison Square Garden Entertainment

Through its subsidiaries, engages in live entertainment business.

Moderate growth potential with low risk.

Market Insights

Community Narratives