- United States

- /

- Entertainment

- /

- NYSE:MCS

The Marcus Corporation's (NYSE:MCS) 26% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

The Marcus Corporation (NYSE:MCS) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Longer-term, the stock has been solid despite a difficult 30 days, gaining 11% in the last year.

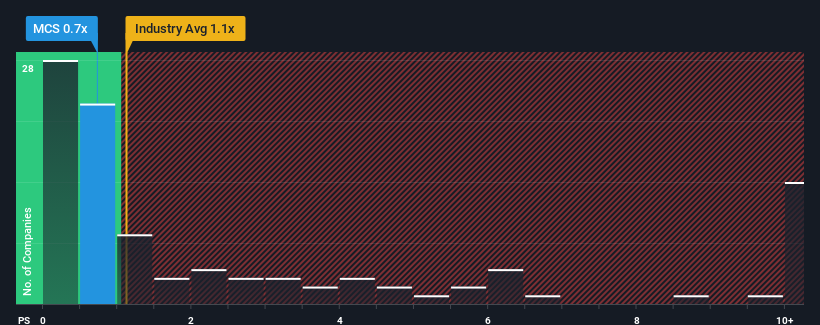

In spite of the heavy fall in price, it's still not a stretch to say that Marcus' price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Entertainment industry in the United States, where the median P/S ratio is around 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Marcus

How Has Marcus Performed Recently?

With revenue growth that's inferior to most other companies of late, Marcus has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Marcus will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Marcus?

In order to justify its P/S ratio, Marcus would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Although pleasingly revenue has lifted 58% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 4.9% per annum over the next three years. With the industry predicted to deliver 12% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's curious that Marcus' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Marcus' P/S Mean For Investors?

Marcus' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Marcus' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Marcus you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MCS

Marcus

Owns and operates movie theatres, and hotels and resorts in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026